An Analysis of Supply Chain Finance and Small and Medium-Sized

Enterprises Financing Pressure Relief

Qianwen Fan

a

Soochow University, RenAi Road, Suzhou, China

Keywords: Supply Chain Finance, Small and Medium-Sized Enterprises Financing, Financial Models.

Abstract: Small- and medium-sized businesses are crucial to the health and stability of the economy. However, SMEs

typically struggle to find funding on the market. This study analyzes the reasons of small- and medium-sized

businesses' financial pressures, introduces three main models of supply chain finance, corresponds the

advantages of supply chain finance to the problems of SME financing and puts forward the suggestion of

relieving the financing pressure of SMEs through the application of supply chain finance in hope that this

article can provide reference direction for the development and reform of SMEs and reduce their difficulty in

financing.

1 INTRODUCTION

Small and medium-sized enterprises are at

disadvantage of defending against risks. After the

attack of Covid-19, most SMEs are heavily hurt

because of the accumulation of inventory and failure

to gain finances from financial institutions. Although

government’s support can temporarily relieve their

pressure, the fundamental way should take market

law and other market entities into consideration.

The competitiveness in the supply chain is

undoubtedly crucial to how competitive modern

businesses are. A stable and efficient supply chain can

effectively reduce the risks and costs of enterprises

and improve production efficiency. At present,

upstream and downstream SMEs in the supply chain

are facing the problems of high capital turnover

pressure and financing difficulties, which may easily

cause SMEs to lose capital and interrupt the

production of the whole supply chain. Supply chain

finance unifies various roles in the supply chain,

which works and communicates to a limited degree in

traditional financing modes, expands new forms of

financing in addition to the conventional financial

model, uses the supply chain's more developed

information and logistical flow to address the weak

capital flow, and promotes finding a solution for

SMEs' financing issues.

a

https://orcid.org/0000-0002-4883-5272

Under the current context of information

technology being more and more common in the

process of company operation, although SCF is

gradually known and taken by many enterprises, there

are still some barriers in the way of using SCF to

solve SMEs’ difficulties. Technologies such as big

data, algorithms, artificial intelligence, blockchain

and Internet of Things truly incorporate SMEs into

the system of supply chain finance, which can turn

previously unusable data on business behaviour into

standardised, quantifiable and usable credit data,

solving the problem that the traditional credit

granting model relies excessively on the credit status

of individual enterprises and collateral guarantees

(Wang 2022). However, the most urgent problem is

that most SMEs have not digitized fully, which needs

both time, money, labour and resource input. SCF in

SMEs exists moral fraud risk, operational risk and

credit risks. And there is no authoritative and unified

standards for evaluating SMEs’ credit risks and for

regulating SCF.

Fan, Q.

An Analysis of Supply Chain Finance and Small and Medium-Sized Enterprises Financing Pressure Relief.

DOI: 10.5220/0012069400003624

In Proceedings of the 2nd International Conference on Public Management and Big Data Analysis (PMBDA 2022), pages 23-29

ISBN: 978-989-758-658-3

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

23

2 ANALYSIS OF FINANCING

PROBLEMS OF SMEs

In the process of financing, SMEs will encounter

various obstacles due to their small scale of operation,

lack of credit records and few fixed assets, mainly

because of their few financing channels and the

transfer of capital pressure from core enterprises.

2.1 Few Financing Channels

Enterprises have a variety of financing channels that

are available from the aspect of literacy, including

endogenous financing such as equity capital, retained

earnings and depreciation, and exogenous financing

including marketable securities, like stocks and

bonds, as well as bank loans and commercial credit

financing (Zhang 2006). Exogenous funding, in

which SMEs are only able to obtain limited liquidity

funds, is more challenging to get than endogenous

financing, which is the primary financing strategy

utilized by SMEs. The main reasons for the difficulty

of exogenous financing for SMEs are as follows.

2.1.1 Immaturity of the Capital Market

Most SMEs do not have the conditions to issue stocks

and bonds, and SME stock financing only accounts

for about 1% of their total domestic financing (Zhang

2006). Even if the conditions for issuing stocks and

bonds are met, SMEs do not have an advantage in the

capital market. Due to their relatively small size of

companies, lack of social visibility, lack of

transparency of financial information, low credit

history and high investment risks, the market value of

SMEs' stocks and bonds is low, making it difficult for

enterprises to quickly obtain the funds they need

through stocks and bonds. SMEs have a high demand

for liquidity and more short-term funds mainly for

production and operational turnover. The speed of

access to funds as well as the cost of access to funds

is important factors in the financing, while the current

capital market in China still has a lot of room for

improvement, making it difficult for SMEs' financing

needs to be met quickly and at a low cost.

2.1.2 Hard to Get Bank Loans

Information asymmetry refers to the phenomenon

that information is unevenly distributed among the

corresponding economic individuals, and the more

information a transaction subject has, the more

advantageous it is in the transaction. Due to the fact

that the phenomenon of information asymmetry

exists widely, banks have less information about the

profitability and collateral of SMEs and are in a

disadvantageous position in the transaction. The high

uncertainty of banks in providing loans to SMEs leads

to the problem of high cost, and high credit risk (Fan,

Su, and Wang 2017).

For banks, providing loan services requires

company reviews and credit record enquiries, a

process that entails time costs and manpower costs.

Information on financial statements and corporate

governance structure of large enterprises is more

accurate and transparent and easily accessible, and

there are mature market mechanisms and clear credit

rating criteria for loans to large enterprises.

Investigating large enterprises is more time-efficient

and labour-efficient than investigating SMEs, and

lending to large enterprises is less risky because of

more financial information and high transparency of

operation situation, and the larger the loan amount,

the more interest the bank can get, so banks are more

inclined to lend to large customers with lower

transaction risks rather than The banks are therefore

more inclined to lend to large customers with lower

transaction risk than to SMEs with low information

transparency, the inaccurate credit assessment, small

loan amount and high default risk (Li 2012).

Bank loans also require collateral and guarantees.

Bank loans are more inclined to fixed assets as

collateral, such as land, real estate, machinery and

equipment, etc. SMEs have fewer fixed assets and

more liquid assets. Due to their scale and short

operating time, SMEs' assets are mainly liquid assets

such as inventory goods, materials in transit, raw

materials, etc. It is inconvenient for banks to control

liquid assets and more difficult to supervise them

(Song 2019), thus requiring a guarantee from a third

party when applying for a loan from a bank. The

development of China's guarantee mechanism is not

yet perfect, and there are fewer institutions providing

guarantees for SMEs. The People's Bank of China

survey shows that the financing needs index of SMEs

is higher than the financing needs index of large

enterprises. This reflects the urgency of SMEs'

financing needs and development potential.

PMBDA 2022 - International Conference on Public Management and Big Data Analysis

24

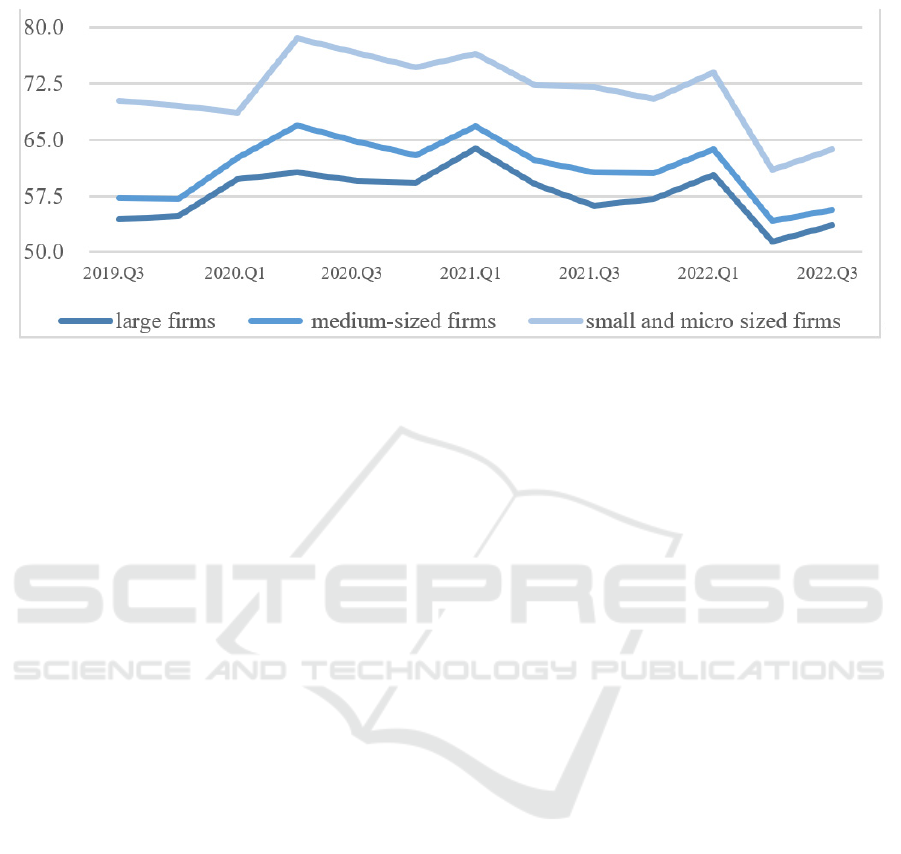

Table 1: The comparison of the loan demand index.

2.2 Transfer of Capital Pressure from

Core Enterprises

The transfer of capital pressure is mainly in the form

of transfer of pressure from core enterprises to

upstream and downstream SMEs. There is usually a

core enterprise in the supply chain, and the core

enterprise is usually larger. The core enterprise

usually occupies a dominant position in the whole

supply chain and is the key linkage of production,

sales and transportation in the supply chain, and is the

information exchange centre and the "dispatch

centre" of logistics distribution in the supply chain

(Yu 2011). To maximize their interests, core

enterprises often use delayed payment or advance

payment to delay capital outflow and increase capital

inflow, but in this case SMEs lack capital inflow.

In the case of upstream SMEs, the core companies

use the credit sales model to reduce their financial

pressure by delaying payment or paying in

instalments. With credit sales, upstream sellers are

unable to obtain payment for their orders as soon as

they arrive, but companies need working capital to

run their operations, so the financial pressure is

transferred to the upstream companies. Credit sales

only transfer the risk from the downstream

enterprises of the supply chain to the upstream

enterprises, which cannot fundamentally solve the

problem of shortage of capital flow in the supply

chain, but on the contrary, it will endanger the

stability and fluidity of capitals in supply chain and

make financing cost of the supply chain become more

expensive and bring risks to the sustainable operation

of the supply chain. For downstream SMEs, due to

the lack of voice, downstream enterprises need to pay

the core enterprises in advance to obtain the

corresponding raw materials, semi-finished products,

finished products and other ordered materials. In

addition to prepayment to core enterprises,

downstream enterprises also need to pay for the

operation, transportation and sales costs.

3 THREE MAIN MODES OF

SUPPLY CHAIN FINANCE

At different stages of the supply chain, the financing

models adopted by SMEs can be divided into

accounts payable model, accounts receivable model,

confirming warehouse and financing warehouse

models

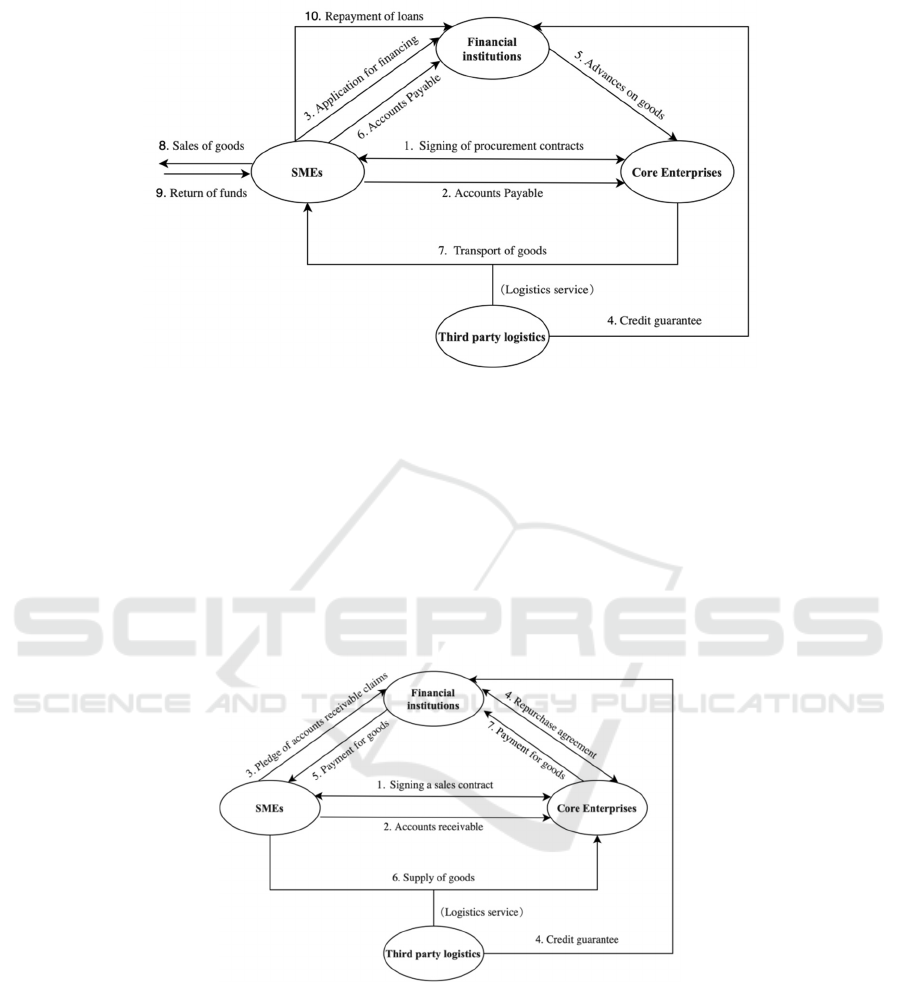

3.1 Accounts Payable Model

In the procurement stage, SMEs mainly use the

accounts payable model for financing. SMEs need to

apply for financing from banks when they are under

financial pressure in the procurement process. By

assessing the risks of core enterprises, third-party

logistics enterprises supervise and evaluate the goods

and provide guarantees for SMEs, banks advance the

payments to core enterprises, and SMEs can get the

goods by forming accounts payable to banks and

repay the banks after the return of funds. Fig 1 shows

the accounts payable model.

An Analysis of Supply Chain Finance and Small and Medium-Sized Enterprises Financing Pressure Relief

25

Figure 1: Accounts payable model.

3.2 Accounts Receivable Model

In the sales phase, SMEs are mainly financed through

accounts receivable. As shown in Fig 2, After

reaching a sales contract with the core enterprise, the

SME pledges its accounts receivable claims against

the core enterprise to the financial institution. The

financial institution investigates the credit status of

the core enterprise, its repayment ability and the

operation of the entire supply chain to assess the

transaction risk and determine the loan amount; if

necessary, it will sign a repurchase agreement with

the core enterprise. Third-party logistics companies

provide credit guarantees in the process. The SME

can obtain a short-term loan to complete the purchase

of raw materials, production and processing

activities, and transportation activities to fulfil the

order; the core enterprise will repay the loan to the

financial institution after the order is delivered.

Figure 2: Accounts receivable model.

3.3 Confirming Warehouse and

Financing Warehouse Model

Fig 3 reflects the basic process of Confirming

warehouse and financing warehouse models. During

the operational phase, SMEs will use the confirmed

and collateral models to finance their operations. In

the confirmatory warehouse financing model, the

SME reaches an agreement with the financial

institution to pledge the purchased warehouse

receipts to the financial institution; the seller

enterprise will send the goods to a designated

warehouse after receiving the silver cheque paid by

the buyer, with the bank controlling the right to pick

up the goods and the third party logistics responsible

for supervising the flow of materials as well as the

value assessment records; the seller will store the

items in the designated warehouse. In this way,

PMBDA 2022 - International Conference on Public Management and Big Data Analysis

26

downstream enterprises can solve the difficulties of

collateral and alleviate the pressure of large-volume

funding in a short period. In the warehouse financing

model, enterprises apply for loans from banks with

their inventory as pledges, and the third-party logistics

agency inspects, evaluates and supervises the pledges.

Figure 3: Confirming and financing warehouse model.

4 SUPPLY CHAIN FINANCE

DEVELOPMENT STATUS

According to the statistics of Huachuang Consulting,

the scale of China's supply chain finance market will

increase from 2015 to 2022. It was 11.97 trillion yuan

in 2015, 12.95 trillion yuan in 2016, 14.42 trillion

yuan in 2017, 17.50 trillion yuan in 2018, 22.18

trillion yuan in 2019 and 27.01 trillion yuan in 2020.

Supply chain finance offers SMEs a more flexible and

affordable funding approach than traditional lending

options, which compensates for their poor

creditworthiness.

Table 2: The market of SCF.

Statistics from the CBRC show that the loan

balance of inclusive micro and small enterprises in

banking financial institutions is increasing and the

interest rate of inclusive micro and small enterprise

loans is decreasing. the loan balance in the first two

quarters from 2019 to 2022 is $43 trillion, $56 trillion,

$72 trillion and $42 trillion, and the loan interest rates

are 6.7%, 5.88%, 5.69% and 5.35%.

Financial institutions only take into account the

credit risk associated with funding businesses under

the conventional financial model. When evaluating

loan issuance, supply chain finance breaks down the

silos across supply chains by taking into account the

credit standing of core firms, the operation of each

link upstream and downstream, the credit history of

SMEs, and the assured efficacy of logistics

enterprises.

The use of supply chain finance in SME financing

has greater space for growth now that big data, cloud

computing, and blockchain technology are supporting

it. This paper makes the following recommendations

for encouraging the use of supply chain finance in

SME financing.

All of China's main commercial banks have

started offering services relating to supply chain

finance, so far as financial institutions are concerned.

All of China's main commercial banks have started

offering services relating to supply chain finance, so

11,97

12,95

14,42

17,5

22,18

27,01

0,

7,

14,

21,

28,

35,

2015 2016 2017 2018 2019 2020

An Analysis of Supply Chain Finance and Small and Medium-Sized Enterprises Financing Pressure Relief

27

far as financial institutions are concerned. They

include Ping An Bank, China Minsheng Bank, China

CITIC Bank, etc. Through Internet technology, they

build online supply chain financial service platform,

apply supply chain financial information

management system and provide intelligent product

system such as supply chain cloud account. China

Minsheng Bank has launched "Purchase e", "Order e"

and "Xinrong e" series products, Guangdong

Development Bank has launched "Logistics Bank.

Data show that in the first half of 2022, Ping An

Bank's supply chain finance financing amounted to

542.452 billion, up 24.0% year-on-year. China CITIC

Bank's cumulative supply chain financing during the

reporting period amounted to 382.587 billion yuan,

up 53.53% year-on-year comparison, with 15,796

financing customers, up 60.92% year-on-year. China

Merchants Bank provided supply chain financing for

15899 enterprises with 208 billion yuan as of the first

half of the year. Industrial Bank had a supply chain

financing balance of 318.697 billion yuan and a bill

pool financing business volume of 121.817 billion

yuan by the end of June.

On the enterprise side, logistics enterprises

themselves have the advantage of information

tracking systems and commodity evaluation systems,

and they also control the transportation of actual

commodities. Foreign logistics enterprises UPS set

up UPSC to provide supply chain financial services,

including inventory financing, accounts receivable,

etc.; domestic Shunfeng company set up Shunyin

Finance to provide warehouse financing, order

financing and other services. Besides logistics

enterprises, the giant core enterprises of various

industries have also entered to participate in the

supply chain finance business. Sanquan Food

registered the establishment of Zhong Run Quan

Rong (Tianjin) Commercial Factoring Co. Guoneng

Group registered Guoneng (Beijing) Commercial

Factoring Co., Ltd. and Southern Pearl (Tianjin)

Commercial Factoring Co. Beijing Byte Jump

Network Technology Co., Ltd. incorporated Hainan

Word Jump Commercial Factoring Co. Gome

developed account cloud loan, credit cloud loan,

goods cloud loan, invoice cloud loan four products.

Relying on its own logistics system, Jingdong

launched the "Jingbao Bei" Internet financial service.

5 SUGGESTIONS

The empirical study by Weibin Zhang and Ke Liu

demonstrates that SMEs have obvious financing

constraints (Zhang and Liu 2012), and with the

development of supply chain finance the financing

constraints faced by SMEs have been alleviated to a

certain extent. Gu Qun's study demonstrates that the

development of supply chain finance can alleviate the

financing constraints of SMEs from the perspective

of investment-cash flow sensitivity (Gu 2016). Ali,

Z., Gongbing, B. and Mehreen, A. show that trade

digitization strengthens the relationship between SCF

and SMEs performance. The relationship between

SCF and SMEs performance (Ali, B, and Mehreen

2020).

5.1 Improving Information Technology

The need to keep the business status and goods up-to-

date between companies, banks and third-party

logistics requires each link to improve information

technology. Blockchain technology, cloud computing

and other services will all be of great help in the

process of improving information technology.

Blockchain technology enables information security

to be efficiently shared across all parts of the supply

chain and ensures maximum authenticity and

trustworthiness of information. The Internet of

Things enables timely updating of information in the

process of delivery of goods. In the process of

informationization, attention should be paid to the

joint participation of all parties to try to avoid the

emergence of an information gap.

5.2 Establish a Credit Assessment

System

Supply chain finance has unique advantages in

weakening the credit risk of SMEs, reducing

information asymmetry and solving the problem of

lack of collateral security. When evaluating

businesses for funding for SMEs, banks now evaluate

the performance of the entire supply chain rather than

just one particular organization (Yan and Xu 2007).

In most cases, the transaction's assurance may be

provided by the main businesses and third-party

logistics companies. In the financing process, the

introduction of logistics enterprises and storage

supervisors helps banks to better track the flow status

and value changes of pledges or collaterals, solving

the drawback of lack of relevant information in

movable pledges. By changing from the traditional

two-party model to a three-party model, information

asymmetry and risk management problems will be

improved, so the willingness of financial institutions

to provide financing to SMEs will be increased, and

the financing channels of SMEs will be expanded.

PMBDA 2022 - International Conference on Public Management and Big Data Analysis

28

5.3 Promote Supply Chain Upgrading

A modern supply chain is a cohesive system of

information flow, money movement, and logistics.

Supply chain finance depends on the flow of logistics

and information to move capital, and moving money

places more demands on the flow of logistics and

information, requiring an upgrade of both. The three

streams of development can work together to enhance

the supply chain as a whole. Although logistics,

information flow, and capital flow are essentially

unseen, they are represented in an organization's

capability for distribution, information exchange, and

capital turnover. When it comes to information flow

during the SME funding procedure, in the process of

SME financing, to pull the capital flow, there is a

need for timely information exchange between all

parties to reduce the risk of information asymmetry.

Banks monitor and assess financing risks by

obtaining information on the operations of each

enterprise in the supply chain; logistics and

warehousing enterprises need timely information to

arrange distribution activities and assess the value of

their products, and enterprises need to transmit

production information promptly to improve the

efficiency of the supply chain.

5.4 Formation of Authoritative

Regulatory Organizations and

Improvement of Relevant Policy

Regulations

China's banking and financial sectors have

authoritative industry organizations, such as the

China Banking and Insurance Regulatory

Commission, the People's Bank of China, etc. The

two things, authoritative organizations and improving

relevant policy regulations, go hand in hand.

Authoritative organizations can gather experts and

talents to promote research on the supply chain

finance industry, thus providing a reference for the

improvement of policies. The improvement of

policies is a prerequisite for the sustainable

development of the supply chain finance industry.

6 CONCLUSION

A four-way win-win solution to the credit risk issue,

which is essential to resolving the financing issue for

SMEs, is provided by supply chain finance. It aids in

resolving the funding issue facing SMEs, expanding

the revenue stream for logistics companies, lowering

the loan risk for financial institutions, and enhancing

the effectiveness of core businesses and even the

entire supply chain. With the advancement of

technology such as blockchain, the internet of things

and AI will back up SMEs’ reforming towards

digitization, which will further prompt the

convenience of the use of supply chain finance and

lead SCF into the use of more industries. It is out of

doubt that SCF have huge potential both in solving

the problems of SMEs’ financing.

REFERENCES

Ali, Z., Gongbing, B. and Mehreen, A. (2020). Does supply

chain finance improve SMEs performance? The

moderating role of trade digitization. Business Process

Management Journal. 26, 150-167.

Fangzhi Fan, Guoqiang Su & Xiaoyan Wang (2017). Credit

risk evaluation and risk management of small and

medium-sized enterprises under the supply chain

finance model. Journal of Central University of Finance

and Economics. 12, 34-43.

Hua Song (2019). The development trend of supply chain

finance in China. China Business and Market. 3, 3-9.

Jianmei Yu (2011). Alleviating the financing difficulties of

SMEs with supply chain finance. Economic Review

Journal. 3, 99-102.

Jingmin Zhang (2006). Research on the current situation

and countermeasures of financing for small and

medium-sized enterprises in China. Journal of Harbin

University of Commerce (Social Science Edition). 5,

12-14.

Junhong Yan & Xiangqin Xu (2007). Analysis of the

financing model of small and medium-sized enterprises

based on supply chain finance. Shanghai Finance. 2, 14-

16

Meiwen Wang and Sheng Wang (2022). Research on

supply chain finance to alleviate the financing

constraints of SMEs under the new economic normal -

a panel data analysis based on 42 SMEs in Shandong

Province. Heilongjiang Finance. 1, 29-33.

Shanliang Li (2012). Research on financing of small and

medium-sized enterprises based on the perspective of

supply chain finance. Journal of Soochow University

(Philosophy and Social Science Edition). 6, 130-137.

Qun Gu (2016). Study on the effect of supply chain finance

in alleviating financing constraints - empirical evidence

from technology-based SMEs. Finance and Economics

Series. 5, 28-34.

Weibin Zhang & Ke Liu (2012). Can supply chain finance

development reduce SMEs' financing constraints? --An

empirical analysis based on small and medium-sized

listed companies. Economic Science. 3,108-118.

An Analysis of Supply Chain Finance and Small and Medium-Sized Enterprises Financing Pressure Relief

29