The Inverted U-Shaped Effect of Economic Policy Uncertainty on

Corporate ESG Performance: A Study Based on Machine Learning

Models and Micro Data

Chenhong Zheng, Fangshun Xiao, Meihua Zou, Mengzhe Liu and Mengqian Zhang

*

Economic and Technological Research Institute, State Grid Fujian Electric Power Co., Ltd., Fuzhou, 350000, Fujian,

China

mengqian_zhang20@126.com

Keywords: Economic Policy Uncertainty, ESG Performance, Machine Learning, Random Forest Model.

Abstract: In this paper, we first use the traditional econometric models to examine the impact of economic policy

uncertainty (EPU) on enterprises’ Environmental, Social and Governance (ESG) performance in the economy

using a sample of all A-share listed firms from 2007 to 2020. Then, we apply the Python Machine Learning

model to further explore the real nonlinear impact of EPU on corporate ESG performance. Our estimation

results indicate that the nexus between EPU on enterprises’ ESG performance is inverted U-shaped, and the

results remain robust after endogeneity treatment and robustness checks. By further investigating the

heterogeneous effects of EPU in ESG performance, we find that the inflection point of the effect of EPU on

ESG performance is larger for firms in more market-oriented regions and non-state enterprises. For large-

scale firms, EPU shows a positive linear relationship with ESG performance rather than an inverted U-shaped

relationship. The results of the machine learning model analysis show that the importance of EPU on the

impact of corporate ESG is more prominent compared to traditional factors. There is a significant non-linear

relationship between the two. Compared with the traditional econometric model, the machine learning model

fits better. Our study provides policy insights for policy economic policy implementation and for promoting

high-quality economic development.

1 INTRODUCTION

Since it is impossible to know exactly if, when, and

how current economic policies will change, there is a

high degree of uncertainty about the potential

direction and intensity of the economic policy for

economic entities, which is called Economic Policy

Uncertainty (EPU) in general (Baker et al., 2016;

Gulen and Ion, 2016). Firms, as the main micro-

objects of economic policy, are inevitably affected by

economic policy uncertainty. It has been found that

EPU is a "double-edged sword" for firms (Segal et al.,

2015). Enhancing corporate reputation by improving

social environment performance has been proved to

be an effective way for firms to hedge against

potential negative shocks ((Kruger, 2015). At present,

China is in the stage of high-quality development led

by a green economy, and environmental issues are

widely emphasized. As the basic unit of economic

and social operation, enterprises bear more

responsibilities. In this context, the performance of

corporate social and environmental responsibility

(CSR) and its motivation have become one of the

focal points of academic research, and many research

results have been accumulated (Yoo and Managi,

2022). However, the system of CSR fulfilment in

China is still in the exploration stage. Companies

have more freedom to decide whether and to what

extent to exercise their social responsibility, which is

both determined by internal factors and the external

macro environment (Wu and Memon, 2022).

Therefore, we should further discuss enterprises’

social and environmental behaviours in the context of

a larger macroeconomic environment. From this

perspective, clarifying the nexus between EPU and

corporates’ Environmental, Social and Governance

(ESG) performance is significant for the

implementation of economic policies and the

improvement of corporate social and environmental

governance.

464

Zheng, C., Xiao, F., Zou, M., Liu, M. and Zhang, M.

The Inverted U-Shaped Effect of Economic Policy Uncertainty on Corporate ESG Performance: A Study Based on Machine Learning Models and Micro Data.

DOI: 10.5220/0012034900003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 464-471

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

However, the existing literature so far has been

silent on the potential effect of EPU on enterprises'

ESG performance despite its importance. Given that,

this paper first systematically explore the impact of

EPU on corporate ESG performance using traditional

econometric model and the panel data of all A-share

listed enterprises in China from 2007 to 2020, and

further explores how the impact of EPU on ESG

performance varies by ownership nature, firm size,

and market environment, respectively. Then, we

further apply a Machine Learning model to explore

the potential nonlinear effects of EPU on corporate

ESG performance to reveal the true relationship

between the two.

This paper extends the growing body of literature

in the following aspects. First, the existing studies on

the relationship between EPU and CSR mainly

explore the one-way impact of EPU on corporate

performance behaviour, ignoring the non-consistent

effect of varying degrees of EPU on firms' ESG

performance. This paper confirms the inverted U-

shaped nexus between EPU and corporate ESG

performance, which may contribute to the research on

the nexus between EPU and corporate social

environmental performance. Second, this paper

further explores the external and internal conditions

that motivate firms to fulfil their ESG responsibilities

under EPU in three dimensions: regional

marketization, firm ownership, and firm size, which

enriches the study of firms' motivation to fulfil their

social and environmental responsibilities. Third, this

paper finds that EPU presents heterogeneity in

corporate ESG performance across market

environments as well as corporate characteristics,

which helps guide the government to introduce more

targeted macroeconomic policies to encourage

corporate to take social and environmental

responsibility. Finally, this paper broadens the

research approach by combining computer models

with economic models to study the nonlinear

relationship between EPU and ESG. Machine

learning models, as an important frontier research

result in the field of artificial intelligence, are

applicable to the study of nonlinear problems.

Compared with causal inference, machine learning

models focus more on the combined effect of an

explanatory variable influencing the explanatory

variable under the action of multiple factors, which is

of great significance to better fit the complex

economic system and improve the decision-making

predictability of enterprises. Therefore, the machine

learning model can better reveal the true nonlinear

influence trend of EPU on enterprise ESG

performance.

We proceed as follows. Section 2 briefly

summarizes the views of existing studies. Section 3

describes the empirical strategy and the data. Section

4 presents the empirical results. Section 5 concludes

and proposes policy implication.

2 LITERATURE REVIEW

Economic policies as well as macro-environmental

changes are the basis for corporate social and

environmental behavior decisions that cannot be

ignored (Ilyas et al., 2021). Research on the nexus

between EPU and corporate ESG performance is still

in its infancy, and the existing studies have

conflicting views that have not yet been agreed upon.

On the one hand, EPU deteriorates the information

environment of enterprises. Firms will be more

prudent in their financial decisions for precautionary

purposes (Yang et al., 2020). For enterprises, CSR

fulfillment is a special kind of long-term asset

investment with long payback period and high

uncertainty of return (Zhao et al., 2020). In the face

of strong external environmental uncertainty, the

value of investment options possessed by firms rises

(Bernanke ,1983). Investing more liquid resources in

social and environmental activities such as pollution

reduction may negatively affect the short-term

financial performance of firms by crowding out

limited resources, putting them in a financing

constraint dilemma (Ho and Wu, 2021). As a result,

firms may neglect to fulfill their social and

environmental responsibilities in the face of stronger

EPU. Several studies provide empirical evidence for

it. For example, Zhao et al. (2020) find that when

EPU significantly inhibits the fulfillment of corporate

social and environmental responsibility, which is

more pronounced for state-owned enterprises.

On the other hand, high EPU significantly

increases enterprises’ external risks (Pastor and

Veronesi, 2013). In the Chinese economic

environment, active social responsibility is an

effective measure to help firms reduce their external

risks (Krüger, 2015). For companies, active social

and environmental responsibility can reduce the

information asymmetry problem between them and

their stakeholders, enhance shareholders' and

bondholders' investment confidence, and thus

facilitate companies' access to scarce competitive

assets and core resources (Hartzmark and Sussman,

2019). Moreover, good social and environmental

The Inverted U-Shaped Effect of Economic Policy Uncertainty on Corporate ESG Performance: A Study Based on Machine Learning

Models and Micro Data

465

performance helps firms to establish a quality image

in the capital market and create a reputational

insurance effect, which in turn improves firms' ability

to cope with and mitigate risks and reduces the impact

of negative events (Dyck, 2019). There is a body of

research that directly or indirectly provides empirical

evidence for the positive nexus between EPU and

enterprises' ESG performance. For example, Rjiba et

al. (2020), Ahsan and Qureshi (2021) find that

corporate social and environmental responsibility

activities can alleviate the adverse impact of EPU on

firm value. Ilyas et al. (2022) find that companies will

cushion the negative impact of uncertainty by

improving their social environment performance in

times of high EPU, similar conclusion has also been

reached by Yuan et al. (2022).

In sum, there is no consensus on whether

economic policy uncertainty has an "incentive effect"

or a "disincentive effect" on the fulfillment of

corporate social and environmental responsibility.

Putting aside the contradictory results of existing

studies, there are still many puzzles. Is there only a

one-way effect of EPU on corporate social and

environmental behavior? Or does the relationship

between the two show non-consistency with changes

in economic policy uncertainty? These questions

remain to be explored. In this study, we try to answer

this question by empirically investigating the non-

linear nexus between EPU and corporate ESG

performance.

3 DATA AND METHODOLOGY

3.1 Classical Econometric Model

To examine the non-linear relationship between EPU

and firm ESG performance, this paper constructs the

following benchmark regression model by referring

to Zhou et al. (2022).

2

0! 2it t t

it jitit

ESG EPU EPU

X

αα α

βλγθε

=+ +

+ + +++

(1)

Where,

i denotes enterprise,

j

denotes industry,

and

t denotes year. The explained variable

it

E

SG

is

the comprehensive score of corporate social

environmental responsibility in year

t , which

measures the degree of fulfillment of corporate social

environmental responsibility. The higher the ESG

score, the higher the degree of corporate social and

environmental responsibility fulfillment.

t

E

PU

is the

core explanatory variable, which refers to the degree

of economic policy uncertainty in year

t . In this

paper, we use the Chinese EPU index developed and

compiled by Baker et al. (2016) using textual data

mining method. We draw on the arithmetic mean

method proposed by Zhao et al. (2021) to convert the

monthly index into the annual one after taking

logarithms.

it

X

is a set of control variables in firm-

level. Drawing on existing research (e.g., Ilyas et al.,

2022), we add a series of control variables to the

benchmark model that may affect firms' ESG

performance, including the enterprise's total asset net

profit rate (

R

OA ), firm age (

A

ge ), asset liability ratio

(

L

ev ), the proportion of independent directors ( Dire

), and the cash flow rate ( Cashflow ). Also, firm

individual-fixed effects

i

γ

, industry-fixed effects

j

λ

and year-fixed effects

t

θ

are included in the model to

control for the characteristics of individual

heterogeneity of firms that do not vary over time and

the potential influences over time.

it

ε

is the random

error perturbation term.

3.2 Machine Learning - Random

Forest Model

This paper applies the Machine Learning-Random

Forest model to the basic data set to further verify the

nonlinear impact of EPU on enterprise ESG

performance. On the one hand, the idea of splitting a

variable in the random forest model is more

consistent with the investigation of the importance of

variables, which also facilitates us to compare the

contribution of EPU with the classical variables that

affect the enterprise ESG performance. On the other

hand, compared with the traditional econometric

models, machine learning models can make full use

of the data information of variables in order to

improve the accuracy of prediction, and find a more

realistic form of complex functions. Referring to

Wang et al. (2022), we set the following stochastic

forest nonlinear function model.

(, ,,,)

it t it j t it

ESG EPU Controls

φγ

θε

=

(2)

Where

it

E

SG

is the enterprises’ ESG performance

score.

t

E

PU

is the core explanatory variable, which

refers to the degree of economic policy uncertainty.

it

Controls

is a set of control variables, consistent with

those in section 3.1.

j

γ

and

t

θ

represent industry

dummy variable and time dummy variable

respectively.

it

ε

is the residual item. ()

φ

⋅ is a

nonlinear model constructed by Random Forest

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

466

method. Since the model is a black box function

without analytic expression, we further solve the

partial dependence function

ˆ

()

φ

⋅ (e.g.

1

ˆ

()

x

φ

is the

partial function of the explained variable to the

dependent variable

1

x

) to further characterize the

marginal effect of EPU on the enterprise's ESG

performance. Finally, the sample mean is used to

estimate the overall mean, as shown in Equation (3).

112

1

1

ˆ

() (, ,..., )

n

jjp

j

x

fxx x

n

φ

=

=

(3)

3.3 Data Source

This paper selects the ESG scores of all Chinese A-

share listed companies from 2007 to 2020 as the

research object to study the impact of China's EPU on

corporate ESG performance. To ensure the robustness

and validity of the results, samples labelled ST, *ST,

PT and with more missing data were excluded, and

enterprises included in the financial and insurance

industries were also excluded. Finally, 9594 valid

samples were obtained. Drawing on the measurement

method of economic uncertainty proposed by Baker

et al. (2016), this paper uses the Economic Policy

Uncertainty Index jointly published by the University

of Chicago and Stanford University to measure EPU

in China. The index is based on the number of articles

in the South China Morning Post that contain the

words "uncertainty", "China" and "economic policy"

as a proportion of the total number of articles in the

same month. Some existing studies have also

confirmed the applicability of this indicator to

measure China's economic policy uncertainty (e.g.

Zhao et al., 2021; Ilyas et al., 2022). ESG data are

obtained from Bloomberg Databases, which contains

index values for three primary indicators: corporate

environmental disclosure, social responsibility

disclosure, and corporate governance disclosure. It is

also a widely used database in the research on

determinants and impacts of enterprise ESG

performance. The basic information and financial

data of the A-shared listed companies involved in the

empirical study are obtained from the CSMAR

database and the WIND database. The marketability

index is obtained from Wang et al. (2017).

4 EMPIRICAL RESULTS

4.1 Basic Results

We first use a two-way fixed panel regression model

to preliminarily examine the nexus between EPU and

firm ESG performance. Column (1) of Table 1 reports

the regression results, which indicates that there is a

significant positive nexus between EPU and firm

ESG, which is consistent with the research results of

Yuan et al. (2022). However, from the previous

review of the literature, there is no consensus on

whether EPU has an "incentive" or "disincentive"

effect on the ESG performance of firms. On the one

hand, according to the pecking order theory, On the

one hand, referring to the theory of pecking order

theory, when facing the potential risks brought by the

uncertainty of economic policies, fulfilling social

environmental responsibility can be regarded as the

insurance paid in advance by enterprises in order to

buffer risks. The active engagement in ESG activities

can send positive signals to stakeholders and win their

confidence, enhance corporate reputation and moral

capital, thus alleviate financing constraints to

smoothly pass the risk period. On the other hand,

based on real options theory, when faced with higher

external uncertainty, companies tend to hold off on

their current investment decisions, especially

investment in social and environmental activities,

which is considered a special long-term investment

with long payback cycles and high uncertainty of

returns. Therefore, when economic uncertainty

continues to rise, companies may reduce the

fulfillment of their socio-environmental

responsibilities.

Based on the above analysis, the nonlinear setting

of the effect of EPU on corporate ESG performance

may be more accurate. Therefore, we estimate

Equation (1) to capture this nonlinear effect. Columns

(2) and (3) of Table 1 report the results without and

with the introduction of control variables,

respectively. The results show that EPU exhibits a

significant inverted U-shaped nexus on firm ESG

performance at the 1% confidence level, validating

the nonlinear nexus between them. This finding

suggests that when EPU is at a low level, firms' ESG

performance increases as EPU increases. However,

when EPU rises and reaches a relatively high level,

firms' motivation to engage in ESG activities

decreases significantly. The value of this inflection

point is 158.9116.

The Inverted U-Shaped Effect of Economic Policy Uncertainty on Corporate ESG Performance: A Study Based on Machine Learning

Models and Micro Data

467

Table 1: Baseline Results.

(

1

)

(

2

)

(

3

)

EPU

0.2456*** 0.8917*** 0.7577***

(0.0055) (0.1387) (0.1399)

2

EPU

-0.0028*** -0.0024***

(

0.0006

)

(

0.0006

)

Constant -7.0547*** -42.4797*** -36.1088***

(

1.9671

)

(

7.7560

)

(

7.8133

)

Break point 158.9116

Controls Y Y Y

Firm-fixed effect Y Y Y

Industr

y

-fixed effect Y Y Y

Yea

r

-fixed effect Y Y Y

Observations 9594 9594 9594

R

2

0.390 0.390 0.395

Note: Robust standard errors are presented in parentheses, ***, ** and * indicate the significance at 1%, 5% and 10%,

respectively. The same in Table 2 and Table 3.

4.2 Robustness Tests

Although the uncertainty of economic policy is

relatively exogenous for micro enterprises, the

performance of micro enterprises is also the

motivation and basis for some macroeconomic policy

adjustments. Therefore, there may be an inverse

causal relationship between EPU and corporate ESG

performance. To address this potential endogeneity

issue, this paper uses the US EPU index as an

instrumental variable for 2SLS estimation. On the one

hand, in the context of economic globalization, the

effects arising from economic policy changes in one

country may be transmitted to another country

through activities such as international trade. For

example, China's interest rate and exchange rate will

soon be affected by changes in U.S. monetary policy.

From this perspective, EPU in the U.S. is closely

related to that in China. On the other hand, corporate

ESG activities belong to the category of corporate

social responsibility and are directly influenced by

domestic environmental regulation policies as well as

institutional culture. Foreign economic policies do

not directly constrain the social and environmental

behavior of Chinese enterprises. Therefore, we can

conclude that EPU in the US is not directly related to

Chinese firms' ESG performance. The regression

result after introducing the instrumental variables is

reported in column (1) of Table 2. After using

instrumental variables, there is no under-

identification and weak instrumental variables, and

the impact of EPU on enterprises’ ESG performance

remains consistent with the baseline result, indicating

the reliability of the results of this paper.

In addition to addressing potential endogeneity

issues, this paper also tests the robustness of the

benchmark results by replacing the explanatory

variables as well as by winsorizing the variables.

Specifically, we first replace the arithmetic mean in

the benchmark regression with the monthly median

value of the EPU index and run the regression again.

The regression results are shown in column (2) of

Table 2, which remains consistent with benchmark

results after replacing the annual EPU index measure.

Then, in order to avoid confounding the findings by

outliers on a larger scale, we winsorize all continuous

variables at the 1% and 99% levels and estimate

Equation (1) again. The result in Column (3) is

significant at the 1% level, again verifying the

robustness of the findings of this paper.

Table 2: Robustness Test Results.

(1) (2) (3)

EPU

0.4939*** 0.5412*** 0.7984***

(

0.0595

)

(

0.1660

)

(

0.1352

)

2

EPU

-

0.0019***

-0.0015* -

0.0026***

(

0.0002

)

(

0.0008

)

(

0.0006

)

Controls Y Y Y

Firm-fixed

effect

Y Y Y

Industry-

fixed effect

Y Y Y

Year-fixed

effect

Y Y Y

Observations 9579 9594 9594

R

2

0.290 0.395 0.403

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

468

4.3 Heterogeneity Tests

If the marketization of a region is slow, it means that

firms in this region are more dependent on

government support and lack the tools and ability to

hedge the risk of EPU. Higher degree of

marketization means stronger the inter-regional

linkages in terms of capital markets and trade

activities, and the more vulnerable firms are to

economic policy changes. Therefore, we further study

the impact of EPU on firms' ESG performance under

different degrees of marketization, and the results of

the group regressions are shown in columns (1) and

(2) of Table 3. We can see that for both the high and

low marketization groups, there is a significant

inverse-U nexus between EPU and ESG performance.

The inflection point value for high marketization

areas is greater than that of low marketization areas,

which indicates that for firms in high marketization

areas, active ESG activities is better able to cope with

EPU.

Then, the data are grouped and regressed

according to SOEs and non-SOEs to further

investigate the differences in the impact of EPU on

firms with different ownership. Columns (3) and (4)

of Table 3 report the results. We can find that the

inverted U-shaped nexus exists in both types of firms.

However, the inflection point of SOEs is slightly

smaller than that of non-SOEs, indicating that the

"insurance effect" of ESG activities is better for non-

SOEs than for SOEs. This may be due to the different

motives and patterns of resource allocation through

CSR between SOEs and non-SOEs.

Finally, the impact of economic uncertainty on

ESG performance may be influenced by firm size,

given that different sizes of firms may experience

different levels of attention and pressure from

stakeholders regarding their ESG activities. Given

that, we regress the sample in groups based on median

firm size. Columns (5) and (6) of Table 3 show the

results. It is easy to find that for large-scale firms, the

nexus between EPU and ESG of firms shows a

significant positive relationship rather than an

inverted U-shaped relationship. However, for small-

scale firms, higher levels of economic policy

uncertainty exhibit an inhibitory effect on ESG, with

an inflection point of 140.6926. The possible reason

is that, relative to small-scale firms, large firms have

sufficient resources to continue their ESG activities,

even in an environment of high economic uncertainty.

Table 3: Heterogeneity test results.

(1)

High-mrk

(2)

Low-mrk

(3)

Soe

(4)

Non-soe

(5)

Big

(6)

Small

EPU

0.8190*** 5.1598** 0.7813*** 0.7095*** 0.5121** 1.0113***

(0.1946) (2.0146) (0.2078) (0.1931) (0.2104) (0.1718)

2

EPU

-0.0025*** -0.0226** -0.0025*** -0.0022*** -0.0012 -0.0036***

(0.0009) (0.0091) (0.0009) (0.0008) (0.0009) (0.0008)

Break point 161.9973 114.3835 157.4578 161.3996 No 140.6926

Controls Y Y Y Y Y Y

Firm-fixed

effect

Y Y Y Y Y Y

Industry-fixed

effect

Y Y Y Y Y Y

Year-fixed

effect

Y Y Y Y Y Y

Observations 4908 4686 5063 4531 4957 4637

R

2

0.415 0.389 0.411 0.376 0.385 0.425

4.4 Machine Learning Model Analysis

of Nonlinear Effects

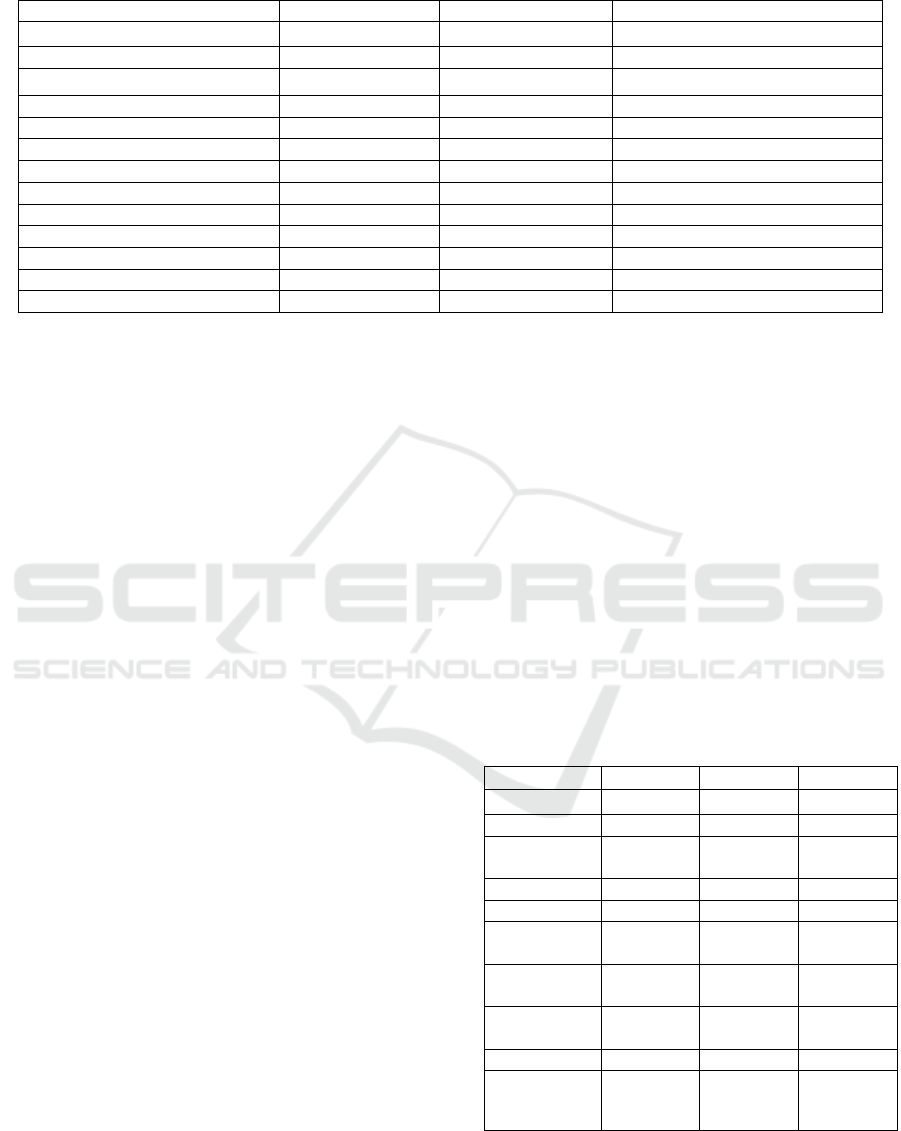

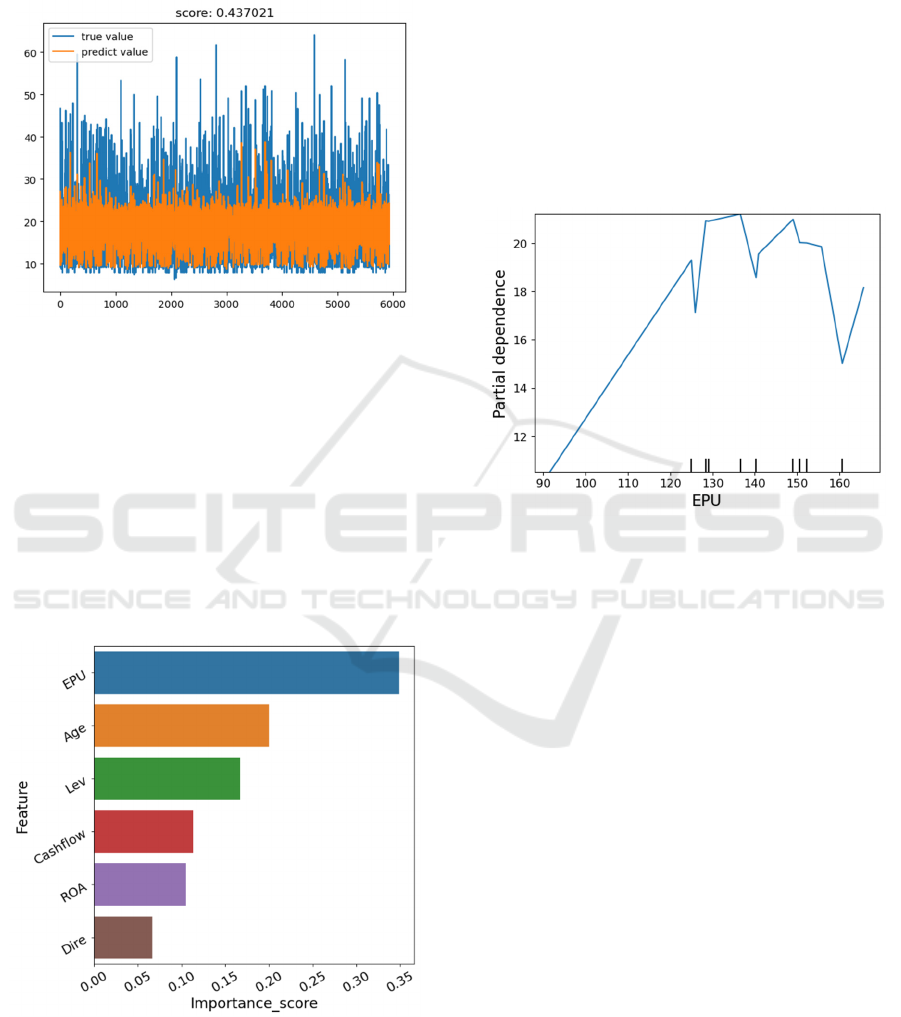

In Section 3.2, we construct a Random Forest model

with continuous dependent variables, uses regression

trees as the basic learners, and selects the splitting

nodes with the minimum mean square error as the

optimization criterion. Figure 1 depicts the degree of

fit between the true value and the predicted value

obtained from random forest regression. A

comparison of the performance of the Random Forest

The Inverted U-Shaped Effect of Economic Policy Uncertainty on Corporate ESG Performance: A Study Based on Machine Learning

Models and Micro Data

469

model and the classical two-way fixed effect

econometric model reveals that the Random Forest

model has a greater fitting advantage than the

classical econometric model (0.437021>0.395).

Figure 1: Regression Results Fit Degree Analysis.

We further compared the relative importance of

EPU and traditional factors that affect the enterprise's

ESG performance. The order of importance of all

variable is shown in Figure 2. It can be easily found

that EPU has the highest importance among the

factors influencing ESG performance, and its

importance score is much higher than other traditional

factors influencing ESG performance, which

confirms the core findings of this paper. The

remaining variables with higher importance are firm

age (

Age

) and asset liability ratio (

Lev

).

Figure 2: Feature Importance of Random Forest.

To more accurately depict the nonlinear

relationship between EPU and enterprise ESG

performance, we draw a partial dependence function

to determine the direction of EPU's impact on

enterprise ESG performance. The results are shown

in Figure 3. The internal scale of abscissa represents

the 1/10, 2/10, ..., 9/10 quantile of EPU level. It can

be seen that when the EPU level is low (before 1/10

quantile), the EPU and the enterprise ESG show a

linear relationship. Then, with the increase of EPU

degree, the model response value first decreases and

then increases rapidly. After the EPU degree reaches

2/10 quantile, the model response value fluctuates

sharply with the change of EPU degree, which

strongly indicates the nonlinear relationship between

EPU and enterprise ESG performance.

Figure 3: Partial Dependent Function Plot.

5 CONCLUSIONS

Whether companies will fulfil social responsibility as

a strategy to cope with risks and whether this strategy

changes with EPU are the main issue of concern in

this paper. Based on ESG score data, China Economic

Policy Uncertainty Index and data of all A-share

listed enterprises in China from 2007 to 2020, this

paper uses traditional econometric models and

Machine Learning-Random Forest models to

investigates the non-linear influence of EPU on

corporate ESG performance, respectively. The

empirical results indicated that there is a significant

inverted U-shaped nexus between EPU and corporate

ESG performance, which still holds after considering

the endogeneity issue and conducting a set of

robustness tests. Further analysis finds that the

inflection point of the impact of EPU on ESG is larger

for enterprises in more market-oriented regions and

non-state enterprises, and for large-scale firms, EPU

shows a positive relationship rather than an inverted

U-shaped relationship with ESG performance.

However, for small-scale enterprises, the inverted U-

shaped relationship still holds. The results of the

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

470

machine learning model analysis show that the

importance of EPU on the impact of corporate ESG is

more prominent compared to traditional factors.

There is a significant non-linear relationship between

the two. Compared with the traditional econometric

model, the machine learning model fits better.

Based on the above findings, this paper puts

forward the following policy insights and

suggestions. First, the government should consider

the negative impact of policy uncertainty on ESG

activities while implementing macroeconomic

regulation to stabilize the economy, which requires

the government to find an optimal balance between

stabilizing the economy and keeping ESG

performance at a high level. Secondly, enterprises

should establish strategic mechanisms for long-term

participation in social responsibility activities, so as

to play a buffering role and insurance effect when

facing the negative impact of EPU on financing. For

example, firms can counter the negative impact of

EPU on their financing channels by taking advantage

of ESG performance as a non-financial performance

signalling advantage: In addition, this paper further

finds that the inflection point value is smaller among

firms in low-marketing regions and state-owned

enterprises, and the ESG activities of small-scale

firms are more susceptible to the negative impact of

high EPU compared with those of large-scale firms,

which is a phenomenon that warrants government

attention. When revising the original economic

policies or issuing new economic policies, the

government can consider giving certain policy

preferences to such listed enterprises so that they can

maintain a certain level of profitability and actively

fulfil their social and environmental responsibilities

at the same time.

REFERENCES

Ahsan, T., Qureshi, M. A. (2021) The nexus between policy

uncertainty, sustainability disclosure and firm

performance. Appl. Econ., 53(4): 441-453.

Baker, S. R., Bloom, N., Davis, S. J. (2016) Measuring

economic policy uncertainty. Q. J. Econ., 131(4): 1593-

1636.

Bernanke, B. S. (1983) Irreversibility, uncertainty, and

cyclical investment. Q. J. Econ., 98(1): 85-106.

Dyck, A., Lins, K. V., Roth, L., Wagner, H. F. (2019) Do

institutional investors drive corporate social

responsibility? International evidence. J. Finance.

Econ., 131(3): 693-714.

Gulen, H., Ion, M. (2016) Policy uncertainty and corporate

investment. Rev. Financ. Stud., 29(3): 523-564.

Hartzmark, S. M., Sussman, A. B. (2019) Do investors

value sustainability? A natural experiment examining

ranking and fund flows. J Finance., 74(6): 2789-2837.

Ho, J. C., Chen, T. H., Wu, J. J. (2021) Are corporate social

responsibility reports informative? Evidence from

textual analysis of banks in China. China. Financ. Rev.

Int., 12(1): 101-120.

Ilyas, M., Khan, A., Nadeem, M., Suleman, M. T. (2021)

Economic policy uncertainty, oil price shocks and

corporate investment: evidence from the oil industry.

Energ. Econ., 97: 105193.

Krüger, P. (2015). Corporate goodness and shareholder

wealth. J. Finance. Econ., 115(2): 304-329.

Pástor, Ľ., Veronesi, P. (2013) Political uncertainty and risk

premia. J. Finance. Econ., 110(3): 520-545.

Rjiba, H., Jahmane, A., Abid, I. (2020) Corporate social

responsibility and firm value: Guiding through

economic policy uncertainty. Financ. Res. Lett., 35:

101553.

Segal, G., Shaliastovich, I., Yaron, A. (2015) Good and bad

uncertainty: Macroeconomic and financial market

implications. J. Finance. Econ., 117(2): 369-397.

Wang, X., Fan, G., Yu, J. (2017) Marketization index of

China’s provinces: NERI report 2016. Social Sciences

Academic Press: Beijing, China.

Wang, Y., Zhang, Y., Li, J. (2022) Digital finance and

carbon emissions: an empirical test based on micro data

and machine learning model. China Population

,

Resources And Environment, 32(06):1-11. (In Chinese)

Wu, D., Memon, H. (2022) Public Pressure, Environmental

Policy Uncertainty, and Enterprises’ Environmental

Information Disclosure. Sustainability, 14(12):6948.

Yang, J., Luo, P., Tan, Y. (2020) Contingent Decision of

Corporate Environmental Responsibility Based on

Uncertain Economic Policy. Sustainability, 12(21):

8839.

Yoo, S., Managi, S. (2022) Disclosure or action: Evaluating

ESG behavior towards financial performance. Financ.

Res. Lett., 44: 102108.

Yuan, T., Wu, J. G., Qin, N., Xu, J. (2022) Being nice to

stakeholders: The effect of economic policy uncertainty

on corporate social responsibility. Econ. Model., 108:

105737.

Zhao, T., Xiao, X., Zhang, B. (2021) Economic policy

uncertainty and corporate social responsibility

performance: evidence from China. Sustain. Account.

Mana., 12 (5): 1003-1026

Zhou, W., Huang, X., Dai, H., Xi, Y., Wang, Z., & Chen,

L. (2022). Research on the Impact of Economic Policy

Uncertainty on Enterprises’ Green Innovation—Based

on the Perspective of Corporate Investment and

Financing Decisions. Sustainability, 14(5): 2627.

The Inverted U-Shaped Effect of Economic Policy Uncertainty on Corporate ESG Performance: A Study Based on Machine Learning

Models and Micro Data

471