Connotation Analysis of Corporate Value Creation Based on ESG

Perspective

Qianzi Kong and Gang Fang

*

Business School, Beijing Institute of Fashion Technology, Beijing, China

Keywords: The Sustainable Development, Stakeholder Supremacy, Environment-Social-Governance, Corporate Value

Creation.

Abstract: As the concept of the sustainable development and other goodness-oriented ideas take root, the connotation

of corporate value creation has been transformed accordingly. Stakeholder Supremacy enriches the single

connotation of traditional economic value creation. Based on the ESG theoretical framework, this paper

integrates the three perspectives of social, environmental, and corporate governance to explore the feasibility

of corporate value creation under the new scope. By analysing the data of the selected sample with the help

of Multiple Regression model by the SPSS software, the study concluded that the realization of integrated

value creation by will promote the realization of single value creation, as well as the achievement of long-

term development goals of Chinese enterprises and the sustainable development of society as a whole.

1 INTRODUCTION

The ESG concept was formally proposed by United

Nations in 2005, and the ESG disclosure framework

was also formally established in The Code on

Governance of Listed Enterprises revised by China

Securities Regulatory Commission in 2018. ESG is a

value concept that encompasses environmental,

social, and corporate governance and provides a

comprehensive assessment of a company's

sustainability from a non-financial perspective. ESG

is a value concept that encompasses Environment,

Social, and Governance to provides a comprehensive

assessment of an enterprise's sustainability from a

non-financial perspective (HUANG 2021). With the

establishment of the peak carbon dioxide emissions

and carbon neutrality goals, The Fourteenth Five-

Year Plan, and Vision 2035, China is paying more

and more attention to ESG, encouraging enterprises

to improve their economic, social and environmental

values through the application of ESG concepts, and

promoting their sustainable and healthy development.

More and more enterprise management matters such

as the choice of value creation choice require positive

analysis. And with the support of various economic

models by data analytics technology and software,

such as Stata, SPSS, EViews, and so on, the

*

Corresponding author

enterprises management behaviour is becoming more

efficiently and accurately.

2 CURRENT STATUS OF

RESEARCH ON CORPORATE

VALUE CREATION

The emergence of the ESG concept has accelerated

the impact on the shareholder supremacy's

mainstream of the long dominant. The Shareholder

Supremacy insists on the view that administrator only

needs to be accountable to its shareholders, to

generate residual income for them and thus achieve

the goal of profit maximization. Then the Stakeholder

Supremacy has further captured the discourse on the

meaning of enterprise value creation.

Stakeholder Supremacy didn't deny the former

view, and it thought the traditional scope of enterprise

value creation is too superficial and narrow. In

addition to ESG, Triple Bottom Line also provides a

solid theoretical basis for the broadening of the scope

of this doctrine, which believes that only the

enterprise that create economic, social, and

environmental values (HUANG 2021) and contribute

to social progress in this way are sustainable

282

Kong, Q. and Fang, G.

Connotation Analysis of Corporate Value Creation Based on ESG Perspective.

DOI: 10.5220/0012029600003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 282-287

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

enterprises. Therefore, in order to respond to the

development of the times, what enterprise have to do

today is to let their hidden social and environmental

value creation requirements come to the surface, and

not only the pursuit of economic value.

However, there is still disagreement among

academics on the scope of enterprise value creation

enriched by Stakeholder Supremacy, and the point of

contention that prevents full agreement is whether the

new scope of corporate value creation is a

complement or an addition to the traditional

economic value creation, and the findings can be

summarized into two broad categories.

One type of conclusion is that cost is a factor that

must be taken into account when an enterprise creates

value, and that value creation under the new category

may result in a significant increase in the costs and an

increase in resource consumption of the enterprise,

which, on the contrary, has a negative impact on the

long-term profits of the enterprise and damages the

economic value originally created to obstacle the

sustainable development of the enterprise. Another

type of conclusion says, while realizing value

creation under the new category, the enterprise also

builds a positive image for itself, which can increase

its visibility and obtain policy support in the long run,

thus contributing to increased profits and further

realization of value creation in the traditional

economy.

As the quest for the sustainable development

grows, the above-mentioned controversial point is the

impact of the new scope of enterprise value creation

on the traditional economic value creation, that needs

to be clarified. After analysing the points of

contention, this paper argues that the difference in the

quality of the indicators chosen to measure corporate

value creation is the key point of disagreement in the

research findings and the reason why corporate value

creation under the new scope is not yet universally

accepted.

Based on the ESG concept framework and Triple

Bottom Line, this paper will select representative

indicators based on the nature of corporate value

creation under the new scope, and further prove that

the realization of corporate value creation under the

new scope does not conflict with the connotation of

corporate value creation, but brings positive analysis

to it, thus promoting the long-term sustainable

development of enterprises.

3 RESEARCH HYPOTHESIS

At this stage, with the development of the concept of

the sustainable development and the peak carbon

dioxide emissions and carbon neutrality goals, the

new scope of corporate value creation is attracting

more and more attention, and the demand of various

stakeholders for such information is gradually

expanding, which makes enterprises pay more and

more attention to the disclosure of their own

comprehensive value realization. In order to measure

this integrated value, various new types of integrated

indicators have emerged to evaluate the creation of

economic, social, and environmental values of

enterprises.

However, due to the diversity of the connotation

of corporate value creation under the new scope, the

lack of common and unified standards for the

measurement of indicators by rating agencies, and the

considerable discretion of administrators in

disclosing such information, there are a lot of

greenwashing in many new comprehensive

indicators.

Based on the above analysis, this study uses the

ESG concept framework for measuring corporate

value creation under the new scope, and selects

relevant raw factors data from three perspectives

respectively, social, environmental and corporate

governance, to show its comprehensive value

creation.

3.1 Corporate Social Responsibility

and Financial Performance

From the social point of view, enterprises can

accumulate a good reputation and gain the trust of

relevant stakeholders through the long-term

performance of social responsibility, while

effectively reducing the instability and uncertainty of

their future development, enterprise-wide risk and

idiosyncratic risk, and also has a stabilizing effect on

stock market prices. This not only helps to reduce the

economic losses caused by the volatility of the

enterprise, but can further lead to an increase in

financial performance. According to the above

analysis, this research proposes hypothesis 1:

H1: Corporate social responsibility

performance and corporate financial

p

erformance has s positive correlation.

Connotation Analysis of Corporate Value Creation Based on ESG Perspective

283

3.2 Corporate Environmental

Protection and Financial

Performance

From an environmental perspective, based on

Michael Porter's Porter Hypothesis, appropriate

environmental regulation can effectively improve the

productivity of enterprises, and the increase can be

fully offset by the cost of doing for this. Enterprises

to establish the concept of environmental protection

to increase environmental protection behaviours (LI

2022), which helps to save resources consumption in

operations, green technology innovation capabilities

and the economic transformation of ecological

benefits, and all this will lead to an increase in the

economic efficiency of the enterprise. According to

the above analysis, this research proposes hypothesis

2:

H2: Corporate environmental protection

performance and corporate financial

p

erformance has s positive correlation.

3.3 Corporate Governance and

Financial Performance

From a corporate perspective, corporate governance

is a series of institutional arrangements that serve the

creation of corporate value, and good corporate

governance can promote the standardization of its

operations (YANG 2020). On the one hand, it helps

to improve the quality of internal and external

controls and the accuracy and efficiency of decision-

making; on the other hand, effective management and

balance between stakeholders can reduce transaction

costs and thus increase the economic gains of the

enterprise. In order to realize the role of corporate

governance in promoting value creation, it is

necessary to change to a shared governance model, so

that ownership of the enterprise can be dispersed to

all stakeholders in an orderly manner and avoid the

Tunnel Effect caused by the concentration of large

areas of equity. According to the above analysis, this

research proposes hypothesis 3:

H3: Corporate equity concentration and

corporate financial performance has s

ne

g

ative correlation.

4 RESEARCH DESIGN

4.1 Sample Selection and Processing

In March 2021, World Economic Forum released a

white paper called ESG Report: Helping China Take

Off to Gather Momentum and Win Together with

PwC China. ESG Practice Roadmap under The Peak

Carbon Dioxide Emissions and Carbon Neutrality

Goals and Evaluation Report on the Development of

Chinese Listed Enterprises (2021) has published by

Southern International Forum of Finance and

Economics in December. Both of them studied the

ESG performance of listed enterprises in China and

gave evaluation and suggestions on their current

development status and future development direction.

The release of successive heavyweight ESG

documents signifies that the concept and its

framework have become a signpost for the

sustainable development path of Chinese companies,

as well as a guide for enterprises to achieve value

creation under the new scope.

According to the above reports Secondary Sector

of Economy is more perfect in disclosing information

related to ESG concept. And industries of that area

are all heavyweight players in achieving the peak

carbon dioxide emissions and carbon neutrality goals,

so starting them can provides a relatively abundant

data base for this study on the one hand, and it will

has practical significance for Chinese enterprises to

promote sustainable development on the other.

Therefore, this research selects the 2014-2020

data of listed enterprises from the above industries

Shenzhen A- Main-Board share market as the

research sample using the CSRC's Industry

Classification Guidelines for Listed Enterprises

(2012) as the standard. This research also takes the

following treatments on the data: firstly, the sample

of enterprises with ST status in the year interval is

excluded; secondly, the sample of enterprises with

missing observations is excluded, and finally 208

enterprises with a total of 1,456 sample values are

obtained.

4.2 Variable Definition

4.2.1 Predicted Variable

Domestic and foreign scholars have taken a multi-

industry sample of enterprises, and through research

and analysis of common indicators such as ROA and

ROE, it has been demonstrated that Economic Value

Added (EVA) can reflect a more realistic and

effective corporate financial performance compared

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

284

to traditional financial performance measures (LI

2022). Therefore, this research adopts EVA as

predicted variable to measure corporate financial

performance based on the CSMAR database.

4.2.2 Explanatory Variable

In 2008, the Shanghai Stock Exchange issued The

Notice on Strengthening the Social Responsibility of

Listed Enterprises, in which the concept of Social

Contribution Value per Share was introduced for the

first time, and this indicator integrates the

contribution of enterprises to various interest groups

in society. Therefore, this research adopts Social

Contribution Value per Share as an explanatory

variable to measure the performance of corporate

social responsibility based on the CSMAR database.

The annual environmental performance of an

enterprise can be clearly and intuitively reflected by

whether the enterprise receives annual environmental

honours or reward or not, and this can be used as a

variable to represent the environmental protection

performance of the enterprise. Therefore, this

research sets a dummy variable to represent the

enterprise got an honour or a reward or not as a

measure of environmental protection performance

based on the CSMAR database.

In this research, based on the CSMAR database,

the shareholding ratio of the first largest shareholder

is selected as an explanatory variable to measure the

concentration of corporate equity.

In addition, total corporate assets, gearing ratio,

and total asset turnover ratio were selected as

controlled variables based on the CSMAR database.

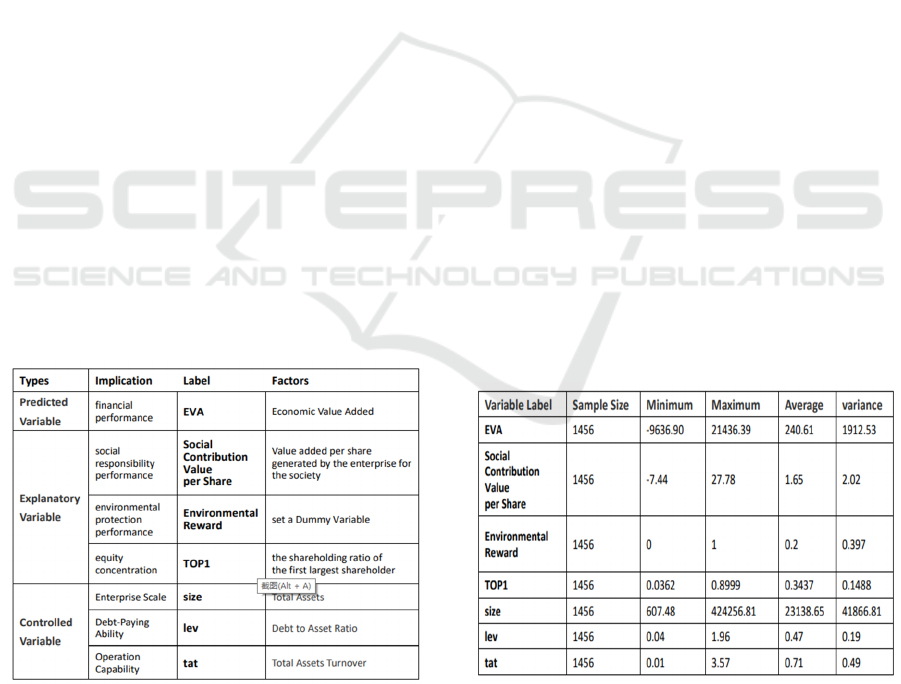

Figure 1: Variable Definition.

4.3 Research Model

This research builds up the following model (1) based

on the above analytical theoretical analysis and

assumptions:

EVA=α

0

+α

1*

(Social Contribution per

Share) +α

2*

(Environmental Rewards) +α

3*

(TOP1) +α

4*

(size) +α

5*

(lev) +α

6*

(tat) +ε1

(1)

α

0

is the constant term; α

i

(i =1 to 6) is the

coefficient of each variable; and ε

1

is the error term.

In this research, the sample data were standardized

before further positive analysis.

The following positive analysis will be conducted

using Multiple Regression model by SPSS software.

5 POSITIVE ANALYSIS

5.1 Descriptive Statistical Analysis

Figure 2 shows the results of the descriptive

statistical analysis. the maximum value of EVA is

21436.39, the minimum value is -9639.90, and the

variance is 1912.53, indicating that there are

significant differences in the level of financial

performance of the companies within the selected

sample, and the development of each industry is very

different. Among the explanatory variables, the

shareholding ratio of the first largest shareholder is

89.99% at the maximum and 3.62% at the minimum,

with the average of 34.37%, which shows that the

concentration of equity among corporates is not

uniform.

Figure 2: Descriptive Statistical.

5.2 Correlation Analysis

The correlation matrix in Figure 3 shows that EVA is

significantly and positively correlated with Social

Connotation Analysis of Corporate Value Creation Based on ESG Perspective

285

Contribution per Share at the 1% level, and EVA is

also significantly and positively correlated with

Environmental Rewards at the 1% level, tentatively

verifying hypotheses 1 and 2.

Figure 3: Correlation Matrix.

5.3 Multicollinearity Analysis

The samples were tested for multicollinearity, and as

shown in Table 4, the mean the average of VIF were

much less than 10 and the 1/VIF were all close to 1,

indicating that there was no multicollinearity between

the explanatory variables.

Figure 4: Multicollinearity Test.

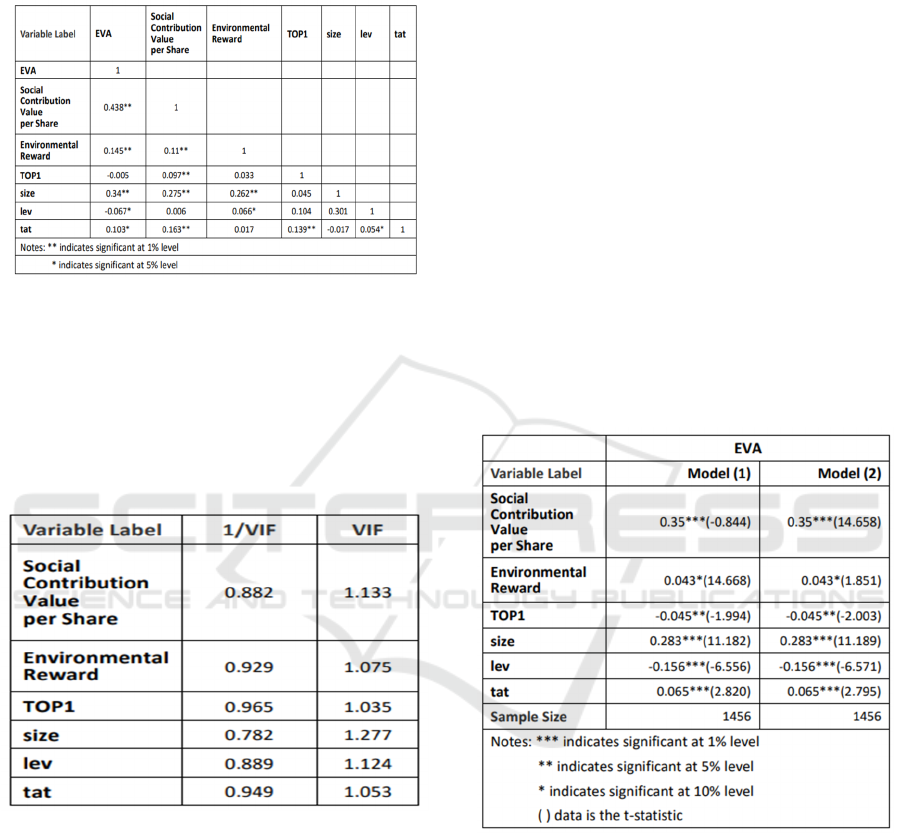

5.4 Multiple Regression Analysis

By multiple regression analysis of the samples

yielded Figure 5, the coefficients of Social

Contribution Value per Share, Environmental

Reward and TOP1 were significant at the 1%, 10%,

and 5% levels respectively. The coefficient α

1

was

positive for Social Contribution Value per Share, α

2

was positive for Environmental Reward, and α

3

was

negative for TOP1. As well as it demonstrated the

social responsibility performance and environmental

protection performance both have a positive

correlation with financial performance in an

enterprise. And the corporate equity concentration

and its financial performance has s negative

correlation. Therefore, hypotheses 1, 2, and 3 were all

valid.

5.5 Robustness Analysis

To ensure the robustness and reliability of the study

results, the control variable of operating income

growth rate is added to model (1), and turned to model

(2) for testing. As can be seen from Figure 5, the

coefficients of the predicted variable EVA and the

explanatory variables Social Contribution Value per

Share, Environmental Reward, and TOP1 in the

model (1) are still significant at the 1%, 10%, and 5%

levels. The original hypotheses remain valid through

the robustness test.

EVA=β

0

+β

1*

(Social Contribution Value

per Share) +β

2*

(Environmental Rewards)

+β

3*

(TOP1) +β

4*

(size) +β

5*

(lev) +β

6*

(tat)

+β

7*

(income

g

rowth rate) +ε

2

(2)

Figure 5: Multiple Regression & Robustness Test.

5.6 Results and Discussions

Based on the ESG concept framework, the following

conclusions and suggestions are drawn from the

above research conducted by SPSS software.

Enterprise managers should be good at building

appropriate economic models to control the business

and development situation before and after the event,

and have a global grasp of it, so as to achieve efficient

and accurate management.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

286

Corporate social performance and financial

performance are positively correlated, and good

social performance can improve corporate economic

performance to a certain extent. Corporate

environmental performance is positively related to

corporate financial performance. Environmental

protection behaviour recognized by the policy will

bring considerable economic value-added to

enterprises. The higher the concentration of equity,

the lower the level of financial performance.

Diversification of equity can effectively avoid

undesirable governance performance.

Enterprises should actively assume social

responsibility so as to promote the achievement of

their economic goals and enhance corporate value.

Enterprises should actively participate in

environmental protection and establish a positive

image of low carbon and environmental protection,

which in turn will get the policy support and

positively influence their financial performance. A

reasonable degree of standardization of the

governance system will effectively reduce non-

systematic risks of enterprises, avoid internal

fluctuations and achieve smooth long-term operation

of enterprises. Enterprises should make reasonable

allocations of assets, liabilities, and related equity,

and regularly evaluate their debt-paying ability,

profitability, operating ability, development level,

and risk level to reduce uncertainty and enhance their

coping capacity.

Through the three perspectives of social,

environmental, and corporate governance, and with

the help of a large number of representative raw

factors data we have conducted research and analysis

on corporate value creation under the new scope, and

confirmed that the comprehensive realization of

economic, social, and environmental values is not a

substitute for the traditional value creation, but an

addition to the maximization of profits. The

integrated value creation connotation of the current

stage of enterprises proposed by Stakeholder

Supremacy which contains the economic value, social

value, and environmental value is feasible.

6 CONCLUSIONS

With the support of various data analysis technologies

and software for various economic models, the

enterprise stakeholders become more accurate in

grasping the overall situation, administrators become

more disciplined in their behaviours, and the

enterprise operations become more efficient.

Nowadays, the realization of integrated value creation

by Chinese enterprises can not only promote their

long-term pursuit of sustainable development, but

also promote the achievement of China's the peak

carbon dioxide emissions and carbon neutrality goals,

and then move towards the direction of the

sustainable development of the whole society.

ACKNOWLEDGEMENTS

Support by: The construction program of innovation

team at Beijing Institute of Fashion Technology

(BIFTTD201901); “The first batch of new liberal arts

research and reform practice projects of the Ministry

of Education” project (Project No.: 2021140009).

REFERENCES

HUANG, S. Z. (2021). Three theoretical pillars supporting

ESG. J. Finance and Accounting Monthly. 19, 3–10.

HUANG, S. Z. (2021). Three major changes in value

creation from ESG perspective. J. Finance Research. 6,

3–14.

LI, J. T. (2022). The Impact of ESG performance on

corporate financial performance from a media focus

perspective. J. Scientific and Technological

Management of Land and Resource. 39(1), 96–104.

LI, J. (2022). Environmental information disclosure and

business performance of firms - A test of mediating

effects based on investor concerns. J. Technology

Economics. 41(5), 85–96.

YANG, J. (2020). The relationship between corporate

governance, social responsibility and financial

performance. J. Commercial Accounting. 21, 85–88.

Connotation Analysis of Corporate Value Creation Based on ESG Perspective

287