Scale of Goodwill Impairment and Audit Charge

Yanru Wang

*

a

and Yuju Li

b

Bejing Jiaotong University, China

Keywords: Goodwill Impairment, Audit Fees, Surplus Management.

Abstract: In the capital market, auditors perform forensic evaluation of accounting information and express independent

audit opinions. Based on the agency theory, stakeholder theory and large sample empirical method, this paper

selects A-share listed companies from 2014 to 2021 as samples to deeply analyze the impact of the scale of

goodwill impairment on the pricing level of audit services, in order to provide empirical evidence for

accounting information users. The results show that the larger the size of goodwill impairment provision

made by clients, the higher the pricing of audit fees in the current year, and the auditor maintains a higher

level of prudence. It is recommended that audits should focus on the subsequent measurement risk of

goodwill, give full play to the external oversight function of audits, and enhance the signaling effect of audit

pricing on the capital market.

1 INTRODUCTION

While the Chinese economic market continues to

expand, mergers and acquisitions have also led to the

accumulation of large amounts of goodwill in the

capital market in a few short years, and the risk of

large goodwill impairment charges is hidden behind

high goodwill. Essentially, the goodwill recognized

in the consolidated statements of operations arises

from the difference between the cost of the merger

and the fair value of the identifiable net assets of the

acquiree acquired in the merger, which is a kind of

merger premium paid by the listed company for the

value creation ability and market development

prospect of the acquire. Although goodwill is an asset

class, it cannot be realized due to its own properties

and cannot be reversed once a provision for goodwill

impairment is made. As an unidentifiable,

unverifiable and non-physical asset, it is highly

subjective and complex, making it difficult to

accurately estimate the fair value of goodwill assets.

In addition, in 2006, China implemented new

accounting standards and adopted the practice of

convergence with international accounting standards

for the recognition and subsequent measurement of

goodwill in business combinations by withdrawing

the amortization of goodwill and replacing it with

a

https://orcid.org/0000-0002-7512-4708

b

https://orcid.org/0000-0002-2558-5063

impairment testing only. Enterprises should

determine whether there is an indication of

impairment at the balance sheet date and perform

impairment tests at least at the end of each year.

Goodwill impairment in the capital market has been a

frequent lightning rod in recent years, with financial

fraud occurring from time to time and investors and

regulators questioning the CPA as the gatekeeper of

the capital market.

The existing literature generally considers the

impairment of M&A goodwill as a negative risk

matter, which will adversely affect listed companies.

Empirical studies have found that impairment of

goodwill implies that the excess premium paid in

M&A restructuring of listed companies does not

bring real benefits to the companies, but also provides

room for management to manage surplus to some

extent (Goncalves et.al., 2019), causing poorer

company performance (Glaum et.al., 2018) and

triggering drastic fluctuations in stock prices in the

market (Knauer and Woehrmann, 2016),

exacerbating the risk of sharp fluctuations in the

company's future share price (Han et al., 2019),

increasing the company's debt financing costs (Xu et

al., 2017), and leading to the generation of pessimism

among investors, analysts, and other stakeholders (Li

et.al. 2011). In fact, the goodwill impairment of

198

Wang, Y. and Li, Y.

Scale of Goodwill Impairment and Audit Charge.

DOI: 10.5220/0012028000003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 198-203

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

mergers and acquisitions has been one of the major

risks of listed companies and capital markets that the

CSRC, the Ministry of Finance and other government

regulatory departments focus on. CSRC has

repeatedly urged accounting firms and market

intermediaries to strengthen supervision to prevent

the risks associated with large-scale goodwill

impairment charges by listed companies. It can be

seen that the goodwill impairment of mergers and

acquisitions of listed companies may not only be an

accounting confirmation behavior, but also may lead

to the risk of material misstatement of the company

and the risk of management information disclosure

violation, which will bring uncertainty to the external

stakeholders of the company and the capital market.

Auditors, as the assurance evaluators of accounting

information of listed companies, have clients with

huge goodwill impairment triggering higher risk of

audit failure. In terms of audit risk response,

established literature suggests that increasing audit

procedures, expanding audit scope, and devoting

more audit hours to obtain sufficient and appropriate

audit evidence are indispensable work elements for

auditors to reduce the risk of material misstatement at

the financial reporting determination level and thus

reduce audit risk, so whether auditors will require an

increase in audit fees as cost compensation and

whether the size of goodwill impairment charged by

the enterprise in the current year affects audit pricing

in the current year, there is less research in the

existing literature.

In view of this, this paper empirically examines

the relationship between M&A goodwill impairment

and audit fees for listed companies, using a sample of

Chinese A-share listed companies over the period

2014-2021, with a view to interpreting the

information content contained in M&A goodwill

impairment for listed companies from the perspective

of auditors' risk decisions.

2 LITERATURE REVIEW

Regarding the factors influencing audit fees, an

analysis of the impact of audit pricing based on the

cost hypothesis suggests that firm characteristics,

client characteristics, and government regulation all

affect audit pricing. Overall, audit costs are higher

and audit pricing is higher when accounting firms

provide audit services to clients with large firms and

complex organizational structures and operations.

Chen et al. (2010) argue that institutional advances

have led firms to focus less on the financial benefits

derived from auditing clients and more on the audit

cost factor invested in ensuring audit quality. When

firms have industry expertise and higher reputation,

the transmission of economies of scale becomes more

pronounced, triggering a decrease in audit pricing

levels (Chen and Ma, 2013). Therefore, cost savings

from economies of scale and learning curve effects

provide the possibility for firms to reduce audit

pricing (Yu et al., 2020).

Regarding the relationship between goodwill

impairment and audit pricing, M&A goodwill

impairment is prone to higher risks and negative

economic consequences. The cost of goodwill

generated by high premium M&A can enhance the

firm's current operating performance, but there is a

lag in the negative impact of goodwill cost on firm

performance (Zheng et al., 2014), and the higher the

M&A premium rate, the weaker the economic

synergy effect, the greater the possibility of triggering

goodwill impairment and the greater the stock return

volatility (Liu and Wang, 2019), increasing the risk

of stock price collapse (Liu et al., 2019). Auditing

should play an external monitoring role in the

impairment of M&A goodwill. On the one hand, an

effective reputation mechanism can motivate

accounting firms to provide high-quality audit

reports, and accounting firms that provide high audit

quality can receive a fee premium (Liu et al., 2018).

In addition, when the auditor faces a high enough

audit risk, the accounting firm devotes more total

audit time and more higher staff level audit time to

high-risk engagements (Bell et.al., 2008), and

according to the cost-benefit theory, the firm will

charge more audit fees to the audited entity.

Some scholars study the impact of goodwill on

audit fees, for example, Zheng and Li (2018)

empirically analyze that the ratio of goodwill opening

balance to assets positively affects audit fees in the

case of positive or negative surplus management. Ye

et al. (2016) argue that the complexity and

subjectivity of goodwill impairment testing leads

firms to invest in greater audit costs, resulting in

higher audit fees. The current period premium M&A

generates additional goodwill, and auditors charge a

risk premium for audits in response to the massive

goodwill impairment charged by clients, thus

increasing audit pricing. Based on this, this paper

proposes the hypothesis.

H1: Other things being equal, the larger the

goodwill impairment charged in the period, the higher

the audit fee.

Scale of Goodwill Impairment and Audit Charge

199

3 RESEARCH DESIGN

3.1 Sample Selection and Data Sources

This paper uses Chinese A-share listed enterprises

from 2014 to 2021 as the research object, and further

screened to ensure the reasonableness of the data:

excluding enterprises in the financial industry;

excluding enterprises with all 0 goodwill impairment

provisions during the sample period; enterprises with

missing data on the main variables during the sample

period and those listed after 2017. Finally, to guard

against the impact of extreme values on our study, 1%

and 99% quantile tailing was applied to all continuous

variables, and a total of 10,319 valid data were

obtained for 1175 firms. All variable data were

obtained from the Cathay Capital database

(CSMAR).

3.2 Sample Selection and Data Sources

3.2.1 Explained Variable: Audit Fees (Afee)

The natural logarithm of audit fees paid by the firm in

the current period is used to measure, which has been

determined to be basically in line with the normal

distribution.

3.2.2 Explanatory Variable: Goodwill

Impairment Size (IG)

The provision for goodwill impairment in the notes to

the financial statements was directly adopted as a

proxy for goodwill impairment, and the classification

of goodwill impairment of size was made on this

basis, which consisted of two indicators: the natural

logarithm of the provision for goodwill impairment of

the enterprise in the current year was adopted (IG1);

the ratio of the provision for goodwill impairment of

the enterprise to the total assets of the enterprise in the

current year was adopted (IG2).

3.2.3 Control Variables

The size of the enterprise (Size), the previous period's

surplus position (Isloss), the type of accounting firm

(Big4), the degree of surplus management (EM, as

measured by the modified Jones model), the asset-

liability ratio (TDR), and the equity pledge (Gqzz) are

selected, and the specific indicators are described in

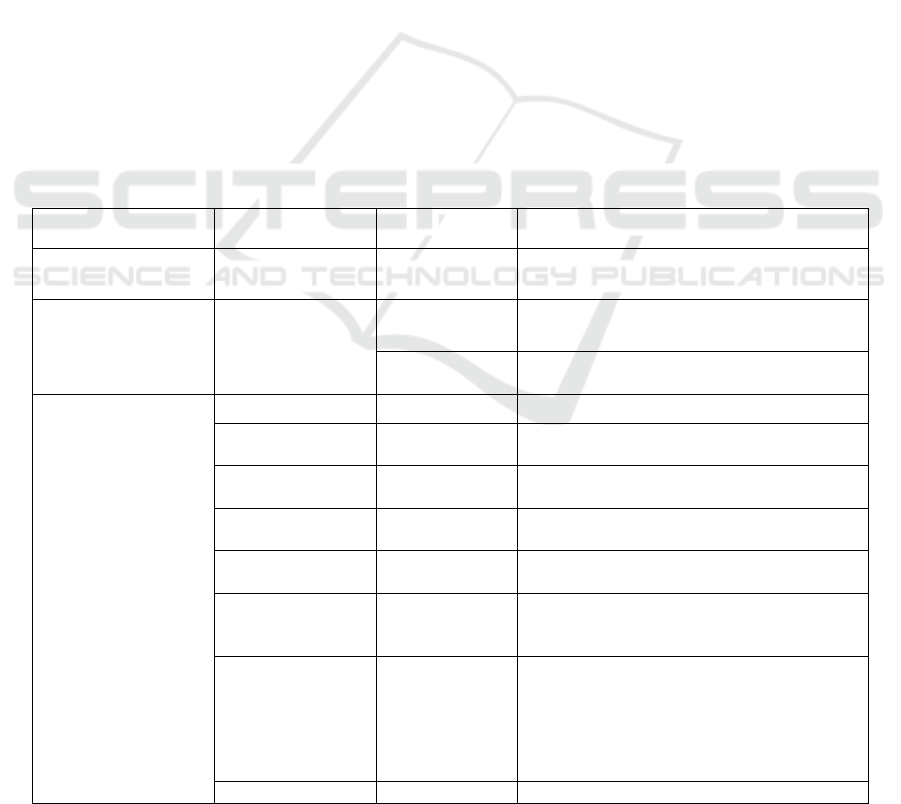

Table 1.

Table 1: Variable definition table.

Type Variable Symbol Calculation Method

Explained variables Audit fees AFee

Natural logarithm of audit fees paid in the

current year

Explanatory variables

Size of goodwill

impairment

IG1

Natural logarithm of goodwill impairment

provision in the current year

IG2

Ratio of provision for goodwill impairment

to total assets of the firm in the current yea

r

Control variables

Size of the firm Size Natural logarithm of total assets

Previous period's

sur

p

lus status

Isloss

Previous year's net profit less than 0 is taken

as 1, otherwise 0

Degree of surplus

mana

g

ement

EM

Absolute value of manipulative accrued

p

rofit

Balance sheet ratio TDR

Ratio of total liabilities to total assets at the

end of the yea

r

Equity pledge Gqzz

The value is 1 if the enterprise has equity

p

led

g

e at the end of the

y

ear, otherwise it is 0

Type of accounting

firm

Big4

The accounting firm hired by the enterprise

belongs to the "Big Four" takes the value of

1, otherwise it takes 0

Industry Ind

According to the industry classification

standards promulgated by the Securities and

Futures Commission in 2001, manufacturing

industry is classified according to the second

level, while others are classified according to

the first level.

Yea

r

Yea

r

Set 2014 as the base, set 8 dummy variables

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

200

3.2.4 Model Construction

To test the impact of large-scale goodwill impairment

on corporate audit fees, the following multiple

regression model is developed.

(1)

In the model AFee

it

is the audit fee of the ith

enterprise in year t, IG

it

is the size of goodwill

impairment of the ith enterprise in year t, Control

j,it

is

the control variable, and C is a constant term. Based

on the existing data and with the help of the statistical

analysis software stata, we run the above multiple

regression model. If the hypothesis holds, the

coefficient α should be significantly greater than 0.

4 EMPIRICAL ANALYSIS

4.1 Descriptive Statistics

Table 2 shows the descriptive statistics of the main

variables. It can be seen that the mean value of IG1 is

1.044 and the maximum value is 9.815, which

indicates that the scale of goodwill impairment is at a

high level and the scale of impairment varies greatly

among companies; the mean value of IG2 is 0.005,

which indicates that the scale of goodwill impairment

charged by listed companies is about 0.5% of the total

asset value on average; the mean value of AFee is

6.080 and the standard deviation is 0.280, which

indicates that the listed companies The mean value of

AFee is 6.080 with a standard deviation of 0.280,

indicating that the difference in audit fees is not very

large among listed companies, which may be related

to competition between supply and demand in the

audit market. The control variables Size, Big4, Isloss,

EM, and Big4 are reasonable and do not differ

significantly from the distribution of variables in

previous literature.

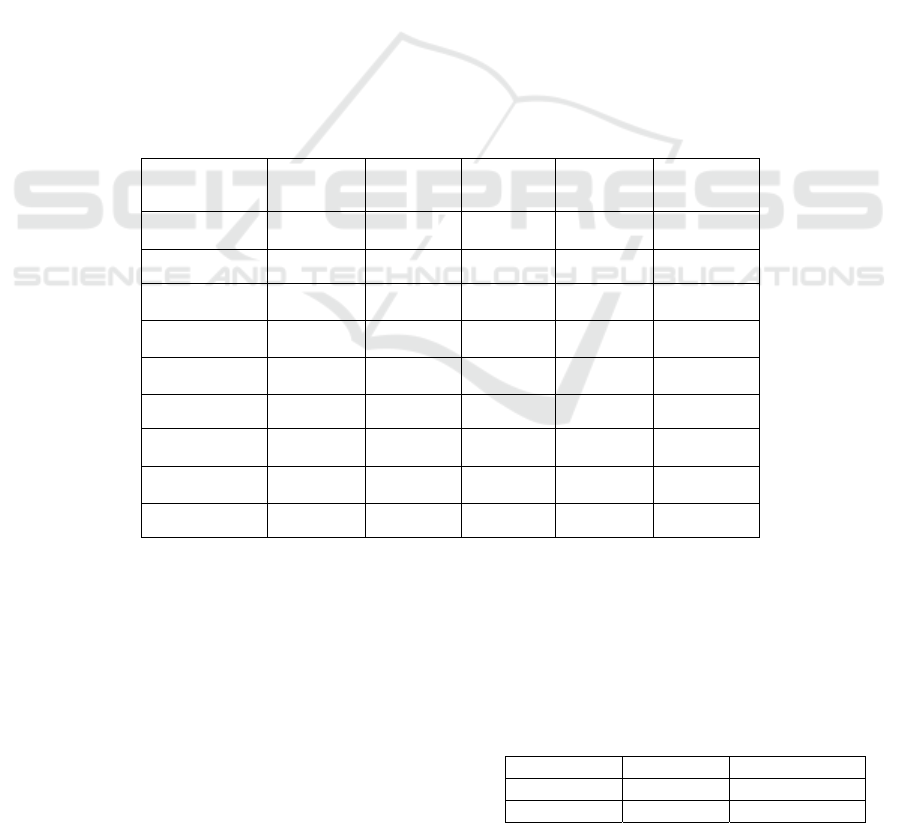

Table 2: Descriptive statistical analysis of the main variables.

Variables N Mean SD

Min

value

Max value

AFee 10319 6.080 0.280 5.301 7.885

IG1 10319 1.044 2.534 0 9.815

IG2 10319 0.005 0.093 0 8.642

Size 10319 9.715 0.531 7.503 12.437

Isloss 10319 0.160 0.366 0 1

EM 10319 0.081 0.158 0 6.464

Big4 10319 0.037 0.190 0 1

TDR 10319 0.460 0.668 0.014 63.971

Gqzz 10319 0.947 0.224 0 1

4.2 Impact of Goodwill Impairment on

Audit Fees

Table 3 shows the regression results of goodwill

impairment and audit fees, where columns (1) and (2)

show the regression results of IG1 and IG2 as

explanatory variables, respectively. As can be seen,

the coefficients of goodwill impairment size are

positive for both measures and pass the significance

test at the 1% level, indicating that goodwill

impairment size significantly increases audit pricing

and the hypothesis is verified. From the regression

results of the control variables, the coefficients of

Size, Big4, Isloss, EM, and TDR are significantly

positive, which is consistent with the results of

existing studies.

Table 3: Impact of the size of goodwill impairment on audit

fees.

Variables (1) IG1 (2) IG2

IG1 0.00703***

(0.000703)

itit

ititit

itititit

Big

GqzzTDREM

IslossSizeIGCAFee

4

Scale of Goodwill Impairment and Audit Charge

201

IG2 0.1055***

(0.0146)

Size 0.341*** 0.3465***

(

0.00384

)

(

0.00383

)

Isloss 0.0716*** 0.0732***

(

0.00501

)

(

0.00502

)

EM 0.0207* 0.0210*

(0.0114) (0.0114)

Big4 0.287*** 0.288***

(

0.00988

)

(

0.00991

)

TDR 0.0188*** 0.0182***

(

0.00266

)

(

0.00267

)

Gqzz 0.0028 0.0039

(0.00788) (0.00791)

Constant 2.7291*** 2.6770***

(

0.0378

)

(

0.0378

)

Industries Control Control

Yea

r

Control Control

Observations 10,319 10,319

R-square

d

0.5998 0.5971

Note: *** p<0.01, ** p<0.05, * p<0.1, standard errors in

parentheses.

4.3 Robustness Tests

4.3.1 Re-Measure the Variables

To determine the degree of influence of the main

explanatory variables on the explanatory variables,

different measures are used for the control variables,

replacing firm reputation from the top four (Big4) to

the top ten (Big10) and replacing firm size (Size) with

total owner's equity (Equity), and the findings are

unchanged after re-measuring the variables.

4.3.2 One Period Lag Treatment for All

Explanatory Variables

To mitigate possible reverse causality issues, all

explanatory variables are treated with a one-period

lag, which also tests the persistence of the effect of

premium M&A on audit pricing. The regression

results for the lagged treatments are all significant at

the 1% level, consistent with the main test.

4.3.3 Fixed Effects Model Regressions

Are Used

The study model may have the problem of omitted

variables, and in order to remove the effects of firm

characteristics that do not vary over time, a fixed-

effects model is used for regression testing, and the

regression results are consistent with the main test

regression results.

5 CONCLUSIONS

In this paper, we selected the data of A-share listed

enterprises from 2014-2021 and analyzed the impact

of goodwill impairment size on the audit fees of

enterprises using panel data. The empirical evidence

found that the larger the scale of goodwill impairment

of enterprises, the higher the audit fees. In this regard,

firstly, the professionalism of auditors should be

improved and listed companies should be carefully

examined for the existence of goodwill impairment

for surplus manipulation; Secondly, the supervision

of goodwill information disclosure should be

increased to reduce the motivation of companies to

use goodwill impairment for surplus management,

and a database of different industries should be

established to provide a basis for goodwill assessment

in M&A and restructuring of listed companies using

big data analysis.

The research conclusion of this paper has certain

practical significance. First, the professional quality

of audit institutions should be improved. Audit

institutions shall remain objective and rational,

maintain professional skepticism at all times, and

issue standard and reliable audit opinions. Certified

public accountants should carefully examine the

financial statements of listed companies, examine

whether listed companies use goodwill impairment to

manipulate earnings, prevent the company from

major misstatement risks and large goodwill

impairment events, and improve the reliability of

accounting information quality. Secondly, strengthen

the supervision of the disclosure of goodwill

information. There is still a large room for

improvement in the supervision of goodwill

information disclosure. Because the penalty cost is

too low, listed companies still have the incentive to

manipulate earnings management by goodwill

impairment. Therefore, our country should strengthen

the information disclosure supervision of goodwill. It

is suggested that relevant regulatory authorities

should introduce regulatory policies on goodwill

information disclosure, increase the content of

goodwill information disclosure of listed companies,

especially the information technology industry,

improve the information transparency of listed

companies and reduce the occurrence of violations.

Penalties will be increased for listed companies that

fail to make timely or inadequate disclosures. In

addition, databases of different industries can be

established and big data analysis can be used to

provide basis for goodwill assessment of listed

companies in mergers and acquisitions.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

202

In addition, the following deficiencies exist in this

paper. The article also does not analyze the role

mechanism of goodwill impairment scale affecting

audit fees deeply enough. In the future it and should

be studied in depth by combining the reasons of both

firms and enterprises. In addition, the ambiguity of

M&A goodwill from the time it arises, coupled with

the subsequent measurement using the method of

impairment, leads to more room for manipulation by

firms. In the future, it may be possible to initially

analyze the reasons for the firm's M&A and to

examine the changes in the firm's surplus before and

after the impairment of goodwill, which will help to

deeply understand the purpose of each relevant act.

REFERENCES

Bell, T. B, R. Doogar, and I. Solomon. (2008). Audit labor

usage and fees under business risk auditing. J. Journal

of Accounting Research. 46(4), 729–760.

Glaum Martin, Landsman Wayne R., WyrwaSven. (2018).

Good will Impairment: The Effects of public

enforcement and monitoring by institutional investors

J. The Accounting Review. 93(6).

Goncalves C, Ferreira L,Rebelo E, Fernandes JS. (2019).

Big bath and good will impairment. J. RBGN-Revista

Brasileirade Gestaode Negocios. 21(2), 312–331.

Lauren C. Reid, Joseph V. Carcello, Chan Li,Terry L. Neal.

(2019). Impact of auditor report changes on financial

reporting quality and audit costs: evidence from the

United Kingdom. J. Contemporary Accounting

Research. 36(3).

Thorsten Knauer. & Arnt Wöhrmann. (2016). Market

reaction to good will impairments. J. European

Accounting Review. 25(3).

Zining Li,Pervin K.Shroff,Ramgopal Venkataraman,Ivy

XiyingZhang. (2011). Causes and consequences of

good will impairment losses. J. Review of Accounting

Studies. 16(4).

Chen, S, L. Ma, H. (2013). The transmission effects of

accounting firm industry expertise, reputation and

economies of scale. J. Audit Research. 06, 84–92.

Han, H, W. Tang, Q, Q.Li, W, F. (2019). M&A goodwill

impairment, information asymmetry and share price

collapse risk. J. Securities Market Herald. 03, 59–70.

Liu, C. Xu, D, D. Zheng, C, Y. (2019). Goodwill, high

premium M&A and the risk of share price collapse. J.

Financial Regulation Research. 06, 1–20.

Liu, X, H. & Wang, J, Y. (2019). Premium M&A, goodwill

impairment and stock yield volatility effects. J.

Financial Economics Research. 34 (03), 83–93.

Liu, X, Q. Sun, J, Yuan, R, L. (2018). M&A performance

compensation commitments and audit fees. J. Journal

of Accounting Research. 12, 70–76.

Xu, J, C. Zhang, D, X. Liu, H, H. (2017). Does M&A

goodwill information affect the cost of debt capital? J.

Journal of Central University of Finance and

Economics. 03, 109–118.

Ye, J, F. He, K, G. Yang, Q. Ye, Y. (2016). Unverifiable

goodwill impairment test estimates and audit costs. J.

Audit Research. 01, 76–84.

Yu, Y, M. Fan, Y, X. Zhou, K, T. (2020). Pre-determination

of audit expenses, abnormal audit expenses and audit

quality. J. Audit Research. 02, 67–75.

Zheng, C, M. & Li, X. (2018). M&A goodwill and Audit

service pricing. J. Audit Research. 06, 113–120.

Zheng, H, Y. Liu, Z, Y. Feng, W, D. (2014). Does M&A

goodwill improve company performance? -- Empirical

evidence from A-share listed companies. J. Journal of

Accounting Research. 03, 11–17+95.

Scale of Goodwill Impairment and Audit Charge

203