Multi-Level Grey Risky Multi-Attribute Decision-Making Method

Based on Dynamic Regret Theory

Lili Qian and Guifeng Deng

School of Statistics and Mathematics, Shanghai Lixin University of Accounting and Finance, Shanghai 201209, China

Keywords: Multi-Level Decision-Making, Risky MADM, Dynamic Regret Theory, General Grey Number (GGN),

Kernel, Degree of Greyness.

Abstract: There are some complex decision-making problems with incomplete information and multiple choices in the

uncertain environment, in which the decision-makers are more vulnerable to the influence of their emotional

psychology. Thus a new method based on dynamic regret theory is introduced in this paper for solving the

multi-level risky multi-attribute decision-making problem with general grey numbers (GGNs).

First,

normalize GGNs and calculate the probability of the combined state to construct the combined decision

matrix. Then, the dynamic regret theory is integrated into the grey multi-level decision-making problem by

constructing grey dynamic regret function and grey dynamic perceived utility function. Finally, the regret

equilibrium set is established and the best scheme is selected according to the comprehensive grey perceived

utility value.

The model proposed in this paper can solve the multi-level grey risky decision-making problem

with the consideration of the regret emotion. It not only complements and perfects the multi-level decision-

making method, but also widens the research scope and space of dynamic regret theory.

1 INTRODUCTION

In real life, there are many uncertain decision-making

problems, that is, decision-making involves

fuzziness, randomness, grey and so on. For example,

decision makers may encounter the interval grey

number whose true value is unknown but the range of

the value is known (Liu and Lin, 2006). The interval

grey number is the basic concept in grey system

theory (Deng, 1982) which is an effective tool to

process the systems with some known information

and some unknown information. Decision

information is grey in this circumstance. In addition,

the attribute values in some decision-making

problems may be stochastic variables which will

change with the different state of nature. The

decision-maker can predict various possible natural

states, or quantify this randomness by setting the

probability distribution, but the decision-maker

cannot get the real state in the future. Decision

information is random and risky. This decision-

making problem is risky multi-attribute decision-

making(RMADM). Due to the limitations of human

cognition and the increasing complexity of practical

problems, decision problems are often both grey and

stochastic, which is called grey risky decision-

making. It can objectively describe more uncertain

decision-making problems and has a broad

application background. Luo and Liu (2004) have

constructed a risky decision-making model based on

interval grey number and provided the grey risky

decision-making method.

However, there are still practical decision-making

conditions where interval grey numbers cannot

accurately or fully describe information. With the

continuous in-depth development of research, a kind

of number, called a general grey number (GGN),

which is in union of open or closed grey intervals, is

introduced by Liu, Fang and Yang

(2012). They think

the general grey number can better describe the

uncertainty. Suppose the market share of the products

of a company is estimated in three ways. The interval

grey number [0.67, 0.82] is less accurate than the

general grey number [0.67,0.7] ∪ [0.73,0.75] ∪

[0.77,0.82] in describing the market share. At

present, little research has been done on risky multi-

attribute decision-making with general grey numbers

(GGNs). Qian et al.

(2019) studied the risky multi-

attribute decision-making based on the general grey

number with kernel and greyness and integrated the

regret theory into the problem. Zhou et al. (2017a)

proposed the stochastic multi-criteria decision-

664

Qian, L. and Deng, G.

Multi-Level Grey Risky Multi-Attribute Decision-Making Method Based on Dynamic Regret Theory.

DOI: 10.5220/0012012200003612

In Proceedings of the 3rd International Symposium on Automation, Information and Computing (ISAIC 2022), pages 664-673

ISBN: 978-989-758-622-4; ISSN: 2975-9463

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

making method with the extended grey number,

which was introduced by Yang

(2007). When dealing

with grey number operation, Zhou et al. (2017a)

adopted the idea and method of interval numbers to a

certain extent, and could not catch the essential

characteristics of grey numbers. As a matter of fact,

the basic concepts such as the kernel, the degree of

greyness, and the field of general grey numbers have

been proposed by Liu et al.

(2012), which can

construct the reduced form of a general grey number

and provide important information of the general grey

number.

In addition, how the psychological behaviour of

the decision-maker affects the actual decision-

making process is also a hot spot of current research.

A large number of practice and research show that in

general, it is difficult for decision-makers to fully

obtain accurate decision-making information. They

are also affected by subjective factors such as their

own emotions, psychological behaviour and

experience intuition, thus making the decision-

making process show the characteristics of irrational

or bounded rationality. That is, decision makers do

not always pursue the maximum utility, but make

satisfactory decisions according to their own

psychological and emotional behaviour and limited

experience cognition. In the grey risky decision-

making problem, the future environment is uncertain,

and the information value is not completely accurate,

which is grey. This dual uncertainty makes the

decision-making more complex. Therefore, decision-

makers are more vulnerable to the influence of

emotional psychology in the stages of information

acquisition, cognitive judgment and overall

evaluation, thus showing a variety of irrational

behaviour characteristics. Researchers hope to find a

better way to explain this personal behaviour

decision-making, which makes the classical expected

utility theory continue to be expanded and improved.

Among them, the most representative research results

are the prospect theory proposed by Kahneman and

Tversky (1979) and the regret theory independently

proposed by Loomes and Sugden (1982) and Bell

(1982). At present, many researchers apply prospect

theory to grey risk decision-making, and rich results

have been achieved. As the emotion that you want to

avoid most in the decision-making process, regret has

also attracted much attention in the field of decision-

making research. Regret theory has gone through a

process of continuous improvement. At first, it was

applied to pair by pair selection, and then it was

extended to a limited number of alternative objects.

Finally, Quiggin (1994) extended it to the case of

general selection sets. So regret theory can be applied

to the case of any infinite alternative actions.

Zeelenberg (1999) believed that anticipated regret

could encourage decision makers to avoid risks and

seek risks at the same time, thus affecting the

decision-making results. Connolly (2002) put

forward the decision judgment theory of regret.

Humphrey(2004) introduced the feedback

information of the abandoned scheme into regret

theory and conducted empirical research. Bleichrodt

(2010) gave the formula for measuring utility

function and regret function. Chorus

(2010)

proposed

a random regret model on basis of regret theory and

applied it to the travel traffic choice problem.

Thanks to containing fewer parameters and

simpler calculation steps, regret theory is more and

more applied to risk-based multi-attribute decision-

making(RMADM)problems, and has already become

a hot spot in the field of decision-making research. To

solve the RMADM problem in which the

probabilities of states and the attribute values are both

interval numbers, Zhang et al. (2013)

proposed a

decision analysis method based on regret theory by

calculating the sum of utility and regret value of each

alternative. Zhang et al. (2014) studied group

decision-making method based on regret theory under

multi-dimensional preference information of pair-

wise alternatives; Liang et al. (2015) introduced the

method of stochastic multi-attribute decision making

with 2-tuple aspirations considering regret behaviour.

Although regret theory has already become a hot spot

in the field of decision-making, the research about

grey risky decision-making with regret psychology is

still in its infancy. Qian et al. (2017) established grey

stochastic multi-criteria decision-making model; Guo

et al. (2015)

constructed multi-objective grey target

model based on interval grey number; Zhou et al.

(2017b) presented a solution to the grey random

multi-criteria problem with extended grey numbers

based on regret theory and TOPSIS method; Qian et

al. (2019) introduced the grey extended EDAs

method based on the general grey numbers, and then

combined the regret theory to construct a new grey

risky multi-attribute decision-making model.

It is noteworthy that the actual decision-making is

quite complex. Except for uncertain fuzzy

information or grey information, it also involves

multi-stage and multi-level decision-making, which

is dynamic decision-making. Different from the static

decision-making background, decision-makers will

face multiple choices in the dynamic decision-making

process. Their later decision-making is not only

determined by the expected consideration, but also

affected by the early decision-making. Therefore,

dynamic decision-making is more vulnerable to the

Multi-Level Grey Risky Multi-Attribute Decision-Making Method Based on Dynamic Regret Theory

665

subjective cognition and psychological behaviour of

decision-makers. For example, the decision maker

will try his best to reduce the regret caused by

previous decisions. The regret caused by decisions in

each stage will not "disappear" in the final evaluation

stage.

Daniel and Rebecca

(2005)

introduced regret

theory into multi-stage decision-making, proposed

dynamic regret theory, and put forward specific

behaviour prediction derived from regret equilibrium.

The main idea is that in the dynamic decision-making

process, the decision-maker will use the later choice

to strategically reduce the overall risk he faces, that

is, the decision maker's final regret is determined by

the accumulation of the results of a series of decision-

making actions, and the regret generated in each stage

of decision-making will affect the final benefit. For

multi-stage and multi-level decision-making analysis,

dynamic regret theory can reflect the regret avoidance

psychology of decision-makers in each stage, which

is closer to reality and has broad application

prospects. Cao(2013) applied the dynamic regret

theory to the selection of different types of venture

capital projects in multiple industries. However, few

attempts have been conducted on applying dynamic

regret to risky multi-attribute decision-making,

especially in uncertain grey environment.

As a result, this paper proposes a grey risky multi-

attribute decision-making model based on dynamic

regret theory, in which the information value is taken

in the form of general grey numbers, and the decision

maker's regret avoidance is considered in multi-level

dynamic risky multi-attribute decision-making.

The rest o this paper is organized as follows:

Section 2 reviews basic concepts and methods such

as general grey numbers and dynamic regret theory.

In section3, an approach for risky multi-attribute

decision-making method with general grey numbers

is proposed based on dynamic regret theory. Section

4 illustrates a numerical example to show the

feasibility and the validity. In section5, conclusions

are discussed and drawn.

2 BASIC CONCEPTS

2.1 General Grey Number

Definition 1. ( Liu et al., 2012)

Let

g

±

∈ℜ

be an unknown real number within a

union set of closed or open grey intervals:

1

[, ]

n

i

i

i

gaa

±

=

∈ ,

1, 2, ,in=

n

is an integer and

0 n<<∞,

,

i

i

aa∈ℜ

and

1

1

ii

ii

a aaa

−

+

≤≤≤

, for any interval

1

[, ] [, ]

n

ii

ii i

i

aa aa

=

⊗∈ ⊂ , then

g

±

is called a

general grey number.

Definition 2. ( Liu et al., 2012)

o

g

g

∧

(

)

is named the simplified form of the

general grey number, if

g

∧

is the “kernel” of a general

grey number

1

[, ]

n

i

i

i

gaa

±

=

∈ and

0

g

is the degree of

greyness of the general grey number. Here,

1

1

=

n

i

i

ga

n

∧∧

=

(1)

is called the “kernel” of the general grey number.

1

()

1

()

()

n

o

ii

i

a

gg

g

μ

μ

∧

±

∧

=

⊗

=

Ω

(2)

is called the degree of greyness.

Ω

is the background

which makes the general number

1

[, ]

n

i

i

i

gaa

±

=

∈

come into being and

μ

is the measure of

Ω

.

Proposition1. ( Liu et al., 2012)

For a general grey number

1

[, ]

n

i

i

i

gaa

±

=

∈ , in the

event that all the

i

a

∧

and

()

i

μ

⊗

are known, its

simplified form

o

g

g

∧

(

)

is one-one correspondence

with the general grey number

1

[, ]

n

i

i

i

gaa

±

=

∈ .

2.2 Dynamic Regret Theory

Daniel and Rebecca

(2005) put forward dynamic

regret theory on the basis of regret theory, which

introduced regret theory into multi-stage decision-

ISAIC 2022 - International Symposium on Automation, Information and Computing

666

making, and realized the effective combination of

regret theory and dynamic decision-making.

Different from regret theory, dynamic regret theory

emphasizes that in the process of dynamic decision-

making, the final regret of the decision-maker is

determined by the accumulation of a series of

decision-making actions. The later decision-making

is influenced not only by the expected consideration,

but also by the early decision-making. The decision-

maker will reduce the final regret caused by the

previous decision as much as possible, that is, the

regret caused by the decision-making in each stage

will affect the final income.

Daniel and Rebecca (2005) also described and

analyzed the idea of dynamic regret decision through

a decision problem. There are two parent schemes A

and B, in which A contains two sub schemes

A

a

and

A

b

, and B also contains two sub schemes

B

a

and

B

b

, as shown in Figure 1.

A B

B

a

B

b

A

a

A

b

Figure 1: Dynamic Regret Decision Tree

In the first stage, the decision-maker makes the

choice between the two parent schemes A and B. If

he chooses A, he can only choose

A

a

or

A

b

in the

second stage, and the regrets in both stages should be

considered in the final evaluation. For example, if A

is selected for the first stage and

A

a

is selected for the

second stage, then comparing the utility of

A

a

and

A

b

will produce the regret value of the second stage.

Then fix the selection

A

a

of the second stage, and

compare the maximum utility of

A

a

and the two sub

schemes

B

a

and

B

b

in B to produce the regret value

of the first stage. Finally, the two regret values are

weighted to obtain the comprehensive regret value of

the final choice.

Daniel and Rebecca (2005) combined regret

theory with dynamic decision-making to better solve

the dynamic decision-making problem considering

decision-makers' regret. The basic idea is that the

comprehensive perceived utility value of the

decision-making scheme is made up of the utility

value of the scheme itself and the total regret value.

The total regret value also consists of two parts. One

is the regret value generated by comparing the utility

value with the sub schemes of different parent

schemes at the first stage; the other is the regret value

generated by comparing the utility value with the sub

scheme under the same parent scheme at the second

stage.

11 2 2

() () ( ) ( )Ux vx R x R x

θθ

=−Δ−Δ

(3)

12

θθ

(>0) , (>0)

respectively represent the degree

of regret of the decision-maker for the first stage and

the second stage.

Daniel and Rebecca (2005) believe that the

behavior of the decision maker at the second stage is

actually the result of his own game, constituting a

psychological Nash equilibrium . Thus the set of

regret equilibrium is put forward. Therefore,

considering the decision-making behavior at the first

stage, a parent scheme is selected to maximize the

utility, so as to form a regret equilibrium solution.

3 RMADM APPROACH WITH

GENERAL GREY NUMBERS

BASED ON DYNAMIC REGRET

THEORY

3.1 Problem Description

Consider a two-stage grey risky multi-attribute

decision-making problem. Assume 𝐴=

{

𝐴

,⋯,𝐴

,⋯,𝐴

}

is the set of schemes of the first

stage. In each scheme 𝐴

, there are 𝑞

sub schemes

selected at the second stage. 𝐴

∗

=

𝐴

,⋯,𝐴

,()

,⋯,𝐴

is the set of the sub schemes

of

i

A

. The set of the attributes is 𝐶=

{𝐶

,⋯,𝐶

,⋯,𝐶

}. And

()

1

,,,,

j

m

ωω ω ω

=

is the weighted vector of the attributes, where

1

1, 0, 1, 2, ,

m

jj

j

j

m

ωω

=

=≥=

. Suppose the

market faces

l

states, and the set of states is

{

}

(1) (t) ( )

,, ,,

l

SS S S=

. Assume the

Multi-Level Grey Risky Multi-Attribute Decision-Making Method Based on Dynamic Regret Theory

667

information value of the alternative

,( )ii k

A

relative to

the attribute

j

C

in the state

()t

S

is expressed by the

general grey number

()

,( ),

()

t

ii k j

a ⊗

,

1, ,in=

,

1, ,

j

m=

,

() 1, ,

i

ik k q==

,

1, ,tl=

.Thus the grey decision matrix of all the sub schemes

of

i

A

under the state

()t

S

at the second stage is

obtained as

()

() ()

,( ),

() ()

i

tt

iiikj

qm

Aa

×

⊗= ⊗

. The

problem to be solved now is how to choose the final

best scheme under the consideration of the

psychological behavior of the decision maker's regret

avoidance.

3.2 Combined Processing of Natural

States

For multi-stage and multi-level decision-making

problems, the selection scheme in the first stage

usually involves different countries, regions or

different industries, so the probability of market

situation is also different. Assuming that the market

states faced by each scheme in the first stage are

independent of each other, the combined market state

can be obtained. The market state probabilities of

1

,,,,

in

A

AA

are shown in Table1, and the

probability of

i

A

under the state

()t

S

is

()t

i

p

.

Table 1: The Probability of the State

(1)

S

……

()t

S

……

()l

S

1

A

(1)

1

p

……

()

1

t

p

……

()

1

l

p

…… ……

i

A

(1)

i

p

……

()t

i

p

……

()l

i

p

…… ……

n

A

(1)

n

p

……

()t

n

p

……

()l

n

p

Obviously, there are

n

l

combined states. Assume the

set of combined states is 𝑆

∗

=

{

𝑆

,⋯,𝑆

,⋯,𝑆

}

,

and the corresponding probability vector is 𝑃

⃗

=

(

𝑃

,⋯,𝑃

,⋯,𝑃

)

, where 𝑃

is the probability of

occurrence of 𝑆

.

() ()

1

1

=( )

l

n

tt

hii

i

t

Pp

θ

=

=

Π

(4)

1, ,

m

hl=

()

1,

0, .

it

t

i

it

the state of A is S

the state of A is not S

θ

=

According to the combination state, the sub

schemes in the second stage are matrix combined.

Suppose the states of 𝐴

,⋯,𝐴

,⋯,𝐴

are 𝑆

(

)

,⋯,𝑆

(

)

,⋯,𝑆

(

)

respectively, where

1, ,

i

hl=

.

The decision matrix generated by all the sub

schemes of 𝐴

under the state 𝑆

()

is 𝐴

(ℎ

)

(⊗)=

𝑎

,(),

(ℎ

)

(⊗)

×

, where 𝑖(𝑘)=𝑘=1,⋯,𝑞

,𝑗=

1,⋯,𝑚. Thus the combined decision matrix is

obtained as

𝑌

(

)

(

⊗

)

=

⎝

⎜

⎜

⎛

𝐴

(

)

(⊗)

⋮

𝐴

(

)

(⊗)

⋮

𝐴

(

)

(⊗)

⎠

⎟

⎟

⎞

(

⋯

)

×

=(𝑦

()

(⊗))

(

⋯

)×

(5)

3.3 Modeling Principle and Method

As different attributes have different dimensions, the

data will be standardized first to facilitate the

calculation.

The grey upper bound effect measurement is

adopted as the conversion formula for the attribute of

benefit type:

()

()

()

()

()

()

max{ }

h

hIj

Ij

h

Ij

I

y

z

y

⊗

⊗=

⊗

(6)

The grey lower bound effect measurement is adopted

as the conversion formula for the attribute of cost

type:

()

()

()

min{ ( )}

()

()

h

Ij

h

I

Ij

h

Ij

y

z

y

⊗

⊗=

⊗

(7)

So the normalized combinatorial decision matrix is

obtained as follows:

1

() ()

()

()=

n

hh

I

jqqm

Zz

++ ×

⊗⊗

( ())

(8)

The attributes are weighted to obtain a new decision

matrix as follows:

1

() ()

()1

()=

n

hh

Iqq

Xx

++ ×

⊗⊗

( ())

,

ISAIC 2022 - International Symposium on Automation, Information and Computing

668

()

() ()

1

=

m

hh

IjIj

j

xz

ω

=

⊗⊗

()

(9)

So the comprehensive decision matrix in the

combined state can be expressed as below

𝑋

(

⊗

)

=𝑋

(

)

(

⊗

)

,⋯,𝑋

(

)

(

⊗

)

,⋯𝑋

(

)

(

⊗

)

=(𝑥

(⊗))

(

⋯

)×

(10)

Then the regret aversion of the decision maker is

considered by the formula (3).

The power function

() (0 1)vx x

α

α

=<<

(11)

is used as the utility function of the attribute

according to Tversky and Kahneman (1992). 𝛼is

named as the risk aversion coefficient. The smaller

the value of 𝛼 is, the greater the risk aversion degree

of the decision-maker is. On basis of the

comprehensive decision matrix, the grey

comprehensive perceived utility value of scheme I

under the state 𝑆

can be obtained:

11 2 2

1

[ ( ) ( ( )) ( ( ))]

n

l

IJIJ

J

UPx R R

α

θθ

=

=⊗−Δ⊗−Δ⊗

(12)

According to Carlos and Elke(2008),

1, 0

()=

0, 0

R

λ

Δ

−Δ≥

Δ

Δ<

,

(13)

1.15≤𝜆≤1.35

is taken as the regret function.

1

1

() max () ()

IJ IJ

I

XX

′

′

∈Ω

Δ⊗= ⊗− ⊗

(14)

2

2

() max () ()

IJ IJ

I

XX

′

′

∈Ω

Δ⊗= ⊗− ⊗

(15)

2

I

Ω=Ω

1

I

Ω=Ω−Ω

Ω

is the set of the first index of all sub scheme sets

under all parent schemes.

I

Ω

is the set of the first

index of the sub scheme sets under the parent scheme

to which the sub scheme with subscript

I

belongs.

According to the calculation results, the optimal

sub scheme

*

i

ij

A

can be found under each parent

scheme

i

A

, thus producing the equilibrium set

***

1

*

1

{,,, }

in

jijnj

DA A A=

.

Next, the grey comprehensive perceived utility value

of each

*

i

ij

A

is calculated on basis of (12). Here

𝛥

(

⊗

)

=𝑚𝑎𝑥{𝑋

∗

(

⊗

)

,⋯, 𝑋

(

)

∗

(

⊗

)

,

𝑋

()

∗

(⊗),⋯,𝑋

∗

(⊗)} − 𝑋

∗

(⊗)

(16)

2

() 0Δ⊗=

(17)

4 CASE STUDY

A multinational enterprise wants to invest and

develop new products abroad. After the preliminary

investigation of the team, the sales volume 𝐶

, market

share 𝐶

and development investment cost 𝐶

are

determined as the investigation attributes, and the two

cities 𝐴

、

𝐴

in country 𝐴

and the three cities 𝐴

、

𝐴

、

𝐴

in country 𝐴

are identified as

candidates. Although different countries may face

different future market conditions, they can be

divided into "good", "medium" and "poor", which is

shown in Table.2. Due to the complexity and

uncertainty of decision-making environment

information and the subjective cognition of decision-

makers, the attribute performance values of these five

cities are represented by general grey numbers, as

shown in the Table.3. Now we want to select the best

investment city according to the above conditions and

considering the regret avoidance of decision-makers.

Table 2: The natural state of the two countries

(1)

S

(2)

S

(3)

S

1

A

0.3 0.4 0.3

2

A

0.45 0.35 0.2

Multi-Level Grey Risky Multi-Attribute Decision-Making Method Based on Dynamic Regret Theory

669

Table 3: Attribute value of five cities in two countries under the "good" natural state

1

C

2

C

3

C

11

A

[400,500] [0.3,0.4]

[0.42,0.48] [75,85]

[91,95]

12

A

[350,400]

[404,410] [0.1,0.2]

{0.3}

[60,70]

[72,76]

21

A

[420,440]

[480,500] [0.1,0.2]

{0.3}

[70,80]

{85}

22

A

[420,450] [0.3,0.4] [80,90]

[95,97]

23

A

[330,340]

[350,380] [0.2,0.3]

{0.35}

[70,76]

Table 4: Attribute value of five cities in two countries under the "medium" natural state.

1

C

2

C

3

C

11

A

[380,400]

{420}

{0.3}

[0.36,0.42] [75,80]

[85,90]

12

A

[320,380]

[390,400] [0.1,0.2]

{0.3}

[65,75]

{80}

21

A

[400,420]

{430}

[0.4,0.6]

{0.65}

[80,85]

{90}

22

A

[380,400] [0.55,0.65] [75,80]

23

A

[340,360]

{375}

{0.2}

[0.3,0.4]

[75,80]

{85}

Table 5: Attribute value of five cities in two countries under the "poor" natural state.

1

C

2

C

3

C

11

A

[350,380]

[400,420]

{0.2}

[0.25,0.35] [75,85]

{90}

12

A

[300,350]

{370}

[0.3,0.4]

{75}

[80,85]

21

A

[380,420] [0.3,0.5]

[85,90]

22

A

[400,410]

{420}

[0.3,0.5]

[80,85]

{87}

23

A

[340,350]

[360,380]

{0.5}

[0.6,0.7]

[70,80]

{82}

Step1 The fields of sales volume, market share and

investment cost are determined as

[

300,500

]

,

[

0,1

]

,

[

50,100

]

respectively. The simplified form of

the general grey number (GGN) can be calculated and

obtained by definition 1,2. Thus the decision matrixes

of the two countries in three states "good", "medium"

and "poor" can be obtained as follows:

0.25 0.155 0.271

(1)

1

0.27 0.067 0.272

425 0.4 86.5

()=

391 0.225 69.5

A

⊗

0.2 0.067 0.188

(1)

2 0.15 0.1 0.23

0.204 0.083 0.12

460 0.225 80

( )= 435 0.35 90.5

350 0.3 73

A

⊗

0.096 0.068 0.2

(2)

1

0.335 0.067 0.187

405 0.345 82.5

()=

372.5 0.225 75

A

⊗

ISAIC 2022 - International Symposium on Automation, Information and Computing

670

0.098 0.174 0.096

(2)

20.10.10.1

0.097 0.127 0.095

420 0.575 86.25

( )= 390 0.6 77.5

362.5 0.275 81.25

A

⊗

0.247 0.12 0.188

(3)

1

0.234 0.1 0.105

387.5 0.25 85

()=

347.5 0.35 78.75

A

⊗

0.2 0.113 0.1

(3)

2 0.049 0.2 0.097

0.152 0.2 0.191

400 0.575 87.5

( )= 412.5 0.4 84.75

357.5 0.4 78.5

A

⊗

Step2 It’s clear there are 9 combined states. The set

of the combined states is

{

}

*

19

,,,,

h

SS S S=

. And the corresponding probability vector can be

calculated on basis of (4).

()

19

,,,,

h

PP P P=

()

= 0.135, 0.105, 0.06, 0.18, 0.14, 0.08, 0.135 0.105, 0.06,

Step3 The sub schemes in the second stage are matrix

combined under the combination state according to

(5).

The decision matrix under the combined state 𝑆

("good"+"good") is

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

The decision matrix under the combined state 𝑆

("good"+"medium") is

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

The decision matrix under the combined state 𝑆

("good"+"poor") is

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

𝑆

("medium"+"good"):

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

𝑆

("medium"+"medium"):

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

𝑆

("medium"+"poor"):

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

𝑆

("poor"+"good"):

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

𝑆

("poor"+"medium"):

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

𝑆

("poor"+"poor"):

𝑌

()

(⊗)=

𝐴

()

(⊗)

𝐴

()

(⊗)

≜𝑦

()

(⊗)

×

Step4 As the beneficial attribute, the sales volume

𝐶

and the market share𝐶

are normalized by (6). As

the cost attribute, development investment cost 𝐶

is

normalized by (7). The normalized decision matrix

under each state is obtained by (8) as follows:

()

() ()

53

() ()

hh

Ij

Zz

×

⊗= ⊗

, here

1, , 9h =

Step5 The attributes are weighted to obtain a new

decision matrix under each state by (9) as follows:

()

() ()

51

() ()

hh

I

Xx

×

⊗= ⊗

, here

1, , 9h =

,

() ()

1

() ()

m

hh

IjIj

j

xz

ω

=

⊗= ⊗

.

Thus the grey comprehensive decision matrix on

basis of (10) is

𝑋

(

⊗

)

=

𝑋

(

)

(

⊗

)

,⋯,𝑋

(

)

(

⊗

)

,⋯,𝑋

(

)

(

⊗

)

=𝑥

(⊗)

×

as shown in Table.6.

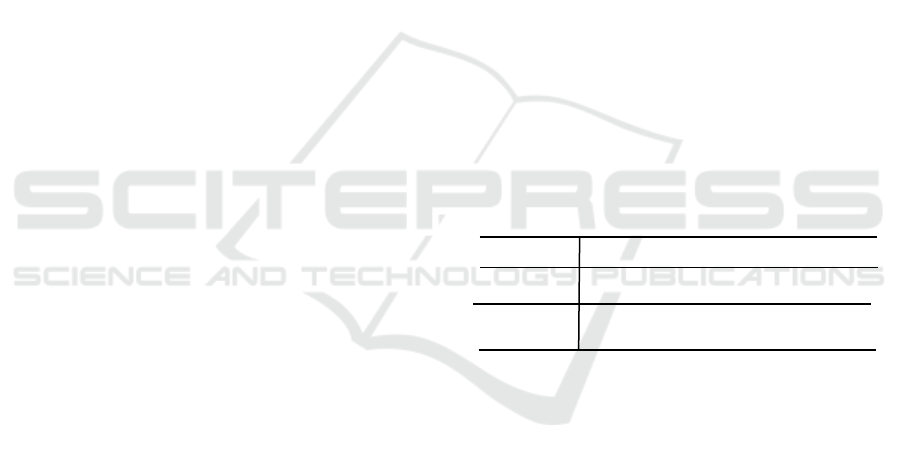

Table 6: Grey Decision Matrix.

1

S

2

S

3

S

4

S

5

S

6

S

7

S

8

S

9

S

0.135 0.105 0.06 0.18 0.14 0.08 0.135 0.105 0.06

111

()XA

0.911

0.272

0.85

0.272

0.85

0.272

0.913

0.2

0.831

0.2

0.845

0.2

0.809

0.247

0.768

0.247

0.783

0.247

212

()XA

0.809

0.272

0.785

0.272

0.785

0.272

0.809

0.335

0.335

0.767

0.335

0.779

0.88

0.234

0.801

0.234

0.819

0.234

321

()XA

0.829

0.272

0.937

0.272

0.915

0.272

0.867

0.2

0.187

0.948

0.945

0.2

0.867

0.2

0.957

0.174

0.957

0.2

422

()XA

0.871

0.272

0.949

0.272

0.843

0.272

0.92

0.23

0.187

0.962

0.874

0.2

0.92

0.23

0.971

0.1

0.887

0.2

523

()XA

0.815

0.272

0.741

0.272

0.811

0.272

0.861

0.204

0.187

0.76

0.842

0.2

0.861

0.204

0.769

0.127

0.855

0.2

Multi-Level Grey Risky Multi-Attribute Decision-Making Method Based on Dynamic Regret Theory

671

Step6 According to Tversky and Kahneman(1992)

and Chorus(2010), the coefficient of risk aversion of

(13) is set as

=0.88

α

, and

=1.25

λ

, and

12

=0.7 =0.3

θθ

,

.

According to (12)(13)(14)(15), if I=1or 2, the

grey comprehensive perceived utility value of the

scheme can be obtained by the formula

𝑈

=𝑃

[𝑥

(⊗)

−𝜃

𝑅(𝛥

(𝑚𝑎𝑥

,

,

𝑥

(⊗)

−𝑥

(⊗)) − 𝜃

𝑅(𝑚𝑎𝑥

,

𝑥

(⊗) − 𝑥

(⊗))]

Thus

1 0.272

0.85002U =

,

2 0.272

0.80334U =

.

According to (12)(13)(14)(15), if I=3 or 4 or 5,

the grey comprehensive perceived utility value of the

scheme can be obtained by the formula

𝑈

=𝑃

[𝑥

(⊗)

−𝜃

𝑅(𝛥

(𝑚𝑎𝑥

,

𝑥

(⊗

−𝑥

(⊗)) − 𝜃

𝑅( 𝑚𝑎𝑥

,

,

𝑥

(⊗) − 𝑥

(⊗))]

Thus

3 0.272

0.91022U =

,

4 0.272

0.924997U =

,

50.272

0.81751U =

.

Step7 The equilibrium set is

*

14

{, }DXX=

according to the above results. Then calculate the

grey comprehensive perceived utility values of the

scheme

14

XX,

on basis of (12)(13)(16)(17) .

𝑈

=𝑃

[𝑥

(⊗)

−𝜃

𝑅(𝑥

(⊗) − 𝑥

(⊗))

−𝜃

𝑅(𝑥

(⊗) − 𝑥

(⊗))]

0.272

0.853=

𝑈

=𝑃

[𝑥

(⊗)

−𝜃

𝑅(𝑥

(⊗) − 𝑥

(⊗))

−𝜃

𝑅(𝑥

(⊗) − 𝑥

(⊗))]

0.272

0.926=

So the best investment city is the city

22

A

of the

country

2

A

.

5 CONCLUSIONS

Aiming at the multi-stage risk multi-attribute

decision-making problem, this paper proposes a

decision-making method based on general grey

number information and dynamic regret theory.

Considering the impact of regret avoidance

psychology on decision-making results, the method

calculates the probability of the combined market

state and constructs the grey regret function as well as

grey comprehensive perceived utility function on

basis of the dynamic regret theory. The set of regret

equilibrium solutions is established according to the

value of grey perceived utility function, and then the

optimal scheme is selected by further comparing the

comprehensive utility value.

The method model proposed in this paper not only

considers the psychological and behavioral state of

regret avoidance of decision makers in the dynamic

decision-making process, but also takes into account

the uncertainty and gray of the dynamic environment.

Compared with the traditional risky multi-attribute

decision-making method, it is closer to reality and has

stronger operability and practicability, which

provides method support and theoretical guidance for

more uncertain decision-making problems in reality.

At the same time, this paper also broadens the

research scope and application space of regret theory

and dynamic regret theory.

REFERENCES

Bell D E.(1982), “Regret in decision making under

uncertainty” , Operations Research, Vol.30 No.5,

pp.961-981.

Bleichrodt H, Cillo A, Diecidue E.(2010), “A quantitative

measurement of regret theory”, Management

Science, Vol.56 N0.1,pp: 161-175.

Cao He.(2013), “Research on Selection Method of Venture

Capital Project Considering the Behavior of

Investors”[D].Northeastern University.

Carlos E L, Elke U. W.(2008), “Correcting expected utility

for comparisons between alternative outcomes: A

unified parameterization of regret and disappointment”,

Journal of risk and uncertainty, Vol. 36 No.1,pp: 1-17.

Chorus C G. (2010), “Regret theory based route choices and

traffic equilibria”, Transportmetrica, Vol. 8 No.4 ,

pp.291-305.

Connolly T, Zeelenberg M.(2002), “Regret in decision

making” , Psychological Science, Vol. 11 No.6,

pp:212-216.

Daniel K, Rebecca S.(2005). “Dynamic Regret Theory”

[K]. Working paper, 2005.

Deng J L.(1982), “Control problems of grey systems”,

Systems &Control Letters, Vol.1 No.5, pp:288-294.

ISAIC 2022 - International Symposium on Automation, Information and Computing

672

Guo Sandang, Liu Sifeng, Fang Zhigeng. (2015), Multi –

object grey target decision model based on regret theory

[J]. Control and Decision, Vol.30 No.9, pp. 1635-1640.

Humphrey S J. (2004), “Feedback-conditional regret theory

and testing regret-aversion in risky choice”, Journal of

Economic Psychology , Vol.25 No.6,pp:839-857.

Kahneman D, Tversky A. (1979), “Prospect theory: an

analysis of decision under risk”, Econometrica, Vol.47

No.2, pp.263–292.

Liang Xia, Jiang Yanping. (2015), “Method of stochastic

multi-attribute decision making with 2-tuple aspirations

considering regret behavior”, Journal of Systems

Engineering, Vol.30 No.6, pp:719-727.

Liu S F, Lin Y.(2006), “Grey information theory and

practical applications” [M], London: Springer-Verlag,

2006.

Liu S F, Fang Z G, Yang Y J, Jeffrey Forrest. (2012),

“General grey numbers and their operations”, Grey

system:Theory and Application, Vol.2 No.3, pp. 341-

349.

Loomes G, Sugden R. (1982), “Regret theory: An

alternative theory of rational choice under uncertainty”,

The Economic Journal, Vol.92 No.368, pp.805-824.

Luo D, Liu S F. (2004), “Research on grey multi criteria

risk decision-making method”, Systems Engineering

and Electronics,Vol.26 No.8, pp. 1057-1059.

Quiggin J . (1944), “Regret theory with general choice sets”

, Journal of Risk and Uncertainty, Vol.8 No.2, pp.153-

165

Qian L L, Liu S F, Fang Z G. (2017), “Method for grey-

stochastic multi-criteria decision-making based on

regret theory” , Control and Decision, Vol.32 No.6,

pp.1069-1074.

Qian Lili, Liu Sifeng, Fang Zhigeng.(2019), “Grey

risky multi-attribute decision-making method based on

regret theory and EDAS”, Grey Systems: Theory and

Application. Vol.9 No.1, pp.101-113.

Tversky A, Kahneman D. (1992), “Advances in prospect

theory: cumulative representation of uncertainty”, J

Risk Uncertain , Vol.5 No.4, pp.297–323.

Yang Y J. (2007), “Extended grey numbers and their

operations”, Proceedings of 2007 IEEE International

Conference on Fuzzy Systems and Intelligent Services,

Man and Cybernetics, Montreal, Canada, pp.2181–

2186.

Zeelenberg M.(1999), “Anticipated regret, expected

feedback and behavioral decision making”, Journal of

Behavioral Decision Making, Vol.12 No.2,pp: 93-106.

Zhou Huan, Wang Jianqiang Wang, Zhang Hongyu.

(2017a), “Grey stochastic multi-criteria decision-

making approach based on prospect theory and distance

measures”, The journal of grey system, Vol.29 No.1,

pp. 15-33.

Zhou Huan, Wang Jianqiang Wang, Zhang Hongyu.

(2017b), “Grey stochastic multi-criteria decision-

making approach based on regret theory and TOPSIS”,

Int.J. Mach. Learn&Cyber, No.8, pp. 651-664.

Zhang Shitao, Zhu Jianjun, Liu Xiaodi. (2014), “ Group

Decision-making Method based on Regret Theory

under Multidimensional Preference Information of

Pair-wise Alternatives”,. Chinese Journal of

Management Science, Vol.22 (Special Issue), pp: 33-

41.

Zhang X, Fan Z P, Chen F D.(2013) , “Method for risky

multiple attribute decision making based on regret

theory” , Systems Engineering- Theory& Practice ,

Vol.33 No.9, pp.2313-1320.

Multi-Level Grey Risky Multi-Attribute Decision-Making Method Based on Dynamic Regret Theory

673