Big Data Financial Analysis Comparison Between Midea and Gree

Based on Power BI Software

Tieping Wang

Department of Economics and Management, Taishan University, Tai’an, China

Keywords: Financial Analysis, Big Data, Comparison.

Abstract: Big data financial analysis is the application of big data technology to analyze the financial and

non-financial related information of enterprises. PowerBI is a very useful computer application software for

financial analysis. This paper uses PowerBI software for big data financial analysis, and makes a

comparative analysis of Midea and Gree in terms of profitability, solvency, operating ability and growth

ability. Gree's commodity profitability is better than Midea, and Midea's capital profitability is better than

Gree. Midea and Gree have relatively weak short-term solvency and comparable long-term solvency.

Midea's overall operational capability is stronger than Gree. Compared with the same period last year, both

Midea and Gree have good growth capabilities.

1 INTRODUCTION

Big data financial analysis is a set of techniques and

methods for the collection, preparation, analysis and

action of huge financial-related data (including

financial data and structured data and a large amount

of non-financial data and unstructured data) of the

company. It integrates accounting and information

systems (Fan, 2014). This paper uses Power BI

software for big data financial analysis, and makes a

comparative analysis of Midea and Gree in terms of

profitability, solvency, operating ability and growth

ability.

Power BI is useful business analysis software.

Power BI can connect available data sources,

simplify the data preparation process, provide

specialized analysis, and support the generation of

beautiful reports to better meet the needs of

accounting information users (Schroeder, 2019). The

use of Power BI simplifies the data analysis work of

business personnel, and can intuitively present the

trend of report data in each period, compare the

company's data with other companies in the same

industry, locate the company's position in the

industry, and determine the company's future

development direction (AREAS, 2018). Power BI is

very useful computer application software for

financial analysis.

Midea and Gree are both well-known home

appliance companies. In the industry rankings,

Midea and Gree have been competing for industry

leaders. Midea's earnings per share, net profit,

operating income and assets are better than those of

Gree, and Gree's gross profit margin is better than

that of Midea. This paper compares and analyzes the

profitability, solvency, operating ability and growth

ability of Midea and Gree, and evaluates the

financial status of Midea and Gree.

2 BASIC SITUATION

Midea's products mainly include HVAC and

consumer appliances, as well as robotics and

automation. Among them, HVAC revenue accounted

for 43.96%, consumer appliances accounted for

37.38%, and robotics and automation was a new

business, accounting for 7.24% of revenue. HVAC

and consumer appliances occupy an absolute

position in Midea's revenue. The revenue of HVAC

accounted for 43.96%, the cost accounted for

45.32%, and the profit accounted for only 39.46%,

which showed that the cost of HVAC was high. In

terms of gross profit margin, HVAC's gross profit

margin was 20.85%, lower than 29.6% for consumer

appliances and 22.72% for robots.

Wang, T.

Big Data Financial Analysis Comparison between Midea and Gree Based on Power BI Software.

DOI: 10.5220/0012027200003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 155-159

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

155

Gree's product concentration is very high, and

73.8% of the company's revenue is concentrated on

air conditioners. Gree also produces household

appliances, but its revenue only accounts for 2.43%.

In terms of profit indicators, Gree air conditioners’

profit ratio reached 92.6%, with 73.8% of the

revenue and 67.94% of the cost, generating 92.6%

of the profit, indicating that the air conditioner is

Gree’s ace product, and the cost is very controlled.

The gross profit rate of Gree air conditioners is

29.79%, the gross profit rate of household

appliances is 32.54%, and the gross profit rate of

other products is low. As far as the sales area is

concerned, Gree's domestic sales accounted for

63.93% of its revenue, 55.53% of its costs, 90.9% of

its profits, and 33.75% of its gross profit margin. Its

foreign sales accounted for 13.98% of its revenue

and 16.49 of its costs. %, the proportion of 0 profit

is only 10%. Gree mainly relies on domestic sales to

obtain profits.

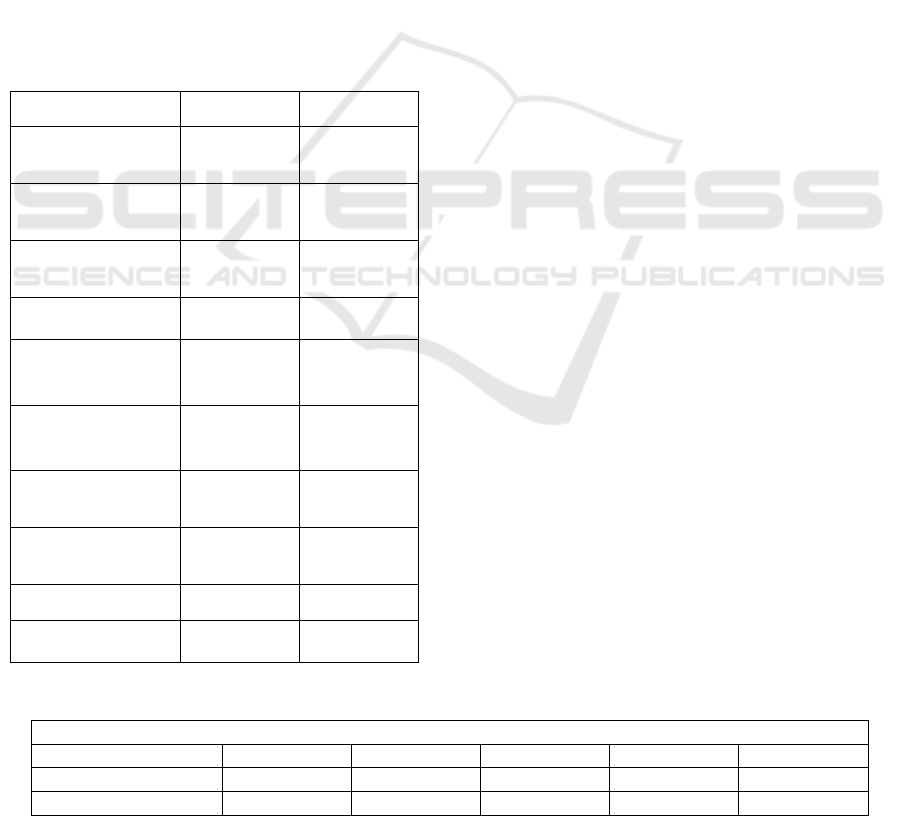

Table 1: Midea and Gree.

Midea Gree

EPS (yuan) 3.41 2.71

Net assets per share

(yuan)

16.97 15.34

Cash flow per share

(yuan)

3.994 1.074

Net profit (yuan)

23.460

b

illion

15.640billion

Total operating

income (yuan)

262.90billion 139.50billion

Total assets (yuan) 376.30billion 286.10billion

ROE 19.51% 15.02%

Shareholders'

Equity Ratio

34.09% 32.87%

Gross profit margin 23.80% 24.13%

Total share capital

(

shares

)

6.985billion 5.914billion

3 FINANCIAL COMPARATIVE

ANALYSIS OF MIDEA AND

GREE

3.1 Profitability

This section analyzes Midea's profitabily. In the

third quarter of 2021, the gross profit margin of

Midea's sales was 23.80%, compared with 25.29%

in the same period last year, indicating that Midea's

main business profitability has been greatly

weakened. Midea's current sales net profit margin

(9.07%), less than 10.24% last year, indicating a

decline in corporate operating efficiency. Midea's

net interest rate on total assets in the current period

(6.43%), less than 6.80% last year, indicating that

Midea's ability to return on total assets declined

slightly. Midea's current ROE was 19.51%, less than

20.35% last year, indicating that Midea's ability to

return to shareholders has weakened. The

profitability indicators of Midea Group have all

declined, and Midea's profitability has weakened.

Gree's gross profit margin in the current period

was 24.13%, compared with 23.37% last year,

indicating that Gree's main business profitability

remained stable. Gree's current sales net profit

margin was 11.36% is more than 10.96% last year,

indicating that the company's operating efficiency

has improved. Gree's net interest rate on total assets

(5.55%) is more than 4.95% last year, indicating that

Gree's ability to return on total assets has improved

slightly. Gree's return on net assets (15.02%) is more

than 11.74% last year, indicating that Gree's ability

to return to shareholders has increased. Compared

with the same period last year, Gree's profitability

indicators generally increased, indicating that the

profitability of the company has improved.

Midea's profitability decreased year-on-year,

while Gree's profitability increased year-on-year.

Comparing and analyzing the profitability indicators

of Midea and Gree, it can be found that Gree's net

sales profit margin and sales gross profit margin are

higher than those of Midea, but Midea's ROE is

higher than that of Gree. Gree's commodity

profitability is stronger, and Midea's capital

profitability is stronger.

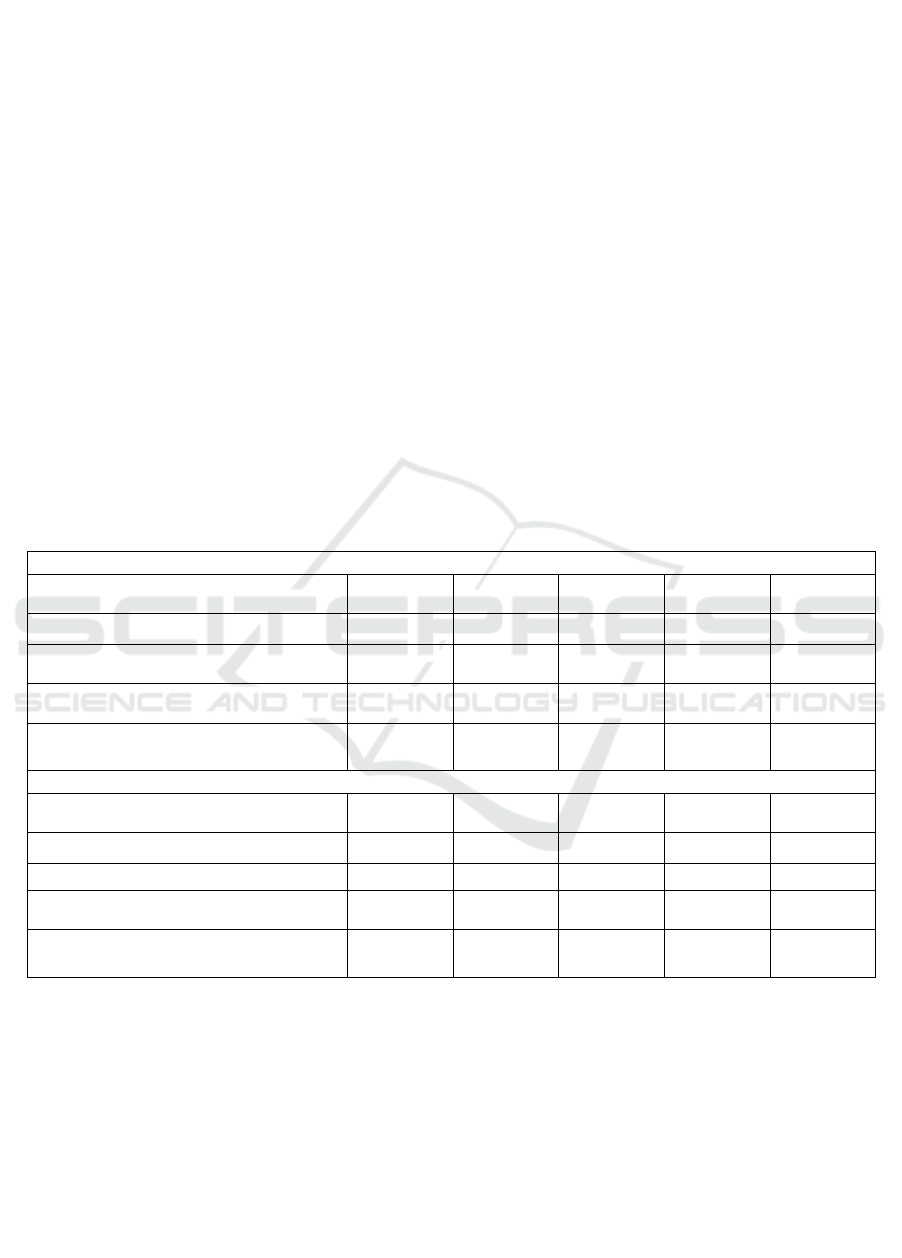

Table 2: Profitability of Midea and Gree.

Midea's profitability

Subject\Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Sales margin 9.07% 8.75% 7.96% 9.68% 10.24%

gross profit margin 23.80% 23.23% 23.00% 25.11% 25.29%

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

156

ROE 19.51% 12.63% 5.35% 24.95% 20.35%

Gree's profitability

Subject\Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Sales margin 11.36% 10.42% 10.40% 13.25% 10.96%

Gross profit margin 24.13% 23.74% 24.43% 26.14% 23.37%

ROE 15.02% 8.11% 2.95% 18.88% 11.74%

3.2 Solvency

Solvency can be analyzed in terms of current ratio,

quick ratio, equity ratio and asset-liability ratio

(Helfert, 2001). In the third quarter of 2021, Midea's

quick ratio (0.75) is more than 0.72 last year,

indicating that Midea has controllable short-term

debt risks. The current ratio of Midea (1.37) is more

than 1.33 last year, indicating that Midea's

short-term solvency was weak. Midea's

asset-liability ratio (65.91%) is more than 65.72%

last year, and the company's ratio of liabilities to

assets remained stable. Midea's cash ratio (35.55%)

is less than 37.35% last year, indicating that the

company's ability to pay cash immediately declined.

Compared with last year's third quarterly report,

Midea's solvency has strengthened.

Gree's quick ratio (0.83) is less than 1.15 last

year, indicating that Gree has controllable short-term

debt risks. Gree's current ratio (1.18) is more than

1.33 last year, indicating that the company's

liquidity was poor and its short-term solvency was

weak. Gree's asset-liability ratio (67.13%) is more

than 57.57% last year, indicating that the company's

financial risks have increased. Gree's cash ratio

(66.43%) is less than 85.43% last year, indicating

that the company's immediate cash payment ability

has declined significantly. Compared with last year,

Gree's debt solvency remained stable overall.

Midea's solvency increased year-on-year, while

Gree's solvency remained stable. Comparing and

analyzing the solvency indicators of Midea and Gree,

we can see that the current ratios of both are

relatively low, the short-term solvency is weak, and

the long-term solvency is comparabl

Table 3: The solvency of Midea and Gree.

Midea's solvency

Subject\Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Current ratio 1.37 1.32 1.32 1.31 1.33

Quick ratio 0.75 0.72 0.93 0.95 0.72

Equity ratio 2.09 2.27 2.08 2.01 2.04

Asset-liability ratio 65.91% 67.53% 66.31% 65.53% 65.72%

Gree's solvency

Subject\Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Current ratio 1.18 1.12 1.31 1.35 1.33

Quick ratio 0.83 0.87 1.01 1.05 1.15

Equity ratio 2.08 2.15 1.7 1.41 1.38

Asset-liability ratio 67.13% 67.93% 62.56% 58.14% 57.57%

3.3 Operational Capability

Midea's business cycle and turnover period are all

declining, implying that its turnover period is

shortened and its turnover capacity is stronger. The

operating cycle is the sum of the inventory turnover

period and the accounts receivable turnover period

(Fabozzi, 2003). In the third quarter of 2021,

Midea's business cycle was 68.87 days, down 5.86%

from the same period last year, because the

inventory turnover period and accounts receivable

turnover period decreased by 7.61% and 2.73%

respectively. In terms of days, the inventory turnover

period was 43.57 days, down 7.61% over the same

period last year, and the accounts receivable

turnover period was 25.29 days, down 2.73% over

the same period last year. The significant reduction

in inventory turnover period is the main reason for

the decline in the business cycle of enterprises.

Midea's current account receivable turnover rate was

10.68 times, more than 10.39 times last year,

Big Data Financial Analysis Comparison between Midea and Gree Based on Power BI Software

157

indicating that the company has improved the capital

utilization efficiency.

Midea's inventory turnover rate (6.20 times),

more than 5.72 times last year, implying that its

inventory realization ability has been enhanced.

Midea's current asset turnover rate was 1.05 times,

more than 0.94 times last year, indicating that the

company's current assets have been reasonably

utilized. Midea's total asset turnover rate (0.71

times), more than 0.66 times last year, indicating

that the company's comprehensive utilization of

assets has been optimized. All of Midea's operating

capacity indicators are improving, indicating that

Midea's operating capacity is stronger than the same

period last year.

In the third quarter of 2021, Gree's business

cycle was 105.54 days, an increase of 23.06% than

last year, mainly due to the longer inventory

turnover period. Gree's accounts receivable turnover

rate (14.58 times), more than 11.67 times last year,

indicating that the company's capital utilization

efficiency has been significantly improved. Gree's

inventory turnover rate (3.10 times), less than 4.31

time last year, indicating that Gree's product market

competitiveness has weakened. Gree's current asset

turnover rate (0.66 times), more than 0.61 times last

year, indicating that the company's current assets

were reasonably utilized. Gree's total asset turnover

rate (0.49 times) is more than 0.45 times last year,

indicating that the company has optimized the

comprehensive utilization of assets. Compared with

last year, Gree's operating capacity remained stable.

Comparing the indicators of Midea and Gree,

Midea's business cycle is 68 days, which is much

lower than Gree's 105 days. Midea's overall

operating capability is stronger than Gree's. The

advantage of Midea is that the inventory turnover is

fast, and the inventory turnover rate is twice that of

Gree. It should be noted that Gree's accounts

receivable turnover is faster. In order to optimize

their respective operating capabilities, Midea should

further speed up account turnover, and Gree should

further speed up inventory turnover.

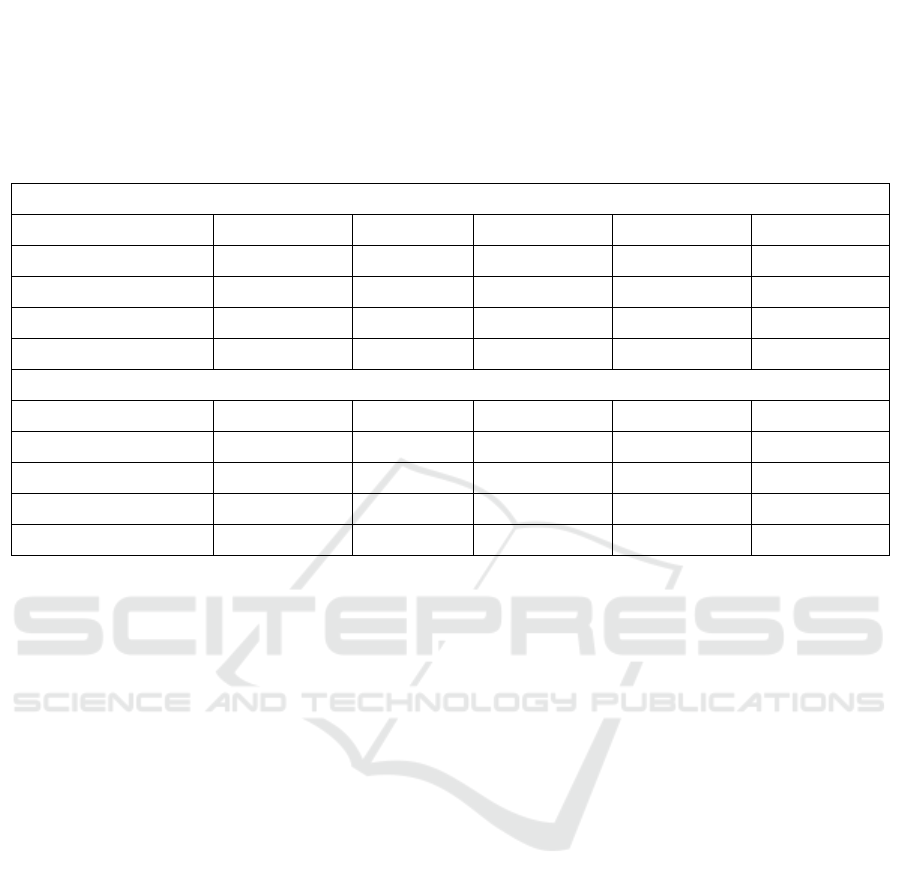

Table 4: Operational Capabilities of Midea and Gree.

Midea's O

p

erational Ca

p

abilit

y

Subject

\

Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Business cycle (days) 68.87 70.41 71.25 80.09 73.16

Inventory turnover rate (times) 6.2 4.07 2.03 6.7 5.73

Inventor

y

turnover da

y

s

(

da

y

s

)

43.57 44.23 44.32 53.72 47.16

Accounts receivable turnover days (days) 25.29 26.19 26.93 26.37 26

Gree's Operational Capabilit

y

Subject

\

Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Business cycle (days) 105.54 98.18 136.09 93.76 85.76

Inventory turnover rate (times) 3.1 2.29 0.83 4.78 4.31

Inventor

y

turnover da

y

s

(

da

y

s

)

87.02 78.55 109.06 75.29 62.63

Accounts receivable turnover days (days) 18.52 19.63 27.02 18.46 23.13

3.4 Growth Ability

This section analyzes Midea's growth ability. In the

third quarter of 2021, Midea's operating income

growth rate was 20.57%. The operating income

turned from loss to profit, compared with -1.88%

last year. Midea's operating profit growth rate was

4.64%. The profit growth rate resumed its upward

trend compared with -0.89% last year. The net profit

growth rate (6.53%) indicates that the company's net

profit growth rate has continued to grow, and the

growth potential needs to be strengthened. The

growth rate of Midea's total assets (4.43%), far less

than 16.06% last year, indicating that the company's

scale has slowed down expansion. Compared with

the same period last year, Midea 's growth ability

has been enhanced.

Gree's current operating income growth rate

(9.73%) indicates operating income turned from loss

to profit. Gree's operating profit growth rate

(13.70%) indicates the profit growth rate has entered

an upward channel. Gree's net profit growth rate

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

158

(14.21%) indicates that the company's growth

potential has been restored. The growth rate of

Gree's total assets (2.46%) indicates that the

company's scale has begun to expand. Compared

with the same period last year, Gree's growth ability

has been strengthened.

2020 is the year of the outbreak of the

COVID-19, and the household appliance industry is

generally sluggish due to the impact of the epidemic.

In 2021, Midea and Gree perform well, and their

growth capabilities are constantly improving.

Table 5: Growth capabilities of Midea and Gree.

Midea 's growth abilit

y

Sub

j

ect

\

Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Net profit (yuan) 23455250000 1.501E+10 6468588000 27222969000 22018301000

Net profit growth rate 6.53% 7.76% 34.45% 12.44% 3.29%

O

p

eratin

g

income

(y

uan

)

2.62943E+11 1.748E+11 83017120000 2.8571E+11 2.17753E+11

Revenue growth rate 20.75% 25.14% 42.26% 2.27% -1.81%

Gree 's growth abilit

y

Sub

j

ect

\

Time 2021-09-30 2021-06-30 2021-03-31 2020-12-31 2020-09-30

Net profit (yuan) 1.564E+10 9.457E+09 3.443E+09 2.218E+10 1.37E+10

Net profit growth rate 14.21% 48.64% 120.98% -10.21% -38.06%

O

p

eratin

g

income

(y

uan

)

1.395E+11 9.201E+10 3.352E+10 1.705E+11 1.275E+11

Revenue growth rate 9.48% 30.32% 60.30% -14.97% -18.64%

4 CONCLUSIONS

Through the big data financial analysis of Midea and

Gree carried out by Power BI software, the paper

found that: Midea and Gree are both well-known

home appliance companies. Based on the above

analysis, Gree's commodity profitability is better

than Midea, and Midea's capital profitability is

better than Gree. Midea and Gree have relatively

weak short-term solvency and comparable long-term

solvency. Midea's overall operational capability is

stronger than Gree. Compared with last year, both

Midea and Gree have good growth capabilities.

ACKNOWLEDGEMENT

The thesis is the result of the Taishan University

Introduced Talents Scientific Research Start-up

Fund Project.

REFERENCES

AREAS, B., Financial analysis. Growth, 2018. 30: p. 10.

Fabozzi, F.J. and P.P. Peterson, Financial management

and analysis. Vol. 132. 2003: John Wiley & Sons.

Fan, J., F. Han and H. Liu, Challenges of big data analysis.

National science review, 2014. 1(2): p. 293-314.

Helfert, E.A. and E.A. Helfert, Financial analysis: tools

and techniques: a guide for managers. 2001:

McGraw-Hill New York.

Schroeder, R.G., M.W. Clark and J.M. Cathey, Financial

accounting theory and analysis: text and cases. 2019:

John Wiley & Sons.

Big Data Financial Analysis Comparison between Midea and Gree Based on Power BI Software

159