Does Local Debt Governance Ease Corporate Financing Constraints?

Empirical Evidence from Chinese A-share Listed Companies

Banchi Xia

Wuhan University of Technology, Wuhan, China

Keywords: Local Debt Governance, Financing Constraints, Listed Companies, Difference-In-Difference.

Abstract: Local debt governance is an important practice of China's economy in the new era. Based on the A-share data

of Chinese listed companies from 2010 to 2019, this paper takes the 2015 "New Budget Law" as an exogenous

impact and constructs an intensity DID model. The research finds that local debt governance will make

companies reduce cash on hand, thereby effectively alleviating the impact of corporate debt. A series of

robustness tests prove the rationality and effectiveness of the DID model. The results of heterogeneity analysis

show that local debt governance has different effects on alleviating the financing constraints of different types

of enterprises. Among them, the effect on non-state-owned enterprises is stronger than that on state-owned

enterprises, and the effect on high-tech enterprises is stronger than that on low-tech enterprises. What’s more,

the role of enterprises is stronger for enterprises in inland cities than for enterprises in coastal cities. This

paper provides relevant policy suggestions for optimizing local debt governance and promoting the high-

quality development of enterprises in the new era.

1 INTRODUCTION

Since the 18th National Congress of the Communist

Party of China, the central government has issued a

series of policies to administer local debts, the

fundamental purpose of which is to prevent and

resolve financial risks. Local government debt

governance is an important fiscal and financial

system reform of the Chinese government since the

new era, and it has played an important role in the

financial sector, micro-market entities, and monetary

and credit sectors. During the 2008 financial crisis,

the Chinese government introduced a large-scale

stimulus plan to expand domestic demand, drive

investment, and ease the pressure of the financial

crisis. Local governments have chosen to issue local

bonds on a large scale in order to collaborate with the

central government's policies, and most of the debts

have not been included in the budget management.

There have been problems such as large debts,

insufficient supervision, and unclear responsibilities.

In response to these problems, the Chinese

government issued the “Budget Law of the People's

Republic of China in 2014” to coordinate and guide

the governance of local debt. It has also continuously

amended the law, standardized the governance

methods and introduced them to all localities, solved

problems left over from history, enhanced the

supervision of local debt, and fully included local debt

in the tabled budget.

Enterprise financing constraints make enterprises

confront problems such as high financing costs,

difficult financing, and slow financing speed. These

problems have a particularly obvious impact on small

and medium-sized enterprises. The increase in the cost

of the financing process will cause the company to

abandon a part of the original investment activities

with a positive net present value when investing and

has to choose an investment with higher net income

and greater risk, changing the existing investment

structure of the company, and facing Higher risk

management costs. Enterprise financing constraints

hinder the long-term healthy development of

enterprises, which may cause some enterprises to

withdraw from the market due to cost reasons, reduce

market competition, affect market vitality, and thus

deal a blow to the country's overall economy. Easing

corporate financing constraints helps companies

obtain sufficient cash flow to support their rapid

development, prompts companies to optimize their

investment structure, diversify their investments to

diversify their investment risks, and promote the long-

term sustainable development of the capital market.

308

Xia, B.

Does Local Debt Governance Ease Corporate Financing Constraints? Empirical Evidence from Chinese A-Share Listed Companies.

DOI: 10.5220/0012074200003624

In Proceedings of the 2nd International Conference on Public Management and Big Data Analysis (PMBDA 2022), pages 308-316

ISBN: 978-989-758-658-3

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

To explore the impact of local debt governance on

corporate financing constraints is of significant

significance to China's capital market, which is

conducive to standardizing the development of

marketization and stimulating the investment and

financing activities of enterprises. The innovation

points and contributions of this paper are as follows:

First, in terms of content, the implementation of the

New Budget Law in 2015 is taken as a quasi-natural

experiment, and the investment and financing

activities of enterprises are included into the

governance framework system of local government

debt, which is conducive to revealing the influence of

local debt governance on micro subjects. Secondly,

the intensity DID model was used to accurately

identify the causal effect and solve the possible

endogeneity and missing variable bias. This paper

provides experience references for the virtuous circle

of government debt and the high-quality development

of micro market players in the new era.

The remaining contents of this paper are arranged

as follows: the second part is the policy background

and literature review, the third part is the data

processing and model setting, the fourth part is the

baseline regression and robustness test, the fifth part

is the heterogeneity analysis, and the sixth part is the

conclusion and policy enlightenment.

2 BACKGROUND AND

LITERATURE REVIEW

2.1 System Background

Since China's reform and opening up policy, with the

establishment of the market economic system, the

scale of local government debt has been expanding.

The government is making efforts to make the

issuance of local bonds more transparent and

institutionalized through supervision. With the

historical change of the concept of social and

economic development in the new era, the debt

governance mode needs to be changed from the

traditional quantitative governance based on GDP to

the performance governance oriented by long-term

benefits, and focus on improving the quality and

efficiency of debt financing.

Since China entered the fast lane of economic

development in the 1990s, the speed of urbanization

has accelerated, and more and more attention has

been paid to the construction of infrastructure in

various regions to protect people's livelihoods and

further promote economic development. In this

situation, the local government is facing huge

pressure from a shortage of funds and stagnant

development. In order to ease the economic pressure

on local governments, China began to implement the

local debt policy to raise funds for local governments

to support their development. The issuance of local

government bonds in China can be divided into four

stages. The first stage is from 2009 to 2010, China

implemented the policy of issuing and repaying on

behalf of the central government. The Ministry of

Finance should issue the "2009 Local Government

Bond Budget Management Measures", which

formulated the policy of the Ministry of Finance to

issue local bonds on behalf of local governments. In

the same year, the State Council approved the

Ministry of Finance to issue 200 billion yuan of local

bonds as an agent. The second stage is from 2011 to

2013, China implemented the pilot project of self-

issued local debt repayment by local governments.

The Ministry of Finance issued the "Pilot Measures

for Issuing Bonds by Local Governments in 2011",

which designated Shanghai, Guangdong, Zhejiang,

and Shenzhen as pilot areas for voluntary repayment,

and the policy of repayment and repayment is still

implemented in other regions except for the pilot

area. The third stage is from 2014 to 2015, China

implemented the pilot project of local government

self-issue and self-repayment of local debt. The

"2014 Local Government Bond Self-Issuance and

Self-Repayment Pilot Measures" issued by the

Ministry of Finance stipulated that local governments

have the right to voluntarily issue book-keeping fixed

bonds. Interest rate bonds. In the same year, the "New

Budget Law" was revised and would be officially

implemented from 2015. Article 35 of it stipulates

that part of the funds for construction investment

necessary for the budgets of provinces, autonomous

regions, and municipalities approved by the State

Council may be borrowed through the issuance of

local government bonds within the limit determined

by the State Council, furthermore standardize the

policies related to the self-issue and self-repayment

of local debt. The fourth stage is from 2015 to the

present, the issuance of the "Local Government

General/Special Bond Budget Management Method"

marks the full implementation of local governments'

self-issued and self-repaid local debts. The issuance

of local government bonds in China presents the

characteristics that the issuer goes from top to bottom

and the scale of issuance gradually increases.

At present, China's local government debt model

has formed an institutional framework with notice,

measures, and opinions as the main body, with the

Ministry of Finance as the core regulatory body, the

Does Local Debt Governance Ease Corporate Financing Constraints? Empirical Evidence from Chinese A-Share Listed Companies

309

People's Bank of China, the China Banking

Regulatory Commission and the National

Development and Reform Commission as the central

point, and other departments as the response points.

In the "management measures", the focus is on the

policy design of borrowing, using, and repayment.

2.2 Literature Review

The existing literature on research on local debt and

micro-market entities is carried out from two aspects,

one of which is the impact of local debt on the

economy, and the other is the relationship between

local debt and corporate financing.

2.2.1 Local Debt and Economy System

With the gradual acceleration of regional

construction in China, local governments are facing

increasing financial pressure. In order to meet the

financial needs of local governments, the scale of

local bond issuance has also increased rapidly. Large

local debts and long debt repayment time have also

led to problems such as insufficient government

repayment capacity, unsound risk management and

control mechanisms, and debt invisibility (Zhou &

Ren 2020). Local governments in China are also

carrying out local debt management while

implementing the local debt policy. The methods and

key points of local debt governance have always been

hotly debated issues in academic circles. (Tao 2015)

pointed out that the government needs to improve the

fiscal transparency of local governments and reform

the fiscal system. (Guo & Mao 2019) believe that the

debt governance model needs to shift from traditional

quantitative governance based on gross domestic

product to long-term benefit-oriented performance

governance, focusing on improving the quality and

efficiency of debt financing. (Li, Zhou, Liu & Ge

2022) believe that local governments need to promote

debt legislation, formulate a sound public debt law,

and establish a social monitoring mechanism for the

use of debt funds. However, the conclusions of the

academic circles are not uniform regarding the impact

of local debt governance on Chinese economic

development. (Zhang & Wang 2009) pointed out that

only by strictly controlling the risks of local bond

issuance can local bonds promote the development of

China's economy, while (Zheng & Zhang 2020)

believed that the growth of local bonds may inhibit

technological innovation, enterprises, and

investment, thereby inhibiting the development of the

real economy. (Tang 2022) pointed out that the scale

of local government debt in China has exceeded a

reasonable threshold, and the crowding out effect of

debt expansion on the real economy is more obvious.

(Panizza & Presbitero 2013) pointed out that the

relationship between government debt and economic

growth is not monotonous, and the threshold of

monotonic transition may not be single. (Wu 2014)

also confirmed through empirical evidence that there

is a nonlinear relationship between economic growth

and local government debt.

2.2.2 Local Debt and Corporate Financing

Constraints

The impact of local debt on corporate behavior is

multifaceted. (Yang & Song 2015) believed that local

debt can not only have a micro impact on corporate

behavior but may also lead to macro risks such as

fiscal risks and financial risks, thereby affecting

corporate behavior. The direct impact of local debt on

enterprises is reflected in the impact on corporate

innovation. High R&D companies are more likely to

be exposed to government debt than low R&D

companies (Croce, Nguyen, Raymond & Schmid

2019). (Xu, Li, Feng, Wu, & He 2021) studied the

data of China's Shanghai and Shenzhen A-share listed

companies and 31 provinces' local debts and

concluded that local debts have a relatively strong

crowing-out effect on corporate R&D investment.

(Zhang, Yin & Wang 2021) conducted an empirical

study to show that the level of hidden debt in local

government debt has a significant inhibitory effect on

the patent applications of local companies and leads

to a reduction in internal R&D expenses. Some

scholars conduct research on state-owned enterprises

and private enterprises separately. (Liang, Shi, Wang

& Xu 2017) found that the expansion of local

government debt greatly crowded out the leverage of

non-state-owned enterprises, and also crowded out

the leverage of state-owned enterprises. (Huang,

Pagano & Panizza 2020) found that local debt

restricts the investment of private enterprises by

tightening capital restrictions, but does not affect the

investment of state-owned enterprises.

Existing literature has different views on whether

local debt can effectively alleviate corporate financing

constraints. (Luo & Mi 2010) believed that local debt

is an effective way to solve the current financing

difficulties of SMEs. It enables small and medium-

sized enterprises to get rid of the discrimination of

banks and other financial institutions in indirect

financing. (Demirci, Huang & Sialm 2019) studied the

data of several countries and found that there is a

negative correlation between government debt and

corporate leverage, and government debt crowds out

PMBDA 2022 - International Conference on Public Management and Big Data Analysis

310

corporate debt. However, (Zhen, Zhang, She, Shen &

Chen 2020) used the PVAR model to carry out

empirical analysis and concluded that the growth of

local debt and financial efficiency are two-way

linkages and mutual promotion; while the growth of

local debt will crowd out financing for private SMEs

and push up financing costs.

3 METHODS AND MATERIALS

3.1 Experimental Subject

The empirical analysis in this paper uses three major

databases: the first is the A-share database of Chinese

listed companies from 2010 to 2019, which includes

the basic information of listed companies, total assets,

total liabilities, owners' equity, cash flow and other

financial indicators, as well as the patent information

of enterprises. The second is the 2010-2019

prefecture-level city database, which includes

population, GDP, primary industry, secondary

industry, tertiary industry and other relevant

information at the prefecture-level city level. The

third is the local debt database for 2010-2019, which

contains the total outstanding debt of prefecture-level

cities and can measure the scale and timing of debt

issuance. The data used in this demonstration are all

from the CSMAR database.

3.2 Empirical Method

3.2.1 Methodology

Since this empirical study is about the change of

corporate financing constraints before and after the

implementation of China's local debt governance

policies, we choose the DID model to evaluate the

policy effect. Compared with other statistical

methods, the DID model can control the qualitative

heterogeneity that does not change over time, avoid

the endogeneity problem, alleviate the missing

variable bias problem, and better reflect the changes

of the research object before and after a certain

exogenous impact.

3.2.2 Model Setting

In order to identify the causal effect of the "New

Budget Law" implemented in 2015, we constructed an

intensity DID model. Because the "New Budget Law"

in 2015 was rolled out at a comprehensive level at

once without a pilot, therefore, ordinary DID cannot

be used for estimation, we use the intensity of local

debt issuance in the database to group according to the

median, among which those greater than or equal to

the median enter the treatment group, and those less

than the median enter the control group. Taking this

as the core, the model is constructed as follows:

cflow

=α

+α

treat ∗ post +α

X

+δ

+σ

+φ

+ε

(1)

Among them, 𝑐𝑓𝑙𝑜𝑤

represents the financing

constraints of i enterprises in city c in year t, 𝑡𝑟𝑒𝑎𝑡

represents the grouping according to the intensity of

local debt issuance, 𝑝𝑜𝑠𝑡 is a policy dummy

variable, 𝛿

represents a dummy variable at the

enterprise level, 𝜎

represents a dummy variable at

the city level, and 𝜎

represents a dummy variable at

the time level, 𝜀

representing the random

disturbance term.

The statistical analysis software used in this paper

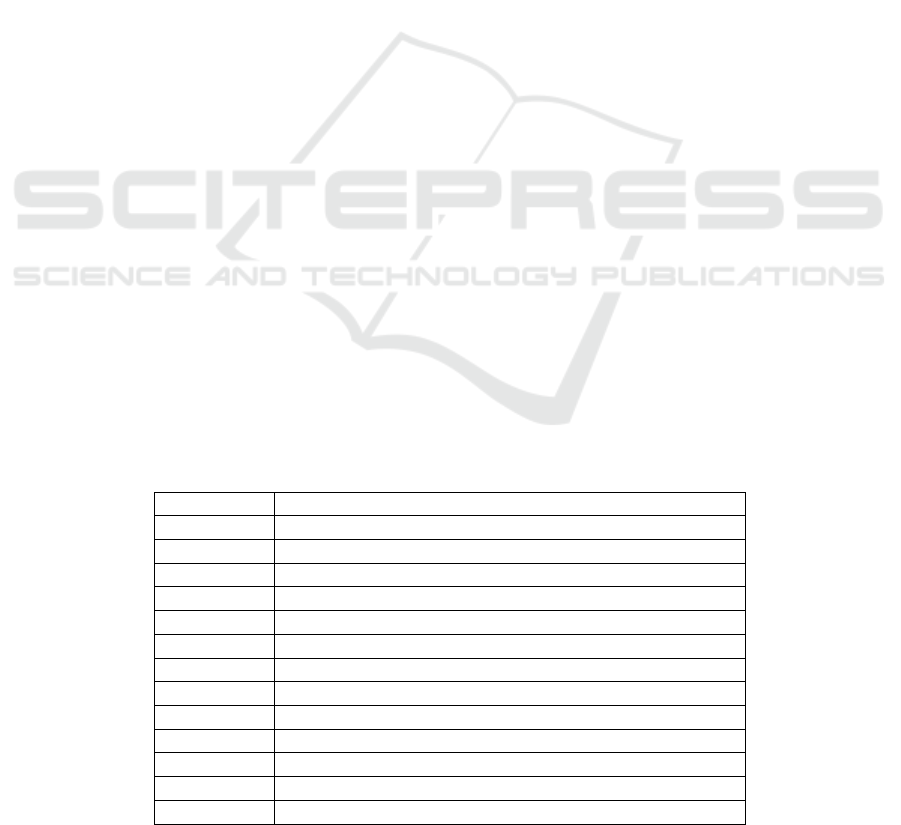

is Stata17. Table 1 shows the code interpretation of

the explanatory variables and the explained variables

used in Stata. Figure 1 is a statistical description of

the variables studied in this paper.

Table 1: Code interpretation of the statistical variables.

Var ia ble c od e Var ia ble

cash Cash holdings

did

𝑡𝑟𝑒𝑎𝑡 ∗ 𝑝𝑜𝑠𝑡

size Company size; ln (TA)

lnSale Logarithm of the operating income

lnage Logarithm of the age of a listed company

roa ROA

roe ROE

rjgdp Urban GDP per capita

decyzb The added value of the secondary industry accounted for GDP

dscyzb The added value of the tertiary industry accounted for GDP

rkzrzzl Natural population growth rate

fisspt Financial freedom

fiscal Scale of fiscal expenditure

Does Local Debt Governance Ease Corporate Financing Constraints? Empirical Evidence from Chinese A-Share Listed Companies

311

Figure 1: Statistical description of variables.

4 BASIC REGRESSION AND

ROBUSTNESS TEST

4.1 Basic Regression

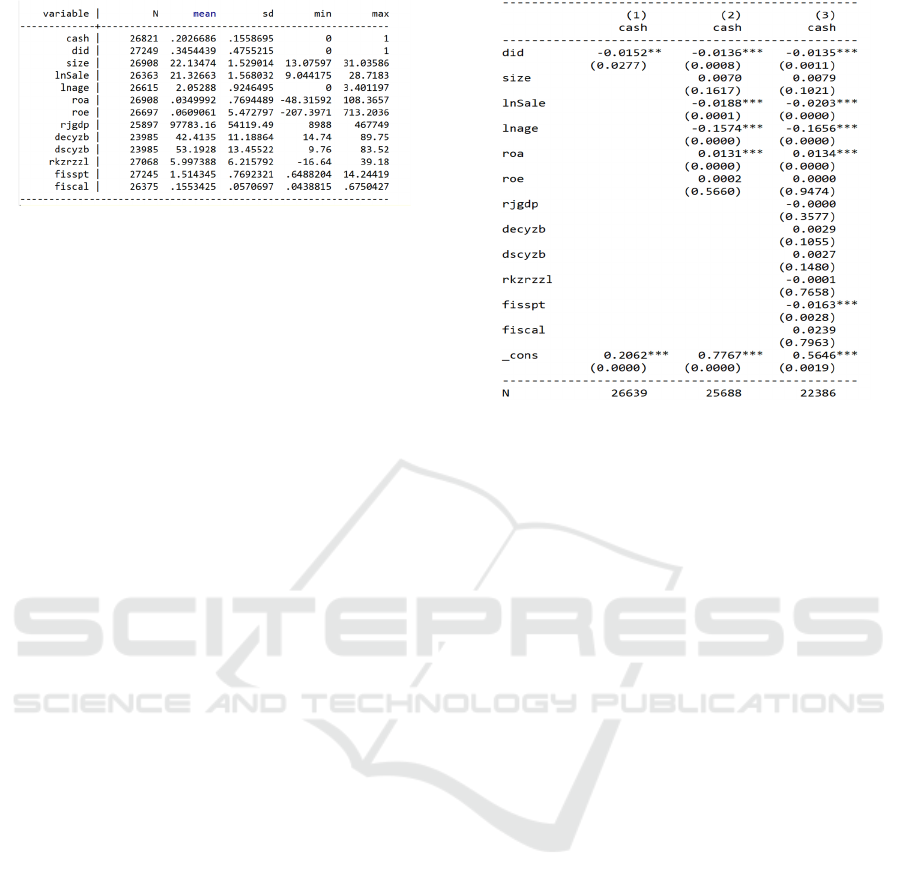

We use the database of listed companies to verify the

benchmark regression model. The regression results

are shown in Figure 2. Column (1) is the company’s

cash on hand as the explained variable. We can find

that the regression result is negative and significant at

5%. Column (2) added the control variables at the

enterprise level on the basis of column (1), we can see

that the direction of the regression result is still

unchanged, and the significance is 1%; then, we add

the control variables at the city level variable, the

regression results are shown in column (3) in Figure

2, we can find that the result is still significantly

negative at the 1% level. It can be found that after the

implementation of the new budget law, local

governments have strengthened the management of

debt quotas, financing constraints in the entire market

have been relaxed, more resources will flow into

enterprises, and enterprises’ expectations for the

future will become better. Under normal

circumstances, the company will increase investment

and reduce cash on hand, so we found that the cash

on hand of the company has decreased through

regression, and the financing constraints have been

eased at this time.

Figure 2: Basic regression results.

4.2 Robustness Test

4.2.1 Parallel Trend Test

We use the event study method to test the parallel

trend, on this basis, construct the econometric model

as follows:

cflow

=α

+βtreat∗

D

+α

X

+δ

+σ

+φ

+ε

(2)

Among them, D

is an event-time dummy

variable with a value of 0 or 1. The value of k

ranges from −3 to 3. When k0, the value is 1 in

the k-th year before the policy shock occurs,

otherwise it is 0; when k0, the value is 1 in the k-

th year after the policy shock occurs, otherwise it is

0; if k=0, the value is 1 in the year when the policy

shock occurs, otherwise it is 0. When doing

regression, we will use it as a baseline group to

compare the difference between the treatment group

and the control group.

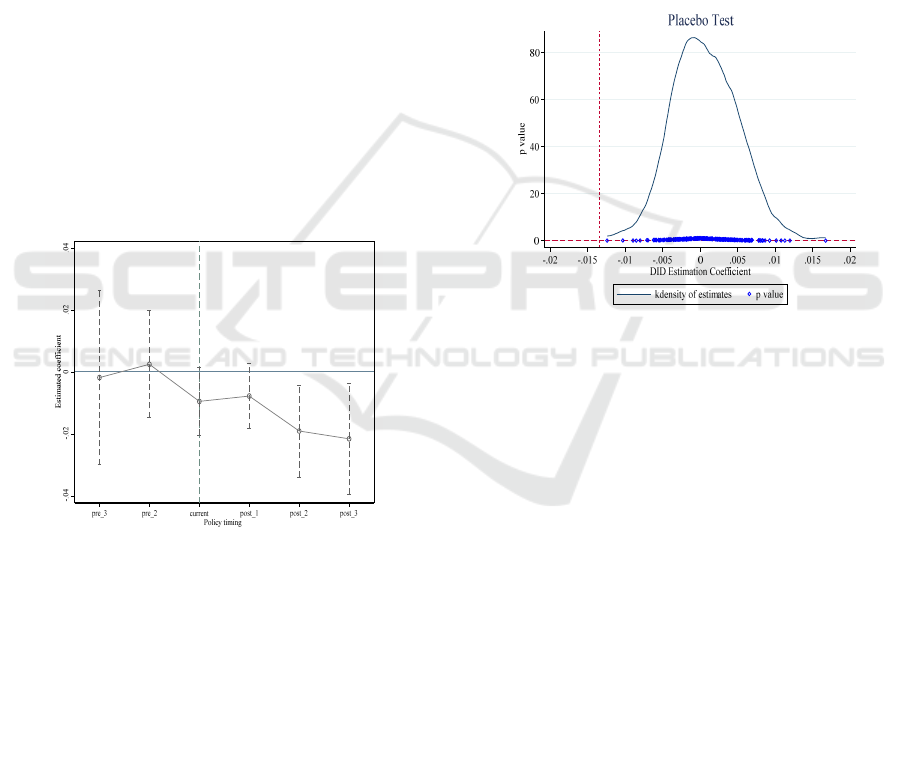

Figure 3 shows the test results of parallel trends.

The dot in the figure represents the estimated value of

did coefficient, reflecting the financing constraints of

the enterprise. The dotted line passing through the dot

and perpendicular to the horizontal axis represents the

95% horizontal confidence interval. pre3-pre2

represents the estimated value of did coefficient

corresponding to the three years before the

occurrence of the policy to the two years before the

occurrence of the policy. post1-post3 represents the

estimated value of did coefficient corresponding to

one year to three years after the occurrence of the

PMBDA 2022 - International Conference on Public Management and Big Data Analysis

312

policy. As shown in the figure, pre3-post1 fluctuates

around 0, which corresponds to a wider 95%

confidence interval and crosses 0, indicating that

there is no significant difference between the

treatment group and the control group compared with

the year before the implementation of the New

Budget Law in 2015. In summary, before the policy

impact occurred, the gap between the enterprises in

the treatment group and the control group in

financing constraints did not change significantly,

indicating that the parallel trend hypothesis was valid.

In addition, Figure 1 also reflects the dynamic impact

of policy shocks on corporate financing constraints.

post2-post3 is significantly negative, which proves

that local debt governance policies only take effect

two years after their implementation, and corporate

cash inventory decreases, reflecting that corporate

financing constraints have been alleviated to some

extent. From the perspective of the size of the

regression coefficient, the coefficient of local debt

governance has a downward trend since the second

year after the implementation of local debt

governance policy, which proves that the easing

effect of local debt governance on corporate

financing constraints has gradually increased.

Figure 3: Parallel trend test.

4.2.2 Placebo Test

Select all enterprises in the year of policy

implementation in 2015 from the overall panel data,

randomly select 50% of the enterprises and match

them with the overall panel data, 50% of the

enterprises selected are used as the experimental

group, and the rest are used as the control group. Do

DID processing on it, and repeat this process 200

times. The final result is shown in Figure 4, which

shows the results of 200 random processes, where the

X-axis represents the size of the estimated coefficient

of the "pseudo-policy dummy variable", the Y-axis

represents the density value and p value, and the

curve is the estimated coefficient Kernel density

distribution, the dots are the p-values corresponding

to the estimated coefficients, the vertical dotted line

is the true estimated value of the DID model −0.013,

and the horizontal dotted line is the significance level

of 0.1. It can be seen that most of the estimated

coefficients are concentrated around zero, and most

of the p-statistics are greater than 0.1. The real

estimated value of the DID model is an obvious

outlier, indicating that the policy implementation

effect is significantly different from the placebo

effect, and the reform of the new budget law on local

debt is the reason for the change in corporate

financing constraints.

Figure 4: Placebo test.

5 HETEROGENEITY ANALYSIS

5.1 State-Owned Enterprises and Non-

State-Owned Enterprises

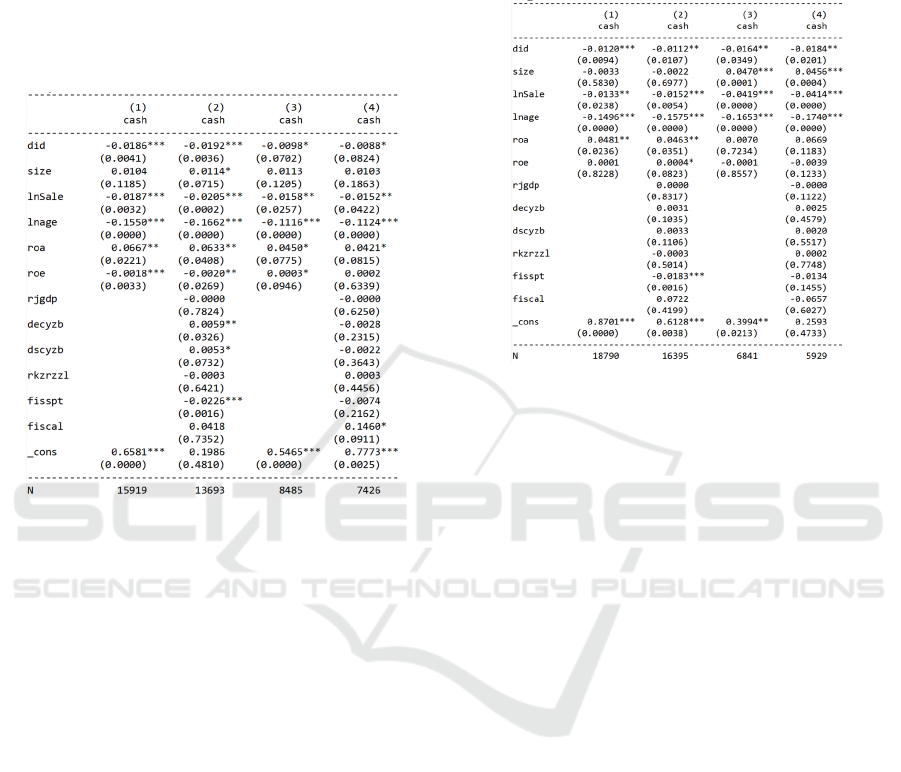

The nature of the enterprise is an important reason

that affects the financing constraints of the enterprise.

According to the attribution of enterprise ownership,

we divide the enterprises studied into state-owned

enterprises and non-state-owned enterprises, and

include them in the regression respectively, as shown

in Figure 5, in which columns (1) and (2) is the

regression result of non-state-owned enterprises, and

columns (3) and (4) are the regression results of state-

owned enterprises. We can see from the regression

results that the regression results of columns (1) and

(2) are negative and significant at the 1% level, and

the regression results of columns (3) and (4) are also

Negative, but only significant at the 10% level. The

results prove that local debt governance has a greater

impact on non-state-owned enterprises. State-owned

Does Local Debt Governance Ease Corporate Financing Constraints? Empirical Evidence from Chinese A-Share Listed Companies

313

enterprises funded by the state have sufficient and

stable financing and lower financing costs. Compared

with state-owned enterprises, non-state-owned

enterprises have more financing needs and face

financing difficulties. Under the situation of local

debt control, resources will be further tilted to non-

state-owned enterprises. At this time, the financing

constraints of non-state-owned enterprises will be

greatly eased.

Figure 5: Heterogeneity analysis of state-owned enterprises

and non-state-owned enterprises.

5.2 High-Tech Industries and

Low-Tech Industries

The industry in which the enterprise is located also

has an important impact on the financing constraints

of the enterprise. From this perspective, we divide

enterprises into high-tech industry enterprises and

low-tech industry enterprises, and include them in the

regression respectively, as shown in Figure 6, where

columns (1) and (2) are the regression results of

enterprises in non-high-tech industries, and columns

(3) and (4) are the regression results of enterprises in

high-tech industries. The regression results show that

after adding all the control variables, the regression

results of columns (2) and (4) are both negative and

significant at the 5% level, but we can see that the

regression of high-tech enterprises The coefficient is

significantly higher than that of enterprises in low-

tech industries, indicating that local debt governance

is more effective in alleviating financing constraints

in high-tech industries. Generally speaking,

enterprises in the high-tech industry need to invest

more in R&D and innovation, so they need more

capital investment to obtain patents. Therefore, the

financing needs of enterprises in the high-tech

industry are more vigorous. Resources will flow to

high-tech industry enterprises, thereby easing their

financing constraints and helping their sustainable

development.

Figure 6: Heterogeneity analysis of high-tech industries and

low-tech industries.

5.3 Coastal and Inland Areas

The regional location of the enterprise will also have

a certain impact on the financing constraints of the

enterprise. According to the location of the enterprise,

we divide the enterprise into coastal area enterprises

and inland area enterprises and include them in the

regression, as shown in Figure 7. Columns (1) and (2)

are inland enterprises, columns (3) and (4) are coastal

enterprises. We can find from the regression results

that the regression results of columns (1) and (2) are

negative and significant at the 1% level, but the

regression results of columns (3) and (4) are not

significant. This indicates that local debt governance

can ease financing constraints in inland areas much

more than that in coastal areas. This difference is

mainly caused by two reasons. One is that the

government’s local debt and its governance model in

coastal areas are more open and transparent than

those in inland areas, and the financing process of

enterprises is more standardized; Compared with

enterprises in inland areas, enterprises in coastal areas

have more abundant financing channels, and

enterprises in coastal areas also have the advantage of

easier access to overseas financing funds. The

financing channels of enterprises in inland areas are

mainly bank loans or corporate debt financing. After

the government fully implements the local debt

management policy, the effect of expanding

financing channels for enterprises in inland cities is

PMBDA 2022 - International Conference on Public Management and Big Data Analysis

314

more obvious than that for enterprises in coastal

cities.

Figure 7: Heterogeneity analysis of coastal areas and inland

areas.

6 CONCLUSIONS AND POLICY

IMPLICATIONS

Based on the A-share data of Chinese listed

companies from 2010 to 2019, this paper takes the

2015 "New Budget Law" as an exogenous shock,

constructs an intensity DID model, and studies the

causal effect of local debt governance on corporate

financing constraints. The results of the basic

regression show that local government debt

governance will make enterprises reduce cash on

hand, thus achieving the effect of effectively

alleviating corporate financing constraints. Parallel

trend test and placebo test proved the rationality and

validity of the DID model. The results of

heterogeneity analysis show that local debt

governance has different effects on alleviating the

financing constraints of different types of enterprises.

Among them, the effect on non-state-owned

enterprises is stronger than that on state-owned

enterprises, and the effect on high-tech enterprises is

stronger than that on low-tech enterprises. The role of

enterprises is stronger for enterprises in inland cities

than for enterprises in coastal cities.

Based on the above research conclusions, this

paper proposes the following policy implications.

First, local debt governance can effectively alleviate

the financing constraints of enterprises. Local

governments should take this opportunity to further

complete open and transparent governance based on

the existing policy framework of local debt issuance,

reasonably control the scale of local debt issuance,

improve the local debt governance system, reduce the

"crowding out effect" on enterprises, and thus

promote local construction. Second, strengthen the

relevant supervision of local debt issuance. The

central government needs to assume the external

supervision task of local government debt issuance,

and the local government also needs to optimize the

policy of local debt issuance, so that local debt can

really play its role and promote the development of

China's macro and micro economy. Third, local

government should further optimize and improve the

capital market, reduce the financing costs of

enterprises, effectively solve the dilemma of

"difficult and expensive financing" for enterprises,

stimulate the economic vitality of market players, and

promote the high-quality development of enterprises.

REFERENCES

Croce, M. M., Nguyen, T. T., Raymond, S., Schmid, L.

(2019). Government debt and the returns to innovation.

J. Financ. Econ. 132, 205–225.

Demirci, I., Huang, J., Sialm, C. (2019). Government debt

and corporate leverage: International evidence. J.

Finan. Econ. 133, 337–356.

Guo, Y., Mao, J. (2019). Local Government Debt

Governance in China in the Past 70 Years: Review and

Prospect. China Finan. Econ. Rev. 8, 49–65.

Huang, Y., Pagano, M. & Panizza, U. (2020). Local

Crowding‐Out in China. J. Finan. 75, 2855–2898.

Luo, S., Mi, M. (2010). Local bonds and small and

medium-sized enterprise financing preliminary

exploration. J. Hangzhou Teach. College (Soc. Sci. Ed.)

(06), 114–119.

Li, X., Zhou, Y., Liu, S., Ge, X. (2022). The characteristics

of local government debt governance: evidence from

qualitative and social network analysis of Chinese

policy texts. Econ. Res. 35, 6037–6066.

Liang, Y., Shi, K., Wang, L., Xu J. (2017). Local

government debt and firm leverage: evidence from

china: local government debt and firm leverage. Asian

Econ. Policy Rev. 12, 210–232.

Panizza, U., Presbitero, A.F. (2013). Public debt and

economic growth in advanced economies: A survey.

Swiss J. Econ. Stat. 149, 175–204.

Tao, K. (2015). Assessing Local Government Debt Risks in

China: A Case Study of Local Government Financial

Vehicles. China World Econ. 23, 1–25.

Tang, Z. (2022). Local Government Debt, Financial Circle,

and Sustainable Economic Development.

Sustainability. 14, 11967.

Wu, Y. (2014). Local government debt and economic

growth in china. BOFIT Discussion Papers.

Does Local Debt Governance Ease Corporate Financing Constraints? Empirical Evidence from Chinese A-Share Listed Companies

315

Xu J., Li Y., Feng, D., Wu, Z., He Y. (2021). Crowding in

or crowding out? how local government debt influences

corporate innovation for china. PLoS ONE 16,

e0259452.

Yang, H., Song C. (2015). Local government debt, property

rights and corporate tax burden. Collected Essays

Finan. Econ. 197, 27–36.

Zhou, L., Ren, J. (2020). Analysis of the causes and

countermeasures of local government debt problems in

China. J. Hunan Finan. Econ. Univ. 36, 94–101.

Zhang, Y., Wang, Z. (2009). On the economic growth

guaranteed by local government debt. Chin. Foreign

Entrep. (10), 111–112.

Zhang, L., Yin, Z., Wang, S. (2021). Local Government

Implicit Debt and Corporate R&D Activities: Evidence

from Chinese Non-financial Listed Companies. J.

Finan. Econ. 47, 94–107.

Zhen, X., Zhang, Q., She, Y., Shen, R., Chen, S. (2020).

Research on the dynamic relationship between local

government debt, financial efficiency and financing of

private SMEs—Empirical analysis of PVAR model

based on inter-provincial panel data. Finan. Account.

Int. Commer. (04), 78–86.

Zheng, X., Zhang, Q. (2020). Discussion on the influence

mechanism of local government debt growth on the

development of real economy: --The intermediary

effect model analysis based on inter-provincial panel

data. New Econ. (07), 81–92.

PMBDA 2022 - International Conference on Public Management and Big Data Analysis

316