The Relationship between Modern Railway Construction and

Financial Market Integration: A Quantitative Study Based on Henan

Province

Shuang Gao

Hubei Business College school of Economics, Wuhan, Hubei, China

Keywords: Modern Railroads, Financial Market Integration, Double Difference Model, Structural Time Series Model.

Abstract: Finance is the bloodline of national economy and the core of modern economy, and the development of

financial market plays a vital role in regional development. The relationship between railroad construction

and financial market integration is less discussed in the literature. This paper takes Henan, which is more

exogenous, as a sample, and constructs financial indicators through recent complete grain price data using the

STSM model; empirically analyzes the difference in the impact of the presence or absence of railroads on

financial markets as well as divides the groups by railroad opening periods to discuss the complex impact of

railroads on financial market integration in different opening periods. It is found that interest rates are lower

in all areas along the railroad, but there are significant group differences. Among the groups by railroad

opening period, the railroads that opened around 1910 and mainly connected to the central cities did not

improve their integration with the provincial financial markets; the railroads that opened in the 1930s and

mainly connected to the hinterland improved the regional financial market integration. This suggests that the

impact of railroads on financial market development is subject to the economic relationships along the route,

the economic attributes of each sector, etc., and that it is not appropriate to generalize. This helps to understand

the divergence in empirical studies, but also highlights the impact of railroads on economic patterns and

urbanization.

1 INTRODUCTION

In the late 19th and early 20th centuries, with the

modern transformation of modern China's economy

and society, a series of new modes of transportation

emerged. The railroad, as one of them, has been

closely associated with the socio-economic changes

since its emergence. Zhang Peigang (1984) mentions

that different means of transportation have different

effects on the market, with railroads tending to

concentrate the market more (Zhang, 1984) In theory,

because railroads reduce transportation costs, they

help optimize factor allocation and promote market

integration. In turn, market consolidation caused by

the reduction of transportation costs is considered to

be an important cause of economic growth in recent

modern times. Therefore, discussing the impact of

railroads on economic development, especially on

market integration, has been a concern of scholars.

Finance is the bloodline of the national economy and

the core of the modern economy, and the

development of financial markets has a crucial role in

regional development. Welfens and Ryan (2011) also

mention the development of financial markets as a

key factor in the economic growth of modern Europe

and America (

Paul, 2011)

.

Due to the lack of complete panel data for recent

interest rate data, testing the relationship between

railroads and financial market integration is a matter

of both data selection and the design of selected

indicators. In the literature, consistency between

prices across locations is usually used to test market

integration. Since only data on grain prices are

relatively systematic before modern times, grain

market integration has the most research. Therefore,

this paper tries to construct a relevant indicator using

grain prices. There have been a number of studies in

this area. As mentioned by McCloskey and Nash

(1984), the storage of grain is actually an investment.

Wheat is stored in October and then in November it

has to pay out the costs of the month, such as storage

costs, depletion costs (spoilage), etc (

McCloskey,

1984)

. If the wheat is sold immediately in November,

102

Gao, S.

The Relationship Between Modern Railway Construction and Financial Market Integration: A Quantitative Study Based on Henan Province.

DOI: 10.5220/0012026500003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 102-107

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

it means that the grain sold and the return on the

money owned (the value of the interest rate) coincide.

If the two do not agree, people will not sell wheat in

November. However, the difference between the two

will converge over time. Therefore, the price of wheat

is equal to the approximate value of interest rates plus

costs such as storage. Based on the above principle,

McCloskey and Nash (1984) used the spread of wheat

prices in medieval England over time to estimate the

interest rate at that time. Assuming that the cost of

storage, etc.is close to a constant, the differences in

seasonal fluctuations in prices across locations are

primarily caused by the interest rate. This method is

used by Mullen Peng (2005, p. 6) to estimate interest

rates using monthly grain prices in the Shandong

states (Peng, 2005). However, the shortcoming of the

above study is that it does not take into account the

exclusion of the non-seasonal component of grain

prices, including the consideration of the unit root, etc.

This paper takes Henan as a sample, one is the

modern The contribution of this paper is to take the

exogenous Henan Province as the sample and to

construct financial indicators using recent complete

data on grain prices; the empirical analysis not only

estimates the difference in the impact of the presence

or absence of railroads on financial markets, but also

divides the groups by railroad opening periods and

discusses the complex impact of railroads on

financial market integration in different opening

periods.

2 HYPOTHESIS AND RESEARCH

METHODOLOGY

2.1 Hypothesis

The railroad construction in Henan, which is located

in the Central Plains, began at the end of the 19th

century with the passage of national railroads, namely

the Ping-Han Railway and the Longhai Railway.

Subsequently, it was continuously expanded and

extended. With the expansion of the railroad network,

different regions became more and more closely

connected to each other. In theory, because railroads

lowered transportation costs, they not only promoted

the flow of goods and labor, but also influenced the

flow of capital. The completion of the Beijing-Han

railroad in 1906 soon stimulated the development of

mining and commercial agriculture along the railroad

lines in the North China Plain, and the demand for

capital would expand. At the same time, the increase

in productivity in the areas along the railroad implied

higher marginal returns to capital, which would lead

to a concentration of capital in these areas. Banerjee,

Duflo, and Qian (2012) argue that this process was

achieved through higher interest rates around the

railroad (Banerjee, 2012). However, significant

economies of scale are usually considered to exist in

finance, and with the increase in the size of financial

markets and the decrease in transaction costs brought

about by capital inflows, capital inflows to areas

along railroads do not require higher interest rates; on

the contrary, interest rates are likely to be lower as a

result.

According to the previous discussion, when the

impact of railroads on economic development is

predominantly positive, d(rail) > 0 corresponds to

d(interest rate) < 0: a decrease in the interest rate.

2.2 Research Methodology

The existing empirical studies show that identifying

the railroad-financial market relationship is not easy

due to the presence of endogeneity. However, as

mentioned earlier, if the construction of railroads

covers only a part of the economy and the selection

of this part is exogenous, it can be considered as a

natural experiment to verify the railroad-financial

market relationship using a double difference (DD)

model. The basic model, with regions with railroad

passage as the experimental group and regions

without railroad passage as the control group, is as

follows.

()

it it t i it it

Interest rate cont rail year county X

(1)

Where the subscript i represents the region and t

represents the period; Interest rate: a variable

measuring the change in interest rates; rail: a dummy

variable with a railroad connection and taking 1 after

opening and 0 otherwise; county: a region fixed effect;

year: a period fixed effect; X: other factors affecting

economic development, such as natural disasters, etc.

Of course, among these coefficients α is the most

concerned in this paper.

Further, combined with the sequence of railroad

construction in time, the experimental group can be

staged and the impact of the experimental group at

different times can be compared, so as to examine the

dynamic impact of railroad construction on the

financial market in different periods. Combining the

opening time of Henan Railway and the availability

of information, this paper divides the sample period

into three periods: before 1905 (pre1905), around

1910 (1910s), and 1930s (1930s). Other factors

affecting economic development, such as war, are

basically excluded from the selection of the sample

period. The wars that occurred in Henan during the

The Relationship Between Modern Railway Construction and Financial Market Integration: A Quantitative Study Based on Henan Province

103

late Qing Dynasty and early Republic of China were

mainly the Warlord Conflict in the 1920s and the

Great War in the Central Plains in 1930s, so the first

two sample periods were not affected by major wars.

As for the sample period of 1930s, the data are mainly

taken from 1933-1937, when the society has basically

restored stability, and the impact of war can be largely

ignored. Of course, the situation was very different

across the country in different periods, and the

stability of the provincial political situation was also

different, and these effects are controlled for in the

econometric model through time fixed effects. In the

three periods, pre1905 is the control period in which

the province was unaffected by the railroad, and each

subsequent period has additional areas open to traffic.

If these areas are divided into different experimental

groups by period - for example, the 1930s opening

group is the areas opened between 1910 and 1930 -

then there will be different experimental and control

groups for different periods, and the short- and long-

term effects of each group can be compared.

At the same time, a more detailed examination of

the specific situation in the experimental group is

necessary in the context of the actual operation of the

railroad. Among them, the presence or absence of

stations and the number of stations in the same

railroad passing area will affect the role of the

railroad. For example, Zhengzhou is located in the

node of the Ping-Han, Longhai Railway, the

transportation location advantage to highlight, the

railroad has become a booster of its development. Not

only that, the industrial structure of different places,

the degree of dependence on the railroad is also

different. (Beijing-Han railroad is located in the main

north-south traffic route, and there are Zhengtai,

Yangluo and Daoqing railroads as branch lines, the

source of goods is wider. The main cargoes

transported by this railroad were "coal and grain",

while coal was the bulk of the transportation in the

northern section, accounting for about half of the

passenger and cargo traffic, and coal produced by

Lincheng coal mine, Jinglong coal mine and coal

mines in Shanxi were directly or indirectly

transported by this railroad. (The main suppliers of

these coals were Beijing, Tianjin and the areas along

the Beijing-Han railroad.) For example, coal

transportation was particularly dependent on the

railroad. Chen Kang mentions that the opening of the

Daoqing Railway provided a cheap way to transport

coal and greatly reduced transportation costs, causing

the price of coal produced in Jiaozuo to drop sharply

in the market. Based on these considerations, the

model is further set as follows.

1980s 1980s

01(1)0itit1itit

1910 1910

( ) + rail station + rail coal

(2)

it p pit p pi t

ps ps

tiitit

Interest rate cont railp railp

year count y X

Where, p represents the group of through traffic;

railp: a dummy variable for the p-period through

traffic, and also introduces its first-order lag term to

examine the long-term impact of the railroad; station:

station density; coal: a dummy variable with coal

companies. The rest is the same as (1).

3 DATA INTRODUCTION

To examine the relationship between railroads and

financial markets based on the model in the previous

section, this paper compiles panel data on the socio-

economy of Henan region from the late 19th century

to the early 20th century. Among them, the sample

period is divided into three periods before 1905

(pre1905), before and after 1910 (1910s), and 1930s

(1930s) as mentioned before. The sample is observed

in counties, and there are 111 counties according to

the administrative division of Henan in the 1930s.

3.1 Railway Data

Railroads are the explanatory variables of most

interest in this paper. The development of railroads is

well documented in various transportation histories,

which facilitates the compilation of this data. The

approach of this paper is to set each county to 1 after

the opening of the railway, so as to obtain the dummy

variable for each opening group. Considering the

time required for the impact of railroad opening, we

put the counties opened to traffic in the first decade

of the 20th century into the 1910s opening group, so

pre1905 is a pure control group not affected by the

railroad.

Due to the limitation of information, the

quantitative indicators such as the mileage of

railroads in each county and the degree of coverage

are not considered. However, what can better reflect

the degree of railroad development in a place is its

station setting status, because the railroad only stops

and carries passengers and goods at the station, and

the setting of railroad stations in the early days was

mainly restricted by exogenous factors such as

location. The Railway Yearbook records in detail the

status of stations of different railroads, including the

time when each station was set up and the time when

the station was converted into a post. Based on this,

this paper collates the number of stations owned by

each county by period and by railroad line. For

example, the number of stations in Zheng County in

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

104

the 1930s actually reached five, three of which were

on the Beijing-Guangzhou line and two on the

Longhai line, which naturally made the convenience

of the railroad in the area much greater than that of

the counties through which a single railroad passed.

However, the number of sites in a certain place may

not necessarily mean that the local passengers and

goods can be more convenient to use the railroad, but

may be simply because the county is too large, the

railroad travels too long miles. Therefore, on the basis

of the number of stations, it is used to divide the area

of each county to calculate the station density of the

county to better measure the convenience of the

railroad.

3.2 Interest Rate Data

In the previous discussion, due to the lack of

complete panel data for interest rate data, this paper

tries to construct a relevant indicator using food

prices.

In terms of data, this paper collates grain prices

from pre1905 to 1930s. Considering the high degree

of commercialization of wheat among the grains in

Henan, wheat prices are selected for the study. The

sources are: pre1905 and 1910s, monthly data of sub-

prefectures from 1895 to 1910 compiled by grain

price transcription files according to the "Grain Price

Table between Daoguang and Xuantong of Qing

Dynasty", with the data of the prefectures to which

they belong instead of the data of each county; 1930s,

monthly prices of sub-prefectures from September

1935 to July 1937 according to the "Henan Monthly

Statistical Report".

In terms of methodology, based on McCloskey

and Nash (1984) and Peng Mullen (2005) studies,

assuming that costs such as storage are close to

constant, the differences in seasonal fluctuations in

prices across locations are mainly caused by interest

rates. However, the shortcoming of the above studies

is that they do not take into account the exclusion of

the non-seasonal component of food prices, including

the consideration of the unit root, etc. Developing a

structural time series model (STSM)

Since grain price data usually contain dynamic

features such as unit roots, it is assumed that for each

period, monthly wheat price data are generated with

the following expression.

2

ti ti ,

2

(1) (1) (1) (1) ,

2

(1) (1) (1) ,

(1)

*

*

(1)

+ 1 111, ( 0, ) (3)

(0, ) (4)

(0, ) (5)

cos sin

sin cos

ti ti ti ti i

ti ti ti ti ti i

ti ti ti ti i

ti

ti c c

ti

ti c c

PiNID

NID

NID

*

/2

,,(1)j(t1)

,

***

1

,,(1)(1)

(6)

cos sin

,(7)

sin cos

ti

ti

s

jj

jti j t i

ti j ti

j

jj

jti j t i jt

wh ere

where P is the price of wheat. Equation (3) means that

it has a trend component μ, a seasonal component γ,

a periodic component φ, and a sum of random

perturbations ε.

The variation of the trend component μ consists

of the horizontal equation (4) and the slope equation

(5).

The periodic component φ is defined by (6),

which has a period of 2π/λc.

The seasonal component γ is defined by (7),

where s denotes the seasonal cycle length.

In the model, the changes in each of the trend,

cycle and seasonal components reflect the normal

dynamic adjustment process of the market, and the

STSM defined in equation (3) precisely allows us to

conveniently extract the seasonal differential in

wheat prices. It is easy to see that the size of the

seasonal spread depends on the variance of the

disturbance term in the seasonal equation of equation

(7), and the standard deviation of the cyclical

fluctuations is calculated from the estimated value of

this variance to measure the level of interest rates.

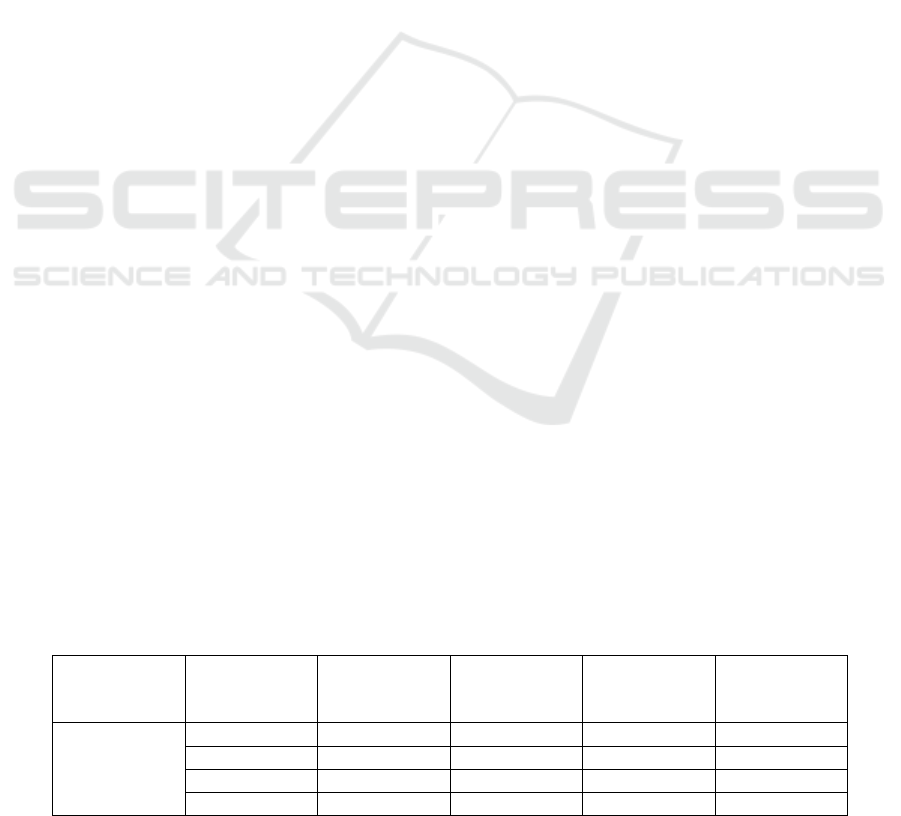

Table 1 provides a statistical description of each

of these variables by period. As can be seen, there

appears to be no sustained and steady increase in

population density and welfare levels, while market

consolidation has improved over the sample period.

So, what exactly is the role of railroads in this? The

following section will test this through DD analysis.

Table 1: Descriptive Statistics of Variables.

Time Variable

Interest rate

data

Welfare level Drough Flood

Pre1905

AVG 0.029 1.559 0.107 0.039

MAX 0.069 1.874 0.38 0.26

MIN 0.001 1.304 0 0

St

d

0.022 0.154 0.118 0.073

The Relationship Between Modern Railway Construction and Financial Market Integration: A Quantitative Study Based on Henan Province

105

n 106 109 111 111

1910s

AVG 0.032 1.575 0.001 0.391

MAX 0.069 1.909 0.03 1.03

MIN 0.004 1.353 0 0

St

d

0.02 0.162 0.004 0.23

n 111 110 111 111

1930s

AVG 0.026 1.439 0.304 0.042

MAX 0.129 3.281 1.01 0.38

MIN 0 0.919 0 0

St

d

0.031 0.326 0.297 0.083

n 111 104 111 111

328 410 333 333

4 EMPIRICAL ANALYSIS

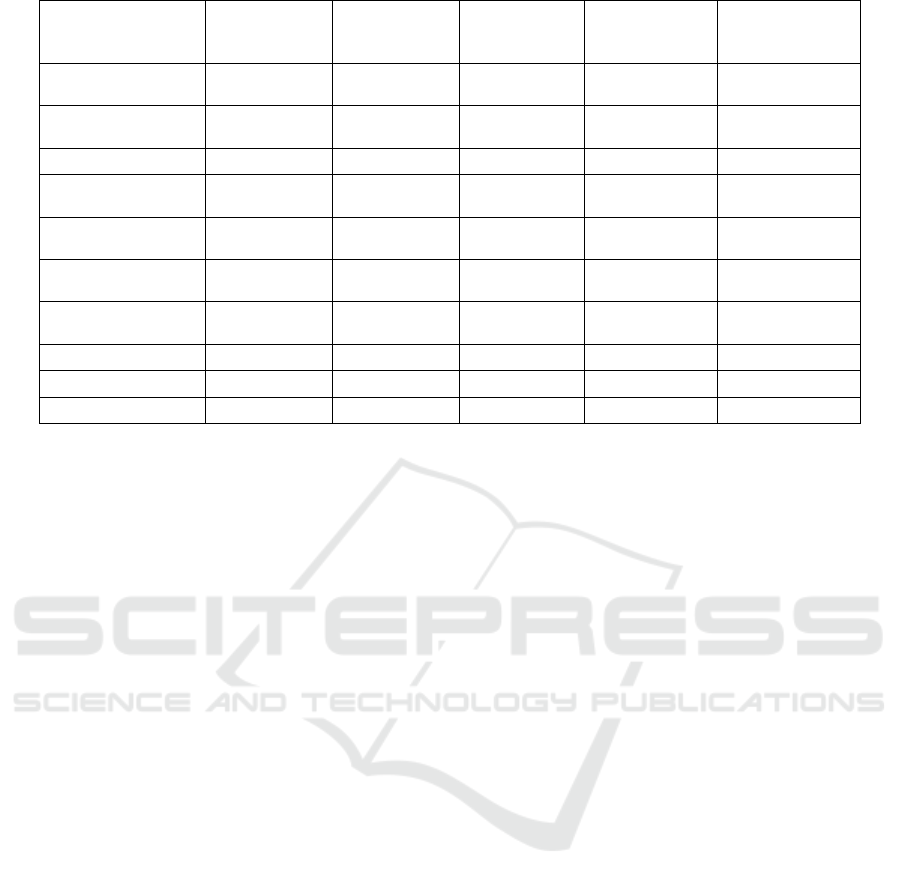

Table2 gives the estimation results of the causal

relationship between railroads and interest rates

identified using the double difference model.

In model 1, only the standard deviation of cyclical

fluctuations is regressed on the railroad dummy

variable, and the results show a negative coefficient

of the double difference estimator with a significant

level of 10%. That is, interest rates in areas along

railroads are 1.2% lower than those in areas without

railroads. If we look at the access group, the

estimation results of model 2 show that the 1930s

access group has a significantly lower interest rate of

2.2% than its control group, but the 1910s access

group does not have a significant effect on the interest

rate. After adding control variables such as disasters,

in models 3 and 4, the 1910s pass-through group has

a 5.8% lower interest rate than its control group and

is significant at the 10% level, and the 1930s pass-

through group has a 4.8% lower interest rate than its

control group at the 1% level of significance.

Compared to the results in model 2, the coefficients

have increased in absolute value and significant level.

Since there are strong economies of scale in the

financial sector, interest rates decrease in both the

1910s pass-through group, and the 1930s pass-

through group, which rejects the hypothesis of

Banerjee, Duflo, and Qian (2012). Meanwhile, the

1910s station density is negatively but insignificantly

related to the interest rate, then it may be because the

railroad attracts population in this group of areas

mainly through administrative status improvement

and material security improvement, so that the

increase in stations and the convenience of trade do

not play a further impact. As for, the 1930s coal and

interest rates were significantly positive, probably

because the development of the coal industry

increased capital demand, coupled with the remote

location of the mines, which made it difficult for the

development of financial services to follow.

If economies of scale existed, the agglomeration

effect would have been strengthened, so would

interest rates along the railroad have been relatively

and consistently lower? In order to test this dynamic

effect, in model 5, this paper tries again to include the

lag term of 1910s through group. Unfortunately, the

effect of the 1910s opening on the 1930s interest rate

is significantly positive. As explained by Banerjee,

Duflo, and Qian (2012), it is possible that this is due

to the increase in productivity in this group of regions,

which leads to an increase in the return to capital.

However, taking the previous evidence together, it is

more likely that the 1910s opening group (i.e., the

area along the Beijing-Han railroad) did not gain

significant market development and the

agglomeration of the financial sector could hardly

have occurred consistently.

Table 2: Estimated results of railway impact on modern Henan interest rate.

Explained

variable: Interest

rate data

model 1 model 2 model 3 model 4 model 5

Rail

-0.012

*

(

0.006

)

1910s through

g

rou

p

-0.007

(

0.007

)

-0.058

*

(

0.033

)

-0.015

*

(

0.008

)

-0.019

**

(

0.008

)

1930s through

group

-0.022

*

(0.012)

-0.048

***

(0.007)

-0.046

***

(0.007)

-0.040

***

(0.007)

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

106

1910s through

group*

(year=1930s)

0.015

*

(0.009)

Site density *

(

y

ear=1910s

)

-0.007

(

0.005

)

Coal* (year=1930s)

0.025

**

(0.012)

control variable:

Drough

-0.024

**

(0.011)

-0.023

**

(0.011)

-0.018

(0.011)

Flood

0.003

(

0.018

)

0.005

(

0.019

)

0.004

(

0.019

)

Welfare level

-0.023

*

(

0.012

)

-0.025

*

(

0.013

)

-0.028

**

(

0.013

)

Constant term

0.032

***

(0.003)

0.031

***

(0.002)

0.071

***

(0.019)

0.073

***

(0.020)

0.076

***

(0.020)

n 328 328 258 258 258

R

2

0.266 0.272 0.377 0.374 0.381

DW 2.654 2.667 2.776 2.701 2.686

5 CONCLUSION

The relationship between railroads and economic

development has been of considerable interest.

Considering that railroad development is often

endogenous to economic development, this paper

selects a sample with a strong exogenous nature,

modern Henan, to examine the impact of railroads on

financial market integration. Unlike previous

literature, this paper examines the diversification of

the impact of railroads, and the results show that: In

the group divided by the period of railroad opening,

interest rates along the railroad all decrease, the 1930s

opening group improves regional financial market

integration, while the 1910s opening group does not

gain significant market development and financial

agglomeration does not occur consistently.

Interestingly, this paper finds two patterns in the

relationship between railroads and Henan's economic

development: the Beijing-Han line (corresponding to

the 1910s through group), which connects the central

cities of the country, has a limited role in the

development of regional financial markets; in

contrast, the Longhai line (corresponding to the

1930s through group), which mainly connects the

hinterland, had a more robust role in financial

development. Clearly, if urbanization goes hand in

hand with administrative capacity and economic

efficiency, the railroad did not help modern Henan

achieve economic development through this route.

This finding helps us not only to explain the

relationship between railroads and economic

development, but also to reflect on the general path

of economic development. At the same time, the two

modes must be weighed when planning railroad

construction in order to make a reasonable

assessment of their effects.

REFERENCES

Banerjee Abhijit., Esther Duflo and Nancy Qian (2012) On

the Road: Access to Transportation Infrastructure and

Economic Growth in China. Working

Paper17897.cords.

McCloskey and John Nash (1984) Corn at interest: The

Extent and cost of Grain Storage in in Medieval

England American Economic Review,74:1.

Paul J.J. Welfens and Cillian Ryan (2011) Financial Market

Integration and Grown. Springer-Verlag Berlin

Heidelberg.

Peng Mulan (2005) The Construction of the Hinterland:

The State, Society, and Economy of The North China

Mainland (1853-1937). Social Science Literature

Publishing, Beijing.

Zhang, Peigang. (1984) agriculture and industrialization.

Central China Institute of Technology Press. Wuhan.

The Relationship Between Modern Railway Construction and Financial Market Integration: A Quantitative Study Based on Henan Province

107